Everything You Need to Know About Revenues, General Revenues, and Their Types

Table of contents:

- What Are Revenues?

- Explanation of the Term “Revenues”

- What Is the Definition of General Revenues?

- What Are the Types of Revenues?

- What Is the Difference Between Revenues and General Revenues?

- What Are the Sources and Types of General Revenues?

- How Are Revenues Calculated? Practical Examples

- How Are Other Revenues Calculated?

- How Are Revenues Collected?

- What Is the Difference Between Revenues and Income?

- What Is the Difference Between Revenues and Expenses?

- What Is the Difference Between Profit and Revenue?

- How Does Daftra Help You Control Revenues?

- Frequently Asked Questions

Understanding the concept of revenues provides a solid foundation in economics. Such terms form the fundamental building blocks of the vast field of financial and economic matters, and one cannot progress in this field without grasping key concepts such as the meaning of revenues, their types, their impact, and the concept of general revenues.

In this article, we present a comprehensive guide based on our accounting expertise on the definition of revenue, methods of revenue collection, and the role of electronic accounting software in managing them.

Summary of Key Points

- Revenues are the financial amounts obtained from business activities in exchange for selling products or providing services. They are measured and evaluated based on important factors, including product price, quantity sold, and the supply and demand rate.

- General Revenues are cash inflows received by government institutions and public authorities to cover public expenditures that serve the interests of society. The sources of general revenues are diverse, with the most important being revenues from utilizing state-owned assets, fees, and taxes.

- Revenues are divided into two main types: operating revenues and non-operating revenues.

- Revenues are calculated using a simple formula: Revenue = Product Price × Quantity Sold.

- Revenues can be collected through three methods: direct cash collection, indirect collection, and withholding at source or through budget expenditure items.

What Are Revenues?

Revenues are the monetary amounts received by a business owner or an organization in exchange for selling goods and resources or providing services to buyers and beneficiaries.

Many people tend to confuse revenues with related terms such as income, profits, and sales. However, in reality, there are clear differences in the formulas, calculations, and accounting items associated with each of these terms, even though they all relate to money earned by individuals or entities.

Explanation of the Term “Revenues”

Revenue can be defined as a reflection of the value of products and services offered to the market based on key fundamentals, namely price, supply, and demand.

In revenue accounting, revenue is expressed as the result of multiplying the price of products or services by their quantity. According to this equation, revenues are affected by increases in both price and quantity.

This makes it essential to carefully study the competitive market and accurately understand customer and audience trends in order to make sound decisions regarding cost determination, required quantities, and expected profits.

What Is the Definition of General Revenues?

General revenues are the total income or cash inflows received by the state for the purpose of covering public expenditures incurred to achieve economic and social balance and to provide benefits to members of society by meeting their public needs, such as healthcare, education, and other services.

A balance is maintained between revenues and expenditures within the state’s general budget to avoid financial deficits resulting from excessive spending and the negative effects associated with such deficits.

What Are the Types of Revenues?

Understanding the types of revenues helps form an accurate picture of a company’s performance and identify its sources of income, which ultimately supports sound financial and managerial decision-making. Revenues are divided into two main types:

1. Operating Revenues

Operating revenues are generated from the core business activities of an organization or company. They include the monetary returns collected from selling products or providing the main services of the business.

Operating revenues aim to cover production costs and day-to-day operating expenses and are directly linked to the company’s core income. Therefore, they represent the largest proportion of a company’s profits. Examples of Operating Revenues:

- Sales of products and goods.

- Income from providing services such as consulting, medical services, delivery services, and others.

- Commission and fee revenues.

- Advertising revenues.

- Revenues from long-term contracts, which are generated through dealing with specific clients and entering into contracts to supply products or provide services over an extended period, often exceeding one year. This type of operating revenue provides significant stability in net income and profits.

2. Non-Operating Revenues

Non-operating revenues are revenues earned by an organization from indirect business activities. This type of revenue is often non-recurring, as it is not linked to ongoing investment or financing activities and typically arises from non-core assets. Operating revenues are presented separately from non-operating revenues in the financial statements. Examples of Non-Operating Revenues:

- Returns from investments in stocks, bonds, and other securities.

- Revenues from selling certain assets, such as real estate, equipment, and others.

- Compensation and penalties imposed on late-paying customers.

- Interest earned on loans granted by the company to others.

Read also: How to Calculate the Contribution Margin

What Is the Difference Between Revenues and General Revenues?

