What are Journal Entries in Accounting and How to Record Them

Table of contents:

- What is the Concept of Journal Entries?

- Importance of Journal Entries

- Types of Journal Entries

- Components of Journal Entries

- Compound Journal Entry Accounts

- Examples of Journal Entries

- How to Create Journal Entries

- The Difference Between Adjusting Entries and Journal Entries

- What is the Purpose of Accounting Journal Entries?

- Frequently Asked Questions

- Simplify your work and let Daftra create journal entries automatically!

How do large companies track every financial transaction and convert operational numbers into accurate and documented data? The answer simply lies in journal entries - the pathway through which all financial transactions pass, with the aim of organizing them and building a clear picture of a company's financial performance. Based on journal entries, financial statements, and reports, institutional financial positions are evaluated, and net cash flows and profits are identified. The following is a comprehensive guide that provides details about journal entries, including their components, importance, types, and step-by-step instructions for preparing journal entries, as well as an explanation of the journal entry format.

Quick Points (Executive Summary)

- Journal entries are daily records of every business or financial transaction conducted by a company to achieve business objectives. Each entry identifies the parties to the transaction in the form of debits and credits according to the double-entry principle.

- There are six basic types of journal entries: simple, compound, opening, closing, reversing, and transfer entries.

- Each journal entry consists of essential elements that cannot be omitted to facilitate later access: date, credit side, debit side, transaction amount(s), entry number - reference document number, journal book number.

- The difference between journal entries and adjusting entries is that the former are recorded daily, while the latter are special cases handled at the end of the accounting period. Additionally, journal entries have their effect during the same accounting period, unlike adjusting entries, whose effects extend to the following accounting period.

- The purpose of journal entries is to achieve accuracy and efficiency in recording daily transactions, facilitating auditing. Journal entries directly contribute to preparing financial statements, which are responsible for company decision-making.

What is the Concept of Journal Entries?

Journal entries are defined as a method for recording business and financial transactions and movements in accounting records, regardless of the size and type of these transactions. It is one of the stages of the accounting cycle, as it represents documentation and archiving of all financial operations that occurred in detail. Journal entries are based on tracking accounts and financial transactions by providing a brief explanation of transaction details. This explanation includes the date of signing the transaction and all parties to this transaction. Journal entries are recorded in the general journal, then later posted to the general ledger, where the information and data resulting from these entries contribute to preparing financial statements and reports.

Importance of Journal Entries

Journal entries are considered the cornerstone of accounting software because they fundamentally contribute to organizing financial information and proving the financial health of an institution in terms of its ability to meet its obligations while achieving profit. Additionally, journal entries serve as a basic daily reference for accountants and save time in managing the company's financial and accounting operations. The following are the most prominent factors that illustrate the importance of journal entries:

1- Documentation of Transactions and Account Reconciliation

Journal entries are used to document all financial transactions in an organized manner, making it easy to review them when necessary. Journal entries also help in account reconciliation and provide the necessary financial data that enable anyone to review the entries and understand the institution's financial position easily.

2- Financial Tracking and Control

Journal entries are used in financial control over all financial and commercial activities and transactions, which prevents any errors or oversights from occurring. They also help monitor the management and development of the company's cash flow and determine the status of creditors and debtors. Furthermore, journal entries help evaluate the status of expenses and cash flows, determine inventory status, and track the number of invoices and goods sold, along with their values. This ultimately helps enable management to make sound decisions that help achieve profit and sustainability while supporting the institution's competitive position.

3- Easy Identification of Accounting Errors

Journal entries ensure the discovery and correction of accounting errors before it's too late, which enhances the accuracy and transparency of financial records used in preparing the general ledger, trial balance, balance sheet, income statement, statement of financial position, and tracking incoming and outgoing cash flow for the institution, contributing to improved liquidity management.

