Everything You Need to Know About Cash Flow Statement, Its Components, and How to Prepare It

Table of contents:

- What is a Cash Flow Statement?

- What are the Components of the Cash Flow Statement?

- What is Net Cash Flow?

- What is the Objective of the Cash Flow Statement?

- What are the Steps for Preparing a Cash Flow Statement?

- When is the Cash Flow Statement Prepared?

- Cash Flow Statement Format

- What is the Direct Method in Cash Flow Statements?

- What is the Indirect Method for Preparing Cash Flow?

- Practical Examples of Preparing Cash Flow Statements

- Cash Flow Statement in Daftra

- Frequently Asked Questions

If you're thinking about investing your money in a company and are still hesitant about making the decision, or if you're concerned about putting your money into purchasing shares in an economic institution before ensuring the possibility of generating profits, you need to review the Cash Flow Statement of that institution to clearly understand its financial position.

Reviewing the cash flow statement helps assess the financial position of the institution and accurately understand the results of the activities it undertakes during a specific time period.

This contributes to identifying the institution's strengths and weaknesses, thus facilitating the decision-making process regarding whether to deal with it or not. However, initially, we must understand the concept of the corporate cash flow statement in detail, its components, objectives, and how to prepare it step by step.

What is a Cash Flow Statement?

A Cash Flow Statement (Statement of Cash Flows) is a financial statement that shows the cash flow operations that entered and exited the company as a result of the economic, operational, financing, and investment operations and activities that the institution undertook during a specific time period of the fiscal year to illustrate the company's financial position.

It also shows all financial flows and expenses that management spent to implement and complete its commercial and investment activities. This financial statement is considered one of the most important tools that help manage and analyze the institution's performance economically, in cooperation with the balance sheet, the income statement, and the profit and loss statement.

Every institution has become obligated to prepare these three statements according to a set of accounting standards adopted in most countries of the world. These financial statements contribute to the possibility of predicting the institution's cash position to develop appropriate economic plans in the short term, enabling the institution's management to make decisions based on a comprehensive analysis of economic activity.

What are the Components of the Cash Flow Statement?

Some specialists believe that the cash flow statement is the most realistic compared to all other financial statements because it tracks the cash operations that the institution performs through three main components: operating, investing, and financing activities. Here are the elements of the cash flow statement in detail:

Cash Flows from Operating Activities

These are cash flow activities that either generate revenue or record money spent to produce a service. These activities include inventory transactions, interest and tax payments, rent, and employee wages.

Cash Flows from Investing Activities

This section focuses on recording gains and losses resulting from investment in the institution's assets and properties. It also shows the amount of money the institution invests in fixed assets such as buildings, vehicles, land, and others.

Cash Flows from Financing Activities

This focuses on recording financial activities and transactions involving debt, profits, and the institution's capital, including long-term debt. For example, cash received from capital increases is recorded. Additionally, cash disbursed as a result of profit distribution is also recorded, which can include dividends to shareholders, investors, and other stakeholders.

The sum of these components represents what is known as “net cash flow.”

Instead of manually preparing the cash flow statement, we provide you with a free Excel cash flow statement template ready for download. Simply fill in your company's data, and the template will calculate the results for you.

What is Net Cash Flow?

Net cash flow is defined as the difference between cash payments and cash receipts for any institution. This difference is calculated monthly, showing the amount of money the institution needs for expansion operations, conducting research in its field of work, purchasing modern equipment, or even paying accumulated debts. This money can include short-term investments that require cash flows.

The net cash flow calculation equation is as follows:

Net Cash Flow = Cash flows from operating activities + Cash flows from investing activities + Cash flows from financing activities

If the result of this equation indicates a positive net cash flow, this is considered a strength for the institution. However, if the result is negative, this warns that the institution is at risk of bankruptcy if the result continues in the same manner for a long period.

While achieving negative net cash flow is concerning, especially if it repeats for more than a month, it doesn't necessarily mean you're in danger.