The main difference between revenues and general revenues lies in their sources. Revenues are generated by a company from selling products and providing core business services, with sales being the primary source, and their main objective is to achieve profit.

In contrast, general revenues include cash inflows or fees collected by the government and public authorities from individuals and companies. The sources of general revenues vary depending on the type and source of income collected, and their primary purpose is to finance public expenditures, serve the interests of society, and meet basic public needs.

From this, we can conclude that the differences between revenues and general revenues can be summarized in the following table:

| Points of Difference | Revenues | General Revenues |

| Beneficiary | Private enterprises | The government |

| Focus and Use | Achieving profit for the company and supporting the expansion and growth of commercial and investment activities | Financing and covering the costs of public services, and improving and developing infrastructure |

| Responsibility and Oversight | Not subject to strict oversight | Subject to oversight and accountability to ensure transparency and credibility |

What Are the Sources and Types of General Revenues?

General revenues represent a core component of the state’s general budget and refer to the returns collected by the government from various sources to finance public expenditures. Below is an overview of the sources and types of general revenues:

1. Revenues from State-Owned Assets

These are revenues generated from the use of assets and properties owned by the state and are divided into:

- Natural Public Assets: Mineral and marine resources, as well as other natural resources.

- Industrial Public Assets: Transportation and communication facilities, establishments that provide multiple public benefits, and cultural, artistic, recreational, and historical institutions.

2. Fee Revenues

These are revenues generated by governments and public authorities through imposing fees on activities and services they provide, such as licensing and permit fees, judicial fees, and others.

3. Taxes

General revenues collected by the state from individuals and companies across different activities and income sources, including:

- Income and profit taxes.

- Property taxes.

- Customs duties.

How Are Revenues Calculated? Practical Examples

The basic formula for calculating revenues is:

Revenue = Product Price × Quantity Sold

For example, if a bakery sells 1,000 bakery items at a price of $5 per item, then:

Bakery Sales Revenue = 1,000 × 5 = $5,000.

The same formula applies to calculating service revenues by determining the agreed service price and multiplying it by the quantity of service provided.

For example, if a consulting company offers its services at a rate of $200 per hour and provides a client with 4 hours of service, then:

Service Revenue = 200 × 4 = $800.

How Are Other Revenues Calculated?

Other revenues related to returns from assets, investments, and similar sources are calculated according to accounting regulations and the rates stipulated in contracts and agreements concluded between the parties.

How Are Revenues Collected?

Revenue collection, including general revenues, is one of the vital processes that ensure the financing of activities.

In this context, the Daftra system helps you manage, track, and collect revenues and customer payments easily through the smart solutions provided by the Daftra sales software.

1- Direct Collection

This method includes several sub-methods for collecting revenues, as follows:

- Cash payment at the time of purchase: This type of collection is a cash collection received by the company or the state directly upon delivery of the sold product or service.

- Collection through checks or bank transfers: This is one of the direct methods of revenue collection through checks issued by the customer and then cashed through banks and financial institutions.

Revenue collection through checks can be managed via the fund and bank account transfer service provided by the Daftra system as part of its electronic payment solutions for customers, and the variety of payment methods.

2- Indirect Collection

Indirect revenue collection consists of several methods, including:

- Withholding at Source:

This is carried out by deducting amounts from service providers or contractors as penalties. In this case, the penalty amount is deducted from their dues. This type of revenue collection can be activated easily and accurately through the supplier management program in the Daftra system.

Or deducting amounts from employees’ salaries for sums previously paid, such as taxes and social insurance contributions. This method of revenue collection can be controlled through the employee payroll management program in the Daftra system, which provides accurate and comprehensive data on all aspects related to employee salaries and their additions or deductions.

- Fees and Taxes:

Fees and taxes are among the most prominent methods of collecting general revenues, as the government collects the revenues needed to finance public expenditures by imposing taxes and fees on various services and products.

- Investment Returns:

Investment returns are considered one of the indirect methods of revenue collection. These returns come from investments in stocks, bonds, and other securities.

- Revenues from the Use of Assets:

An institution or the government can collect revenues and general revenues through selling assets and properties, or by using assets for various purposes, such as leasing to benefit from their returns.

What Is the Difference Between Revenues and Income?

The difference between revenues and income lies in the total amount and profit. Revenues refer to the total amount generated from selling products and services, whereas income refers to net profit after deducting all costs from revenues. From this, we conclude that income is a part of revenue.