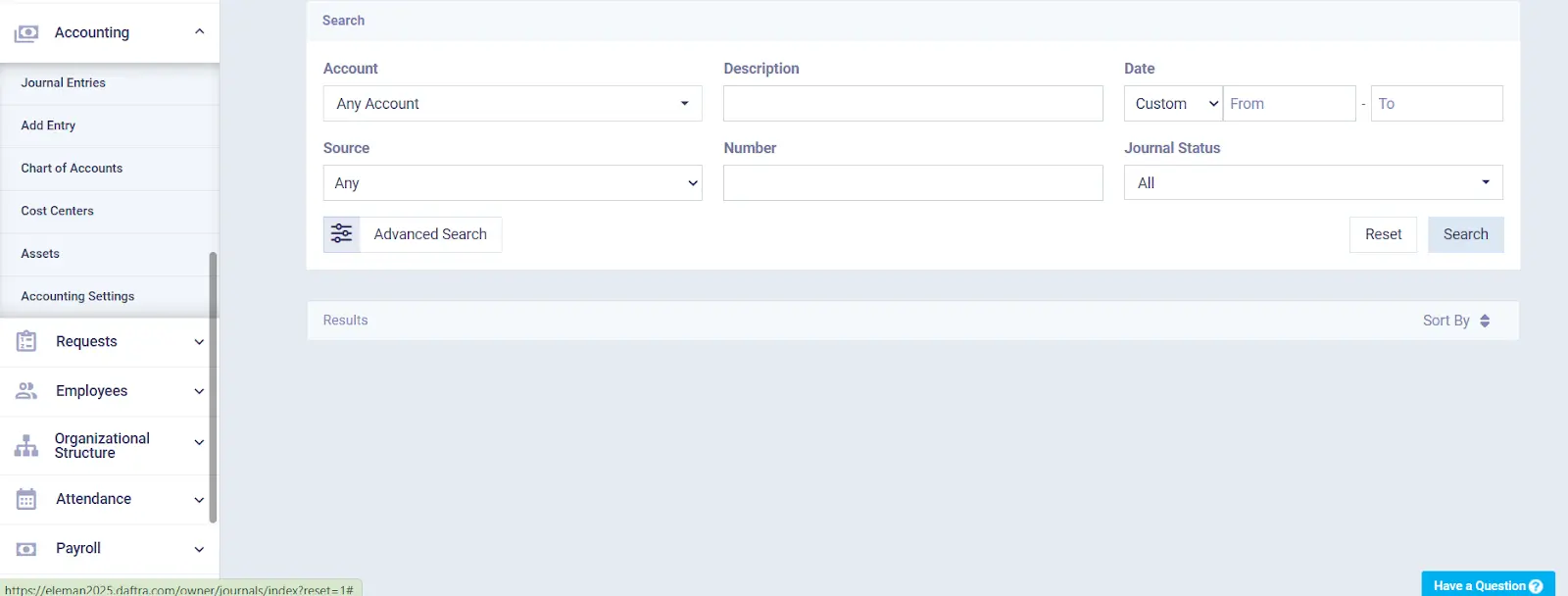

The Daftra accounting software helps you apply journal entries in the accounting software. All you need to do is enter the entry date, description, debit and credit accounts, then save the entry.

Types of Journal Entries

Accounting experts emphasize the necessity of recording all financial and commercial transactions and operations conducted by the company in the accounting record. All papers and documents related to journal entries must also be retained by storing them in the company's archive software and making them available when needed. There are several types of journal entries that are applied as needed, depending on the type of operation or transaction that occurred. The following are the most prominent types of journal entries:

1- Simple Entry

This includes one account on the debit side and one account on the credit side.

2- Compound Entry

This includes more than one account on the debit side, or more than one account on the credit side, or both. It is used to record more than one operation at the same time or in complex transactions.

3- Opening Entry

This is the entry that a company or institution prepares at the beginning of the fiscal year, before starting a specific project or activity. This entry depends on recording the necessary assets and liabilities before beginning the activity. During this entry, many balances transferred from accounts of the previous fiscal year are also recorded.

4- Transfer Entries

This includes recording amounts and cash movements from one cash box to another, or transferring cash amounts between different bank accounts.