This decline could be due to your investment in establishing a new facility or updating equipment you work with, which will achieve clear positive results after completion that may compensate for this decline. Therefore, it's extremely important to analyze the reasons for the decline in net cash flow to be able to deal with it correctly and accurately. But how important is having a cash flow statement?

The Daftra accounting system helps you create cash flow statements by linking accounts related to the statement, where you can create it using either the direct method or the indirect method.

What is the Objective of the Cash Flow Statement?

The cash flow statement holds significant importance in the economic aspect of institutions, as it helps clarify the cash effects resulting from various economic activities that the company implements during a specific time period. This statement works to clarify the institution's ability to increase available cash to pay obligations and implement development plans, whether short-term or long-term. The following are the most important objectives of the cash flow statement:

Tracking Plans and Outgoing Cash Flow Transactions

The cash flow statement provides a comprehensive picture of various expenses incurred by the entity during a specific time period. On the other hand, it clarifies items or transactions on which money was spent that do not appear in the income statement. Therefore, the cash flow statement always tells us about the actual cash spent on some transactions, such as cash paid to creditors, inventory purchases, and others.

Cash Planning

The cash flow statement is used for financial planning purposes, whether for the near or distant term, which helps avoid financial risks such as bankruptcy or seizure of the entity and other problems that the entity may face as a result of its inability to meet its obligations toward creditors, suppliers, and employees. Additionally, the cash flow statement helps us predict long-term economic variables that can affect the entity, including the volume of economic growth for the institution's scope of work, government economic policies, inflation and interest rates, and demographic changes in the population that naturally affect buying and selling operations.

The cash flow statement is considered strong evidence that helps officials responsible for managing financial affairs and decision-makers anticipate the cash flows necessary to achieve short-term goals, and predict logical expectations regarding the entity's financial position in the future. These expectations can then be used to change plans and priorities to maximize productivity and profitability and achieve sustainability and financial stability for institutions.

Verifying the Validity of Cash Flow Budget

One of the most important objectives of the cash flow statement is to verify the success and accuracy of the cash flow budget, which is part of the general budget, as some call it. This is done by comparing the expected cash flow figures in the budget with actual cash flow results.

If there is no difference, this is evidence of the budget's accuracy. If the difference is positive, meaning the entity achieved more internal cash flow than expected in the budget (known as cash surplus), this is greater evidence of the entity's success, strong performance, and financial position. However, if the difference is negative due to the appearance of excess spending on capital assets more than expected in the budget, this causes what is known as a cash deficit. In this case, the reasons for this difference must be analyzed, and necessary measures must be taken to reach the optimal level of cash balance.

Knowledge of cash data entering and leaving the institution helps focus on means and methods through which cash can be generated from other activities to increase profit, such as using inventory efficiently, collecting receivables faster, delaying payment of due invoices, and negotiating the best means and timing for payment.

You can download a template for calculating expected cash flow.

Crisis Management and Making Sound Decisions

Through cash flow statement data, prudent financial decisions can be made that help increase internal cash flow by expanding into new activities to generate profit and determining the size of financing needed for this expansion, or reallocating resources and managing inventory efficiently and monitoring purchasing operations to reduce waste in expenses, and other decisions that help manage financial crises and maximize profitability and positive cash flow.

Instead of using the traditional method of preparing cash flow statements, you can use Daftra accounting software, which helps you identify fixed asset accounts, provide all journal entries, and verify loan operations and their repayment, and dividend distributions automatically.

What are the Steps for Preparing a Cash Flow Statement?

The process of preparing a cash flow statement goes through 8 main stages. During these stages, you can rely on either the direct method or the indirect method for calculating cash flow. There is no difference between preparing using either method except regarding the cash flows from the operating activities stage. The stages of preparing the cash flow statement are as follows:

1/ Determining the Time Frame for the Cash Flow Statement

The time period for preparing the cash flow statement is determined according to the nature and needs of the business in the entity, as well as the form of its transactions.