Below are the most important fundamental differences between revenues and income:

1- Objective

Net income appears in the company’s profit and loss statement; therefore, it is an important measure for evaluating the company’s profitability, performance, and financial stability. In a financial context, the term “income” always refers to net or minimum income, as it represents the total amount of remaining profits after accounting for all expenses.

Revenues, which mean total income, aim to evaluate the efficiency and capability of the company’s operating performance in generating sales from services and products.

2- Value

Income can be higher than revenues when income comes from a source other than direct sales, such as a side investment or financing activity of the company. In this case, income may exceed revenues. However, the basic rule is that income is part of revenue, and accordingly, revenues are of higher value than income.

3- Financial Reporting Results

Revenues show the company’s sales over a specific period of time, whereas income shows the net profit or loss over a defined period.

Read also: Definition of the Term Gross Income

What Is the Difference Between Revenues and Expenses?

The difference between revenues and expenses can be explained as follows: revenues represent the value that reflects the volume of sales achieved by the company from its products, goods, and services, whereas expenses are the costs incurred by the company to purchase the materials necessary to produce goods or provide services. Expenses are deducted from revenues to calculate net profit or loss.

From this, we conclude that the relationship between expenses and revenues can be summarized by the concept of profitability. If revenues are greater than expenses, this indicates that the business activity is generating profits and positive cash flow. Conversely, if expenses exceed revenues, this indicates losses in operations and the occurrence of a financial imbalance.

Therefore, organizations strive to apply sound financial strategies aimed at increasing revenues and reducing expenses as much as possible in order to maintain profit levels and ensure business continuity. You can easily track revenues and expenses from one place by downloading a free revenue and expenses template from Daftra.

What Is the Difference Between Profit and Revenue?

Revenues are a fundamental element in achieving both gross and operating profit. Gross profit can be calculated by deducting the cost of goods sold from revenues. Operating profit is then obtained by deducting all fixed and variable expenses from gross profit.

It can be said that the relationship between profit and revenue is one of sequence or integration: revenues are an indicator for achieving profits, while profit is a measure for evaluating performance and the financial position of the organization.

How Does Daftra Help You Control Revenues?