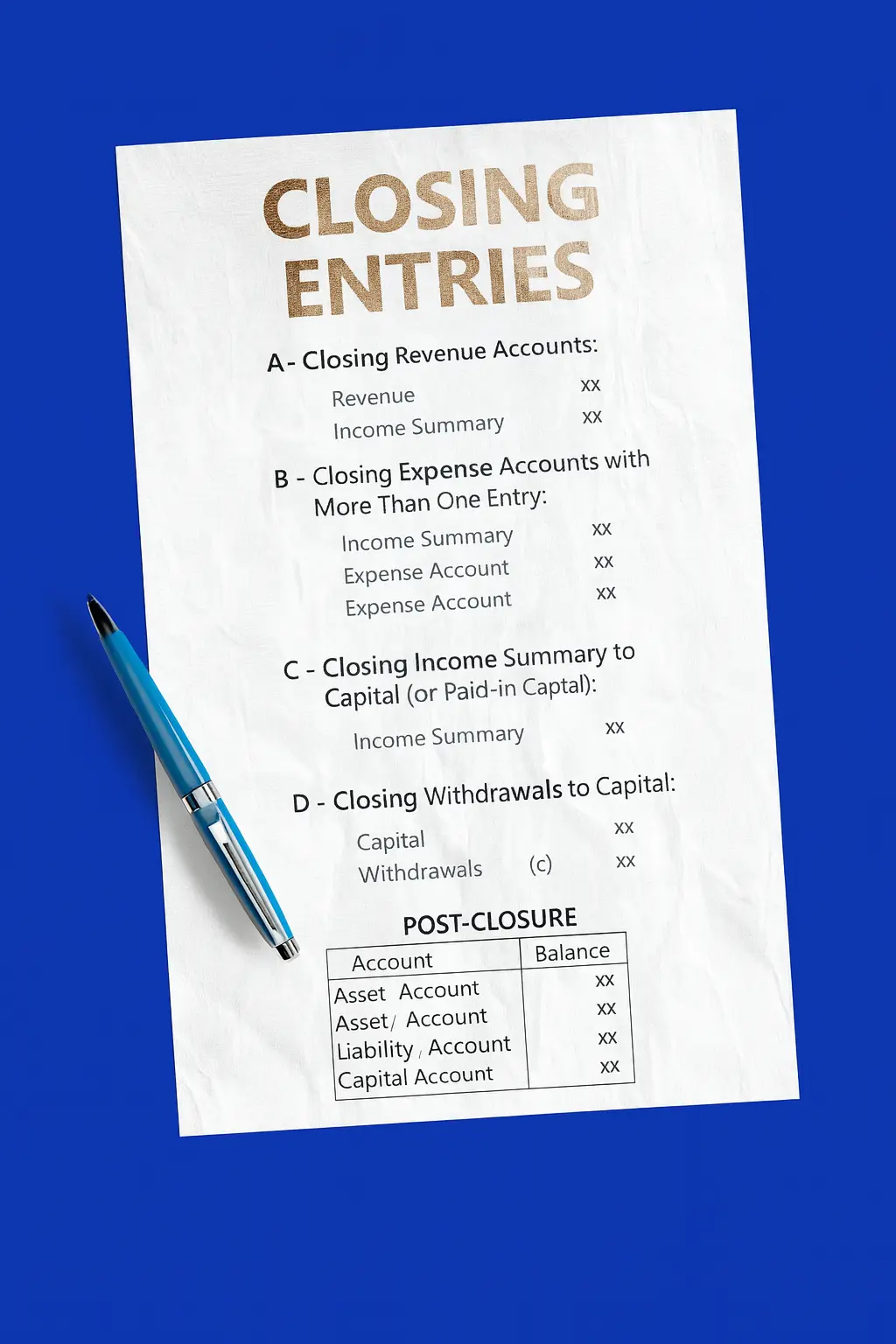

5- Closing Entries

At the end of each fiscal year or accounting period, companies prepare financial reports and financial statements. In this step, companies may close some accounts so that the balances of some accounts become zero at the beginning of the fiscal year. Credit accounts, such as revenues and profits are closed by transferring them to debit accounts, and debit accounts, such as expenses and expenditures, are transferred to credit accounts.

Learn more about what closing entries are and how to calculate them.

6- Reversing Entry

This entry corrects all errors or any oversights that occurred when recording or entering any transaction or entry in the financial books and records.

Learn more about the concept of reversing entries and how to make the entry with practical examples.

Components of Journal Entries

Journal entries are one of the fundamental accounting principles for any institution or company and can be applied in more than one form or method, whether for a large, startup, or even a commercial store, but with the condition of not deviating from their basic rules and components. The following are the most prominent components of journal entries:

1- Credit

All creditor accounts are clarified, whether one or more. In case there is more than one creditor, they are recorded in the journal entry with the term "sundries," then all creditor items are mentioned.

2- Debit

Applying the same steps as the credit side, all debtor accounts are clarified with their related financial transactions. Credit and debit accounts show the impact of financial transactions on assets, liabilities, or equity in the statement of financial position.