2/ Creating an Integrated Context from Income Statement and Balance Sheet Data

Remember that the primary objective of the cash flow statement is to measure income coming into and going out of your institution. A large part of cash flow data appears in detail in both the balance sheet and income statement. The arrangement of financial statements did not come from nowhere, but for the purpose of integration between financial data, so that each stage leads to the next. Therefore, you must carefully review and audit this data to ensure that total assets equal total liabilities and equity in the balance sheet data, as well as verify that the net profit equation, represented by subtracting costs from revenues, yields a correct final result compared to the entered figures.

3/ Determining the Opening Balance

This stage involves determining the opening cash balance of the institution during the period covered by the cash statement. This stage is extremely important, especially if you rely on the indirect method when calculating cash flow resulting from operating activities. However, you will not need this stage if you rely on the direct method.

4/ Calculating Cash Flow from Operating Activities

This stage is considered the most important because it shows the amount of cash generated based on the operational activities that the institution performed. It can be calculated using either a direct or indirect method. The choice of the appropriate method for preparing the cash flow statement depends on the size of the entity, available resources for preparing cash flow data, and the objective of applying the chosen method to operating activities, specifically in the cash flow statement.

5/ Collecting Non-Cash Expenses and Transactions

At this stage, you must verify the recording of non-cash transactions missing from the income statement and other financial records, as well as update emergency adjustments to these transactions such as fixed asset depreciation costs, bad debts, losses resulting from changes in asset values, and changes in exchange rates, interest, and foreign currencies that can directly affect the cash value of transactions.

6/ Analyzing Cash Flow Activities

This stage in the cash flow statement preparation steps requires analyzing all cash activities. We start by tracking operating activities to measure revenues, expenses, and emergency changes in payable and receivable accounts, then analyzing investment activities represented by buying and selling assets and investments in securities, bonds, and others. Finally, tracking cash flows for financing activities such as loans, dividends distributed to shareholders, and financing operations related to buying or selling shares.

7/ Calculating the Closing Balance

After completing the previous stages in calculating the cash flow statement, you will ultimately obtain the closing cash balance for the time period covered by the statement.

8/ Calculating the Difference Between Opening and Closing Balances

Ensure that all computational values comprising the account balances of recorded transactions are documented with supporting evidence and free from intentional and unintentional computational errors and fallacies. Then monitor the differences between opening balance accounts and closing balances that make up the cash flow statement.

9/ Preparing the Cash Flow Statement

A chart is prepared, divided horizontally into three parts for (cash flows from operating activities, cash flows from investing activities, and cash flows from financing activities). Then each activity within the chart is divided horizontally to record its specific items and their accounting value. Then, computational operations are performed for items in each activity to obtain the final balance. Finally, the final balances of the three activities are added to obtain net cash flows. You can disclose the cash flow statement to concerned parties, but only after ensuring its accuracy, as it is an essential part of the entity's financial reports.

When is the Cash Flow Statement Prepared?

The cash flow statement is prepared after preparing both the statement of financial position (balance sheet) and the statement of profits and losses (income statement). Thus, we find that the cash flow statement occupies stage No. 3 of the arrangement of financial statements, and the cash flow statement is prepared on a monthly, quarterly, or annual basis.

Cash Flow Statement Format

| Cash Flow Statement for Arbianco Company for the Financial Period from 1/1/2022 to 6/30/2022 | ||||||