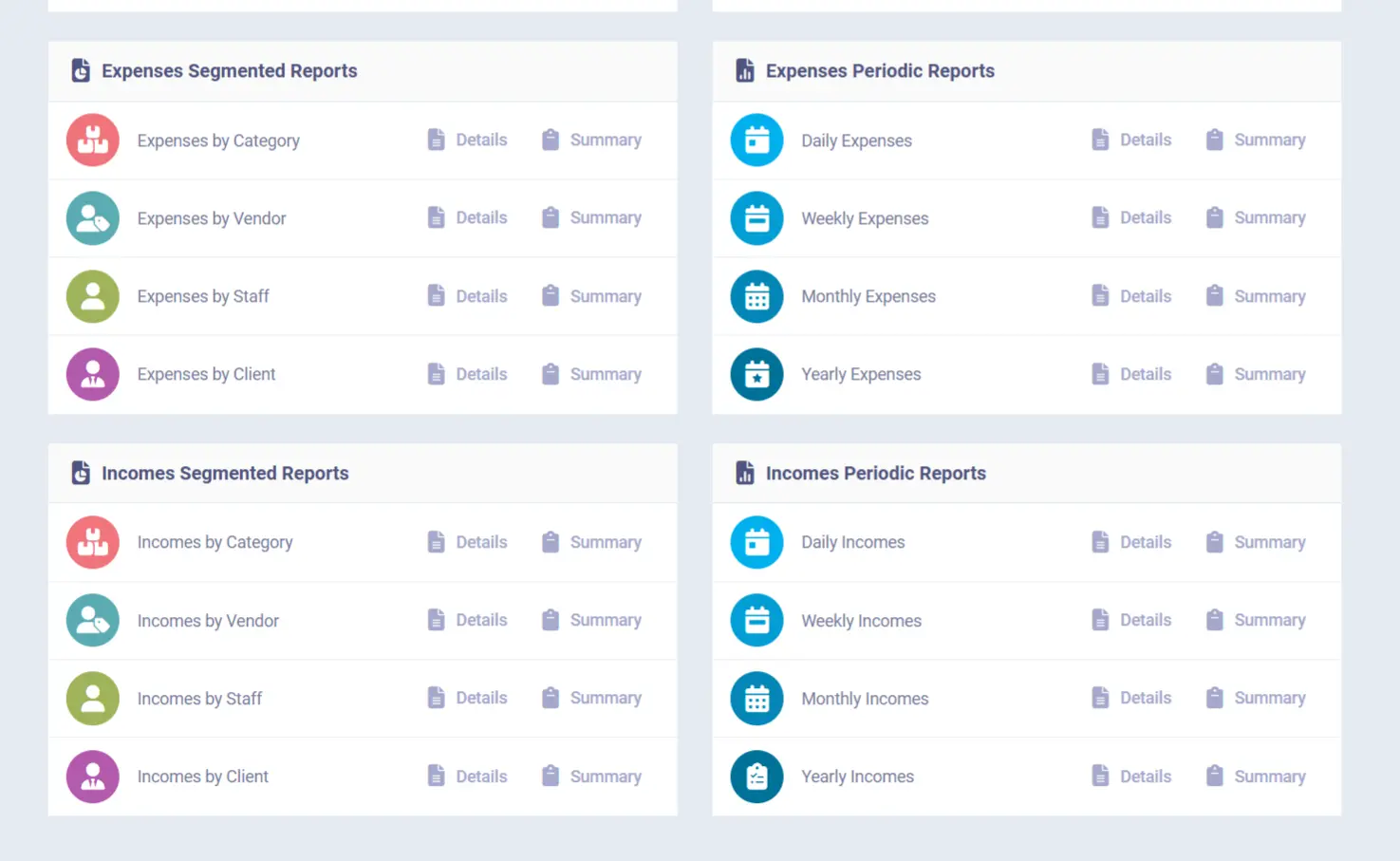

Regardless of whether revenues are operating or non-operating, Daftra’s accounting software helps you generate related reports and even categorizes them into sub-types under each main type. This allows you to easily identify sources of increased profits and, accordingly, reorganize spending ratios and their relationship to profit growth, whether directly or indirectly.

Daftra’s revenue reports are not limited to future planning; they also help you analyze the current situation and determine the results of your business for any past period you choose, easily and in minimal time, with just a few clicks on a user-friendly, flexible dashboard.

Frequently Asked Questions

What are the most important general revenues?

The most important general revenues include taxes, government fees, property-related fees, returns from government investments in other companies, and donations and grants received by government institutions and public authorities to finance specific projects.

Are revenues and sales the same?

No. Although revenues and sales are closely related in the financial and accounting context, where sales are a primary source of revenues, the concept of revenue is broader.

Revenue includes the financial amounts earned by an entity from various sources, not only sales; these may include investments, returns, or interest on loans, among others. Sales, on the other hand, refer specifically to the financial amounts earned directly from selling products and services.

Who is a revenue accountant?

A revenue accountant is the person responsible for monitoring, recording, and analyzing the revenues earned by a company from various activities such as sales, taxes, investment returns, asset sales, and other sources. A revenue accountant’s tasks include:

- Preparing the income statement and other financial statements to understand the organization’s performance and its ability to generate profits.

- Reviewing transactions, contracts, and agreements and reconciling them with recorded revenue figures.

- Providing financial analyses in cooperation with other departments, such as cost management, to make sound financial decisions and identify opportunities to increase revenues and profits.

- Complying with recognized accounting standards and controls for recording and analyzing revenues, as well as internal and external auditing.

What do revenues consist of?

Revenues consist of a variety of sources that contribute to cash inflows for an organization or enterprise. Revenues differ from one company to another depending on the nature of its business and field of activity.

Common components of revenues include sales, investments in bonds and securities, proceeds from asset sales, interest, and government fees.

When are revenues recognized?

Revenues are recognized either on an accrual basis, meaning they are recorded when earned regardless of the time of receipt, or on a matching basis, where revenues are recorded in parallel with the related costs.

Are revenues credited?

Yes. Revenues are usually recorded on the credit side of double-entry bookkeeping. When a company earns revenues, a credit entry is made to increase the revenue account, because revenues increase equity on the balance sheet.

Are revenues net profit?

No. Revenues are not net profit. Instead, net profit represents the net revenues earned by an organization after deducting all expenses. Use the discount calculator to find out any number or price after a discount for free.

Are foreign exchange gains considered revenues?

No. Foreign exchange gains are not considered revenues. They are related to differences in exchange rates between foreign currencies and other currencies during transactions.

The difference between the original value of a currency and the realized value may result in a gain or a loss; therefore, such differences are not considered revenues but are part of other comprehensive income, which results in net profit or loss when classified and recorded according to applicable accounting standards.

Read more: How changes in exchange rates affect accounting operations

When are revenues debited?