3- Narrative/Description

This explains the type of entry and some details specific to the operation or business transaction.

4- Entry Number

Each entry is numbered for easy access when preparing any reports or financial statements.

5- Document Number

The file containing all papers and invoices of the financial operation is numbered, such as payment papers or cash receipt documents.

You might be interested in: Cash Receipt Template Word & Excel.

6- Date

Clarifying the date when the financial transaction occurred, which helps track transactions in sequence according to their related financial operations, organize entries according to time periods, and maintain documented financial records.

7- Transaction Description

A brief description of the financial transaction is mentioned to better understand the entry, such as "product sales" or "payment receipts", and so on.

8- Ledger Account Number

Mentioning the ledger number to which the journal entry will be posted, with the aim of clearly identifying where to enter the entry, organizing accounting records, facilitating faster access to financial information related to each account, and reducing potential errors during the posting process.

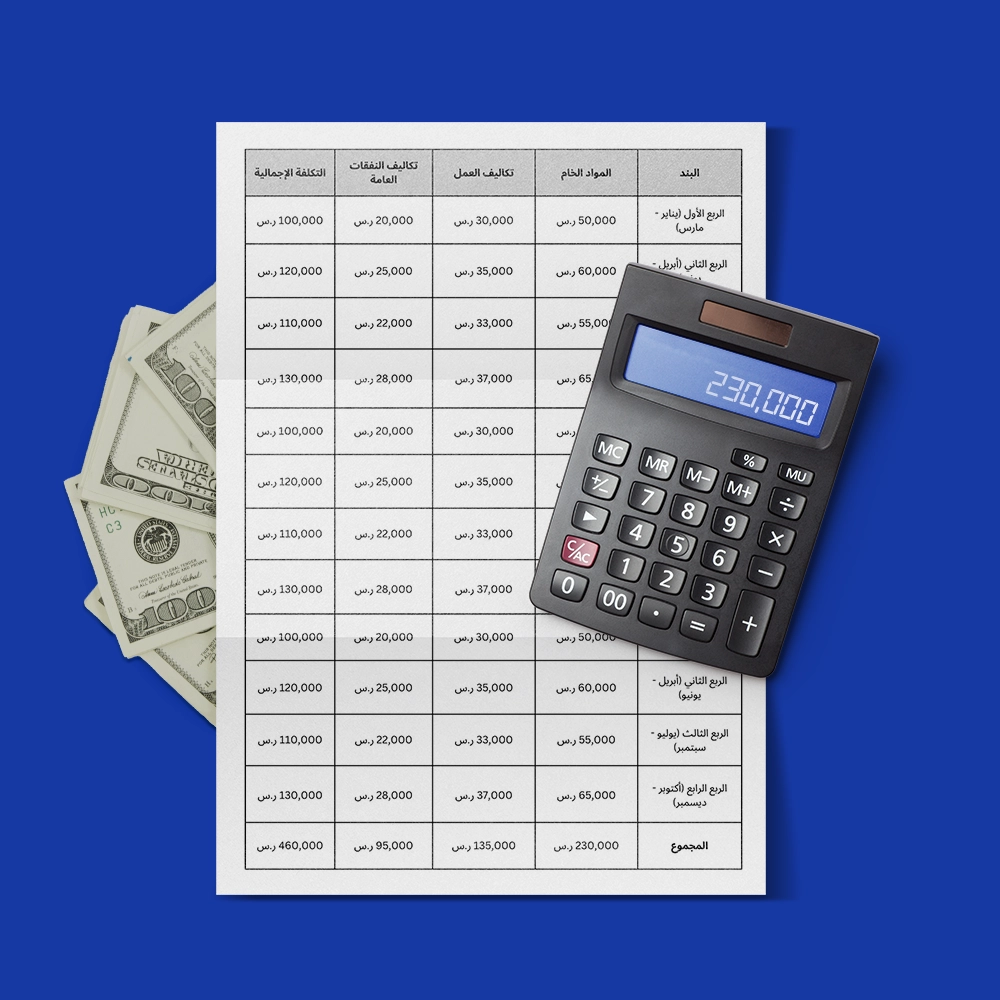

Compound Journal Entry Accounts

A compound journal entry contains more than one account on the credit side, and in this case, we denote the entry as "To Sundries A/c", or on the debit side, and we denote the entry as "By Sundries A/c", or both sides may contain more than one account at the same time. Therefore, we find that each side of the entry is divided into more than one row to record several transactions simultaneously. The entry format is as follows:

| Debit | Credit | Description |

| xx xx | By Sundries A/c | |

| xx | To Creditor A/c |

| Debit | Credit | Description |

| xx | By Debtor A/c | |

| xx xx | To Sundries A/c Creditor 1 Creditor 2 |

Use the compound return calculator and calculate your investment returns.