| Statement | January | February | March | April | May | June |

| Cash Flows from Operating Activities | ||||||

| Customer receipts | XX | XX | XX | XX | XX | XX |

| Purchases | XX | XX | XX | XX | XX | XX |

| Administrative expenses | XX | XX | XX | XX | XX | XX |

| Wages and salaries | XX | XX | XX | XX | XX | XX |

| Other operating cash inflows | XX | XX | XX | XX | XX | XX |

| Other operating cash outflows | XX | XX | XX | XX | XX | XX |

| Total Cash Flows from Operating Activities | XX | XX | XX | XX | XX | XX |

| Net Cash Flows from Operating Activities | ||||||

| Cash Flows from Investing Activities | ||||||

| Sale of property and equipment | XX | XX | XX | XX | XX | XX |

| Cash from the sale of capital assets | XX | XX | XX | XX | XX | XX |

| Purchase of new equipment and assets | XX | XX | XX | XX | XX | XX |

| Lending | XX | XX | XX | XX | XX | XX |

| Other investing cash inflows | XX | XX | XX | XX | XX | XX |

| Other investing cash outflows | XX | XX | XX | XX | XX | XX |

| Total Cash Flows from Investing Activities | XX | XX | XX | XX | XX | XX |

| Net Cash Flows from Investing Activities | ||||||

| Cash Flows from Financing Activities | ||||||

| Share issuance | XX | XX | XX | XX | XX | XX |

| Borrowing | XX | XX | XX | XX | XX | XX |

| Dividend payments | XX | XX | XX | XX | XX | XX |

| Loan payments | XX | XX | XX | XX | XX | XX |

| Other financing cash inflows | XX | XX | XX | XX | XX | XX |

| Other financing cash outflows | XX | XX | XX | XX | XX | XX |

| Total Cash Flows from Financing Activities | XX | XX | XX | XX | XX | XX |

| Net Cash Flows from Financing Activities | ||||||

| Total Cash Flows During the Financial Period | ||||||

What is the Direct Method in Cash Flow Statements?

The direct method for calculating cash flows relies on aggregating all transactions that resulted in payment or receipt of any cash amounts during the time period covered by the cash flow statement. This is done by calculating all amounts collected in cash through operating activities and then subtracting all expenses spent on these activities.

The calculation using this method is performed through the following equations:

A- Calculating Cash Received from Customers

Cash received from customers = Net sales + Decrease in accounts receivable and notes receivable – Increase in accounts receivable and notes receivable

B- Cash Received from Other Sources

Total cash received from other sources = Income from interest or dividends + Decrease in accrued revenues not collected - Increase in accrued revenues not collected

C- Cash Paid to Suppliers

This is calculated using two equations:

Value of purchases = Cost of goods sold + Increase in inventory – Decrease in inventory

Cash paid to suppliers = Value of purchases + Decrease in accounts payable – Increase in accounts payable.

D- Cash Paid for Expenses

Cash paid for expenses = Total expenses during the period (excluding depreciation and amortization) + Increase in prepaid expenses + Decrease in accrued expenses not paid – Decrease in prepaid expenses – Increase in accrued expenses not paid.

What is the Indirect Method for Preparing Cash Flow?

The indirect method for calculating cash flows begins by calculating net profit before adding taxes and credit interest in the income statement, in addition to depreciation expenses for tangible assets, and what is paid to suppliers, and calculating any decrease in inventory, minus what was collected from customers and the increase in inventory.

The cash flow statement is calculated using the indirect method through the following equation:

Cash flow from operating activities = Net profit + Non-cash expenses + Cash from operations + Decrease in receivables + Decrease in inventory + Decrease in prepaid expenses + Increase in payables + Increase in accrued expenses - Increase in receivables - Increase in inventory - Increase in prepaid expenses - Decrease in payables - Decrease in accrued expenses + Income tax paid.

Although the direct method is considered easier to understand, it may take longer, as it depends on calculating each transaction that occurred during the period covered by the cash flow statement, which makes many institutions prefer the indirect method for calculating this statement.

Ultimately, both the direct and indirect methods for preparing cash flows provide three important financial ratios:

- Net cash flow change ratio

- Cash flow ratio from operating activities

- Cash flow ratio resulting from investment and financing transactions

Practical Examples of Preparing Cash Flow Statements

The following is a practical example of preparing cash flow statements using both direct and indirect methods, based on data from income statements, balance sheets, shareholders' equity, and balance sheet items for a Saudi company for the fiscal year ending December 31, 2020.