Revenues are generally not recorded as debits. However, debit entries may occur in special cases, such as correcting errors or reversing incorrect accounting entries. For example, if revenue was recorded incorrectly and the company wishes to correct the error, it may post a debit entry to the revenue account to reduce it.

What is the cost of revenues?

The cost of revenues (or Cost of Goods Sold – COGS) refers to the direct costs associated with producing goods or providing services that generate revenues. These costs typically include raw materials, direct labor wages, and direct manufacturing costs. The cost of revenues helps determine gross profit, which is the difference between revenues and the cost of revenues.

What are expected revenues?

Expected revenues refer to the income a company anticipates earning in the future. These estimates are based on current contracts, purchase orders, or market and sales forecasts.

Expected revenues are an important tool for financial planning and analysis, but they are not recorded as revenues in the financial statements until they are realized in accordance with the revenue recognition principle.

Where do revenues usually appear in the income statement?

Revenues usually appear at the top of the income statement and represent the starting point for calculating profit or loss. Revenues are recorded first, followed by the deduction of costs and expenses related to generating those revenues.

The basic structure of the income statement begins with revenues, followed by the cost of goods sold (if any), and then other expenses to arrive at net profit.

What are unearned revenues?

Unearned revenues, also known as deferred revenues, are amounts received by a company for services or products that have not yet been provided.

Unearned revenue is recorded as a liability in the financial statements because it represents services or products that must be delivered in the future. As the service or product is provided, the unearned revenue is transferred from liabilities to revenues in the income statement.

What is meant by annual revenues?

Annual revenues are the total revenues earned by a company or an individual during a full fiscal year. They include all sources of income, such as sales of goods and services, investment income, and any other income sources.

Annual revenues provide a comprehensive picture of the financial performance of a company or individual over the year.

Why are revenues credited?

Revenues are always credited because they increase a company’s assets and reduce its liabilities.

What is the difference between returns and revenues?

The difference between revenues and returns is that revenues refer to the total amounts from selling products and services, whereas returns represent the remaining profit after deducting expenses and costs from revenues.

What are the types of economic revenues?

Types of economic or government revenues may include:

- Taxes such as income tax, property tax, or value-added tax.

- Revenues from fees, fines, and returns.

What are revenue journal entries?

Revenue journal entries are the process through which all transactions related to revenues and incoming income are recorded. There are two types of revenue entries:

- Accrued revenue entries, which relate to revenues earned from selling services or products but not yet received.

- Unearned revenue entries relate to amounts received for goods or services that have not yet been provided to the customer.

What are capital revenues?

Capital revenues are revenues resulting from the sale of or investment in fixed assets or non-current liabilities.

How are revenues analyzed?

Revenues are analyzed through several factors, including:

- Analyzing seasonal market trends and their impact on sales and revenue performance.

- Analyzing the impact of external factors such as economic conditions and supply and demand rates on revenues.

- Analyzing customer retention rates and repeat purchasing behavior.

What is the difference between customers and accrued revenues?

The difference between customers and accrued revenues lies in the resulting impact. Customers are individuals who purchase on credit, meaning they receive products or services with deferred payment, which results in accrued revenues for the company.

What is the difference between accrued revenues and accounts receivable?

The difference between accrued revenues and accounts receivable lies in invoice issuance. Accrued revenues are recognized before issuing an invoice and upon earning the revenue, whereas accounts receivable are recognized after issuing an invoice to customers.

What are revenue costs?

They are the cost of goods sold and other additional costs associated with producing, providing, distributing, and selling services.

How is revenue audited?

Revenue auditing is conducted through several steps:

- Determining the audit period.

- Collecting documents and records that evidence revenue-generating transactions, such as invoices, receipts, and others.

- Reconciling revenues recorded in actual documents with revenues recorded in the accounting books.

- Recording accrued and unearned revenues.

- Preparing revenue adjustments to apply the accrual principle, ensure the accuracy of financial data, and prevent manipulation.

In conclusion, revenues are one of the most essential pillars of any successful business activity. Understanding the financial and accounting aspects related to revenues enables business owners and enterprises to invest, grow, and achieve sustainable financial stability in competitive markets.

Therefore, companies should be keen to follow successful strategies and practices to deliver real value to customers through products or services in order to achieve the desired revenues and profits.

Equally important is the role of digital accounting software in efficiently and effectively managing revenue items and analyzing financial data digitally with minimal effort and accurate results, helping concerned parties make well-informed financial decisions.