Examples of Journal Entries

In this section, we present exercises on various journal entries to help you review and assist you in recording the appropriate entry for each case.

We provide you with six solved exercises on journal entries in the following lines:

Example #1 - Simple Entry

A textile manufacturing company purchased spare parts for one of its equipment and paid the due amount of $4,000 in cash from the cash box. The journal entry appears as a simple entry in this case, where each side consists of only one account: the equipment account and the cash box account.

| Description | Debit (USD) | Credit (USD) |

| Dr. Equipment A/c | 4,000 | |

| Cr. Cash A/c | 4,000 |

Example #2 - Compound Entry

A company purchased real estate for exactly one million pounds, and paid $50,000 of it, with the remaining amount to be paid in installments against checks and receipts over 5 months. Here we have a debit account valued at $100,000 and credit accounts valued at $50,000 and $50,000. The journal entry appears as a compound entry where the credit side consists of two accounts: bank and notes payable.

| Description | Debit (USD) | Credit (USD) |

| Dr. Real Estate A/c | 100,000 | |

| Cr. Sundries | ||

| Bank A/c | 50,000 | |

| Notes Payable A/c | 50,000 |

The operation is described in the narrative section (real estate purchase where half the required amount was paid and the remainder is paid by check or receipt). Then the operation date is recorded in the date category, followed by recording the document number or ledger page number to which the accounts will be posted.

Example #3 - Opening Entry

A company began the accounting period with fixed assets and current assets as follows:

- Cash: $200,000

- Bank Account: $300,000

- Investment Portfolio: $250,000

- Real Estate: $500,000

- Accounts Receivable: $50,000

- Furniture: $10,000

For liabilities, they were determined as follows:

- Accounts Payable: $150,000

- Loans: $100,000

| Description | Debit (USD) | Credit (USD) |

| Dr. Sundries | ||

| Cash A/c | 200,000 | |

| Bank A/c | 300,000 | |

| Investment Portfolio A/c | 250,000 | |

| Real Estate A/c | 500,000 | |

| Accounts Receivable A/c | 50,000 | |

| Furniture A/c | 10,000 | |

| Cr. Sundries | ||

| Accounts Payable A/c | 150,000 | |

| Loans A/c | 100,000 | |

| Capital A/c | 1,060,000 |

Example #4 - Transfer Entry

A telecommunications company consulted a marketing advisor to obtain a marketing plan suitable for their business. They transferred the consultation fee through the bank account to reach the consultant's bank account. The consultation price was $5,000 USD. In this case, it's better to prepare an intermediary account, which is the transfer account.

| Description | Debit (USD) | Credit (USD) |

| Dr. Bank A/c (Consultant) | 5,000 | |

| Cr. Transfers A/c | 5,000 |

Example #5 - Closing Entry

At the end of the accounting period, a food company wanted to close the revenue account, and the total period revenue was $500,000. Revenue is transferred to an intermediary account called income summary before being transferred to capital. The account closing entry appeared as follows:

| Description | Debit (USD) | Credit (USD) |

| Dr. Revenue A/c | 500,000 | |

| Cr. Income Summary A/c | 500,000 |

Example #6 - Reversing Entry

A car dealership sold a 2024 Hyundai Elantra for $25,000 USD. The accountant recorded the financial transaction directly to the cash account from sales without specifying the sales source account, which is the cars account. Upon noticing the error, the auditor corrected it in one step through the following reversing entry:

| Description | Debit (USD) | Credit (USD) |

| Dr. Sales A/c | 25,000 | |

| Cr. Cars A/c | 25,000 |

How to Create Journal Entries

Journal entry operations can be created and recorded manually in accounting books, and of course, they can be recorded using specialized accounting software. The following are the most prominent steps for creating journal entries:

Steps for Creating Journal Entries:

- Save all invoices and documents related to all financial and commercial operations and transactions.