1/ Preparing Cash Flow Statement Using the Indirect Method

| Details | Total | Items |

| Cash Flows from Operating Activities | ||

| 70,000 | Net profit before interest and taxes | |

| +30,000 | Depreciation expenses | |

| -5,500 | Changes in inventory | |

| 8,000 | Changes in accounts payable | |

| 6,000 | Changes in accounts receivable | |

| -17,000 | Changes in accrued expenses | |

| -7,000 | Changes in cash paid for income tax | |

| -18,000 | Changes in cash paid for interest expenses | |

| 66,500 SAR | Net cash flows from operating activities | |

| Cash Flows from Investing Activities | ||

| 50,000 | Cash receipts from the sale of long-term investments | |

| 20,000 | Expenses for purchasing machinery, equipment, and other fixed assets | |

| 30,000 SAR | Net cash flows from investing activities | |

| Cash Flows from Financing Activities | ||

| 40,000 | Increase in long-term loans and capital | |

| -12,000 | Repayment of loan installments and bonds | |

| -9,500 | Dividend distributions | |

| 18,500 SAR | Net cash flows from financing activities | |

| 66,500 + 30,000 + 18,500 = 115,000 SAR | Net cash flows |

2/ Application Using the Direct Method

| Details | Total | Items |

| Cash Flows from Operating Activities | ||

| 113,200 | Cash received from customers | |

| -29,000 | Cash paid to suppliers | |

| -7,500 | Cash paid for operating expenses | |

| -4,000 | Cash paid for income tax | |

| -6,200 | Changes in cash paid for interest expenses | |

| 66,500 SAR | Total cash flows from operating activities | |

| Cash Flows from Investing Activities | ||

| 50,000 | Cash receipts from the sale of long-term investments | |

| 20,000 | Expenses for purchasing machinery, equipment, and other fixed assets | |