- Identify the debit side, which is defined by the letters "Dr." (from), and the credit side, which is defined by the symbol "Cr." (to).

- Record the debit amount in the debit column, while in the credit column, record the credit amount. A brief description can be written below the account that was recorded.

- Write the file indicating the occurrence of the operation, such as a purchase invoice or receipt.

- Record the timing of the financial operation in the date column.

- Create a brief explanation clarifying the reason for recording the entry and a brief description of the financial operation in the narrative column.

- Record the financial amounts that decreased or increased in an account, along with mentioning the accounts that were affected.

- Number all pages of the journal book, and it is essential to ensure that the journal book is free from any errors or writing in the margins.

- All recorded amounts, whether credit or debit amounts, must be totaled at the end of each page, and the accuracy of this data and amounts must be verified.

Summary of Journal Entry Recording Process: The journal entry recording process can be summarized in the following steps:

- Analyze the financial operation through the accounting document. The accounting document is a document that proves the occurrence of the operation or financial transaction before recording it.

- Identify the credit side and debit side.

- Record the journal entry in the book.

- Post the accounts to the general ledger.

Download a ready-to-edit journal entry template for free from Daftra.

The Difference Between Adjusting Entries and Journal Entries

The difference between adjusting entries and journal entries is that the former is used to adjust accounts at the end of the accounting period and ensure the accuracy of financial records, and adjust revenues and expenses. Adjusting entries are recorded at the end of the financial period, while journal entries are used to record daily transactions to document all credit and debit financial transactions periodically. Journal entries are recorded when the financial transaction occurs.

What is the Purpose of Accounting Journal Entries?

The purpose of accounting journal entries is to record and document every financial transaction within the business digitally or on paper. Journal entries serve the following objectives:

1- Maintaining Accuracy of Financial Transactions

Journal entries break down transactions to show their impact on the accounts involved. Double entries always consist of a credit side that decreases the balance and a debit side that increases the balance in the account.

2- Making Data-Driven Decisions

Journal entries are the basic step for bookkeeping, as they are the source of data that reaches the general ledger as well as financial statements, which form the basis for decision-making in every business.

3- Ability to Trace Original Transactions During Auditing

Internal or external auditors can trace back to the original financial transaction in question through journal entries, ensuring its validity or identifying potential embezzlement attempts.

4- Serving Accounts

Journal entries help guide the business to identify the most important revenue-generating accounts and other accounts that cause expenses.

5- Easy Cash Flow Monitoring

Management can monitor the liquidity available to the business through journal entries, thus determining the best times to finance projects and times when there is a cash shortage.

Common Errors in Journal Entries and How to Avoid Them

The following are the most common errors that can occur when preparing journal entries, with the necessary tips to ensure improvement and precise organization of financial records:

1- Omitting to Record Some Transactions

Sometimes, some financial transactions are omitted from journal entries. This can be avoided through daily review to monitor the documentation and recording of all transactions.

2- Incorrect Number Entry

One of the most common errors when preparing journal entries is entering numbers incorrectly. Therefore, numbers should be reviewed carefully before entry. Accounting software like Daftra can be used to perform calculations automatically to avoid manual or human input errors.

3- Using Incorrect Accounts

Recording transactions in incorrect accounts due to not understanding the nature of accounts and their classifications, or this may happen due to multiple accounts with similar names. For example, recording rent expenses in the fixed assets account instead of the expenses account leads to asset inflation. These errors affect the general ledger when posting journal entries, as well as the trial balance and financial reports. It's also difficult to track and correct such errors, as they require more time and effort. Therefore, it's essential to ensure recording financial transactions in their related accounts.

4- Not Clarifying Transaction Descriptions

Not adding descriptions to transactions. Therefore, sufficient details should be mentioned in each entry to clarify its context, and standardized journal entry templates should be used.

5- Not Updating Entries

Not updating entries when changes occur in financial data. Therefore, software should be implemented for reviewing and updating entries periodically, especially when changes occur in transactions.

6- Incorrect Use of Temporary Entries and Accounts

Data interference may occur in financial data and negatively impact the accuracy of financial reports due to using temporary entries (such as revenues and expenses) instead of permanent entries (such as assets and liabilities). Also, incorrect balances may be carried forward to the next period due to not closing temporary accounts (such as revenues and expenses) at the end of the specified accounting period, leading to conflicting financial data.