| 30,000 SAR | Net cash flows from investing activities | |

| Cash Flows from Financing Activities | ||

| 40,000 | Increase in long-term loans and capital | |

| -12,000 | Repayment of loan installments and bonds | |

| -9,500 | Dividend distributions | |

| 18,500 SAR | Net cash flows from financing activities | |

| 66,500 + 30,000 + 18,500 = 115,000 SAR | Net cash flows |

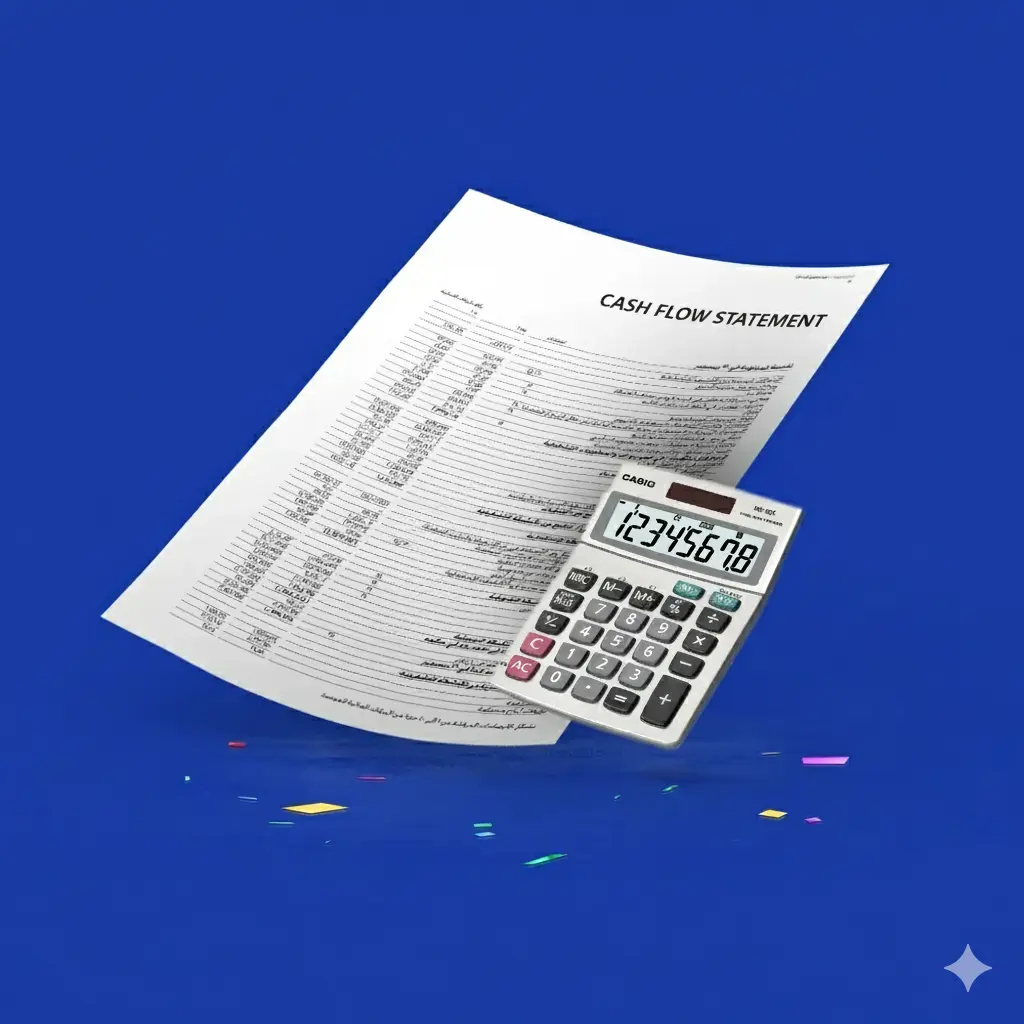

Cash Flow Statement in Daftra

Various financial statements are considered the fruit of accounting operations and are sensitive documents that are shared with external parties, not just employees. Therefore, Daftra accounting software helps you extract cash flow statements easily and automatically, without the need for manual preparation or using programs like Excel. The program provides you with many ways to control the report format and display method according to what suits your work and your specific objective for this report. It won't cost you any time, effort, or even prior accounting knowledge. All you need to do is go to the reports menu in the system, choose general account reports, then click on the desired report for Daftra to prepare it for you.

Frequently Asked Questions

What is a cash flow statement in banks?

A cash flow statement in banks is a financial report that includes all incoming and outgoing cash movements in the bank during a specific time period.

What is the difference between an income statement and a cash flow statement?

The difference between the income statement and the cash flow statement is that they focus on different aspects of presenting financial data and information. The income statement focuses on displaying revenues and expenses during a specific time period, while the cash flow statement focuses on the movement of cash in and out of the company's account during a specific time period.

What are provisions in cash flow statements?

Provisions in cash flow statements are allocated funds representing obligations on the company that have not yet been confirmed, such as depreciation provisions or provisions for potential lawsuits and others.

What is the difference between operating, investing, and financing activities in cash flow statements?

The difference between operating, investing, and financing activities in cash flow statements is as follows:

Operating activities are daily operations where financial amounts are allocated to generate revenue, such as selling products.

Investing activities are operations primarily related to buying and selling long-term assets.

Financing activities are the process of issuing stocks or bonds or obtaining loans to finance capital.

What is cash flow statement analysis?

Cash flow statement analysis involves understanding how the company generates cash and how it spends it to work on developing future plans and recommendations, and evaluating the company's financial stability.

Conclusion After covering everything you need to understand the importance of cash flow statements, their main components, and how to prepare them in this topic, it can be said that the cash flow statement is one of the most important financial tools in your accounting system that will help you maintain the optimal cash balance for the entity. The cash flow statement is a powerful key to solving the puzzle of how to predict the cash flows that the entity will obtain in the future, enabling business owners to develop effective plans to take advantage of available opportunities and avoid expected financial risks in advance.