Such errors can be avoided by understanding the difference between temporary and permanent entries and ensuring the use of appropriate entries for each transaction, as well as closing all temporary accounts such as (revenues, expenses, income summary, and personal withdrawals) at the end of the financial period using closing entries, transferring balances to the profit and loss account, and resetting temporary accounts to zero at the beginning of the new accounting period.

Frequently Asked Questions

How can journal entries be written in the case of sales and purchases?

1- Purchase entry is recorded as follows:

| Date | Description | Narrative | Debit | Credit |

| 1/5/2025 | Goods purchase | Dr. Purchases A/c | 2000 | |

| Cr. Cash A/c | 2000 |

2- Sales entry is recorded as follows:

| Date | Description | Narrative | Debit | Credit |

| 4/6/2024 | Goods sale | Dr. Cash A/c | 1800 | |

| Cr. Revenue A/c | 1800 |

What is the general journal record?

The general journal record is an accounting record used to document all financial transactions daily. All journal entries are recorded in it to serve as a basic reference for accountants or concerned persons when reviewing some transactions. The general journal helps track all financial transactions and is used as a reference for preparing financial reports, as well as monitoring the institution's financial performance.

What points should be considered when passing journal entries?

Ensuring correct number entry, recording the date of each transaction to ensure documentation in its specified financial period, adding detailed descriptions for each entry to clarify the transaction nature, ensuring use of correct accounts according to transaction type (purchase, sale, expenses, etc.), conducting periodic reviews of entries to ensure accuracy and correctness, training employees on using accounting software, and adhering to applicable accounting standards.

What are the journal entries for sales and purchases in warehouses?

Journal entries for purchases and warehouses are the process of recording transactions for purchasing inventory items or selling inventory items, aimed at monitoring the movement of incoming and outgoing goods, which enables analyzing and evaluating warehouse performance.

What are some examples of journal entries?

Some examples of journal entries are recording entries for raw material purchases, product sales entries, salary payment entries, building rent payment entries, or electricity bill payment entries.

What are the most important journal entries in the treasury?

The most important journal entries in treasury are cash receipts entries and cash payments entries, as they help track money movement, evaluate financial inventory performance, and ensure accounting accuracy when preparing reports.

What are the conditions for entries in the journal book?

The conditions for entries in the journal book are identifying accounts related to the financial operation, determining the debit and credit sides, recording the value, and finally recording the following elements: date and description.

What are the components of the journal book?

The components of the journal book are date, description, amount, and debit and credit sides.

What is the benefit of the journal book?

The benefit of the journal book lies in preparing financial reports by leveraging the integration of financial transactions recorded day by day, reflecting transparency, accuracy, and integration in preparing reports that show the company's financial position.

What is the concept of double entry, and discuss the importance of the journal book in the accounting recording process?

The concept of double entry is a method for recording financial operations for two or more accounts by determining credit and debit aspects to ensure a financial transaction balance. The total liabilities must balance with equity. The journal book is an important factor in accounting recording processes because it includes achieving a balance between accounts and providing complete data recorded on their completion dates.

What are retained earnings daily entries?

There are no retained earnings daily entries, because retained earnings are net profits from different periods.

What comes after journal entries?

After journal entries, you post the data and financial transactions to the general ledger, then prepare the trial balance, and finally prepare the financial statements.

What are the types of journal books?

The types of journal books are the general journal book and special journal books. Special journal books can be designated for daily sales entries or daily purchase entries, while the general book is for recording all operations.

Simplify your work and let Daftra create journal entries automatically!

No doubt, much time is wasted adjusting records and executing journal entries, then posting them to the general ledger, then the trial balance, and so on, which is what Daftra's accounting program saves you from. Accounting entries are created automatically as soon as any transaction occurs in the software, and these transactions are automatically balanced in the chart of accounts, posted to the general ledger, and used in the trial balance and in creating financial statements and reports. This saves you much time and effort and shortens the work of a group of accountants.

Conclusion Journal entries can be defined as a method for recording financial transactions and operations. Although the process of recording these operations may sometimes seem repetitive and boring, it is necessary because it gives a true and clear picture of the company and its activities. The function of this entry lies in reviewing all financial and commercial operations and transactions conducted by the company during a specific period, which contributes to evaluating these activities and analyzing their impact on the company's financial position.