What Is Compound Return and How Can You Calculate It?

Many investors need to forecast what their investment will achieve over a specific period, and one way to determine this is to calculate the compound rate of return. So, what is it? And how can it be calculated accurately?

Through this article, you will learn about compound return and how to calculate it. You will also learn about its types, the difference between compound returns and compound interest, and much more.

What Is Compound Return?

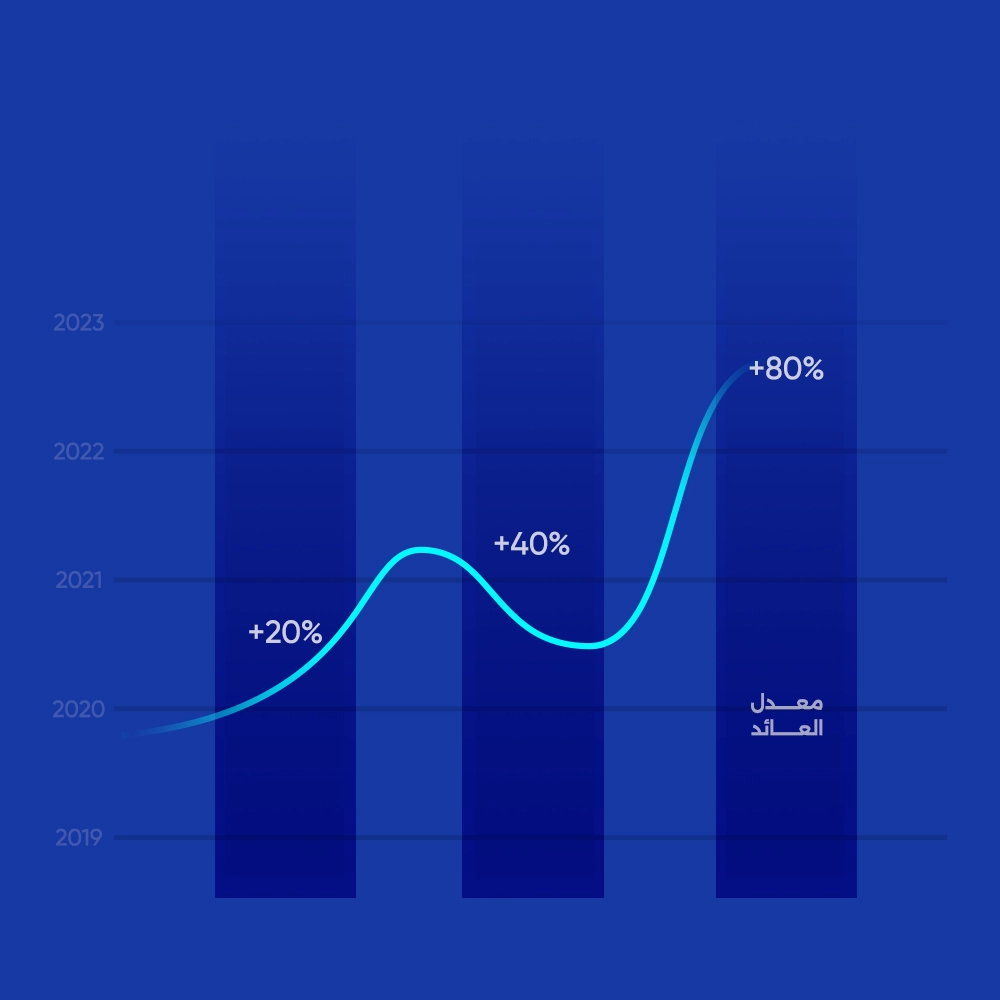

The compound rate of return is defined as a percentage that represents the cumulative effect resulting from a series of gains or losses achieved by an institution’s capital over a specific period of time. Compound return refers to the annual rate at which capital has accumulated over time.

Simply put, if a company says it has achieved an annual compound return of 10% over five years, it means it is as if it started each year having already achieved 10% growth by the end of the previous year.

Compound return is considered a more accurate measure of investment returns than the average return method. This is because the average annual return does not account for compound returns, leading to errors in estimating actual returns.

In many cases, average returns either overestimate or significantly underestimate the magnitude of growth or decline in returns. Compound returns, however, ensure that fluctuations that may lead to inflated or reduced returns are accounted for.

Use the compound return calculator to easily analyze the rate of return on your investments, for free.

How to Calculate Compound Return?

You can easily calculate the compound return of any investment using the following formula:

Compound return = Initial investment amount × (1 + compound return rate) ^ number of years

For example, if an institution invested an amount of $1,000 with an annual compound return of 12% over five years, the result would be as follows:

Compound return = 1000 × (1 + 0.12) ^ 5 = $1,762.33

Read also: What Is Financial Management, Its Functions, and Its Importance for Institutions

What Are the Types of Compound Return?

Calculating compound return is not limited to an annual time frame only; it can also be calculated daily, monthly, quarterly, or semiannually. All of these types ultimately yield accurate results, depending on the investment period.

What Is the Difference Between Compound Interest and Compound Returns?

Some people confuse the terms compound interest and compound returns. However, there is a significant difference between them:

- Compound interest: When a person receives it, it becomes part of their funds, and they can withdraw it or leave it to continue growing.

- Compound return: It is often a theoretical figure on paper and may change due to market fluctuations, which limits its ability to be realized.

For example, if a person invests $10,000 and achieves an annual compound return of around 10%, then over 7 years the value of their investment may reach $20,000. However, if any market fluctuation results in a 50% loss of their funds, they will return to the starting point of $10,000.

Since compound interest, as explained, is characterized by greater continuity, it is also characterized by stability. Compound return, on the other hand, is often variable.

Therefore, you can easily know the balance that will be credited to your account if you place your money in an investment certificate with a fixed annual compound interest, and you will receive this amount regardless of any fluctuations.

In the case of compound returns, however, the figure is merely a projection that may not be achieved, as it is influenced by many factors and subject to market fluctuations.

Although compound interest guarantees a fixed return, compound returns may achieve higher gains. Therefore, the decision to take risks in the market and purchase stocks with compound returns may be better than placing your money in a savings account with fixed compound interest, even if it involves some risks.

Read also: The Concept of Financial Forecasting and Its Methods

What Is the Compound Annual Return?

The compound annual return is the rate of return a company, institution, or investor needs annually to grow the initial balance to the final balance over a specific period. This rate assumes that any profits earned at the end of each year are reinvested during the specified period.

However, this rate is not considered a real rate of return; rather, it is a representative figure. It reflects the growth rate the investment could have achieved over a specified period if it had earned a fixed annual growth rate, with profits reinvested at the end of each year.

Nevertheless, this rate plays an important role in comparing stock growth across companies. But it overlooks the impact of market fluctuations. What a company earns in a certain year is not necessarily what it will earn in the following year; profits may even turn into losses.

How Does the Daftra Program Help You Calculate Compound Return?

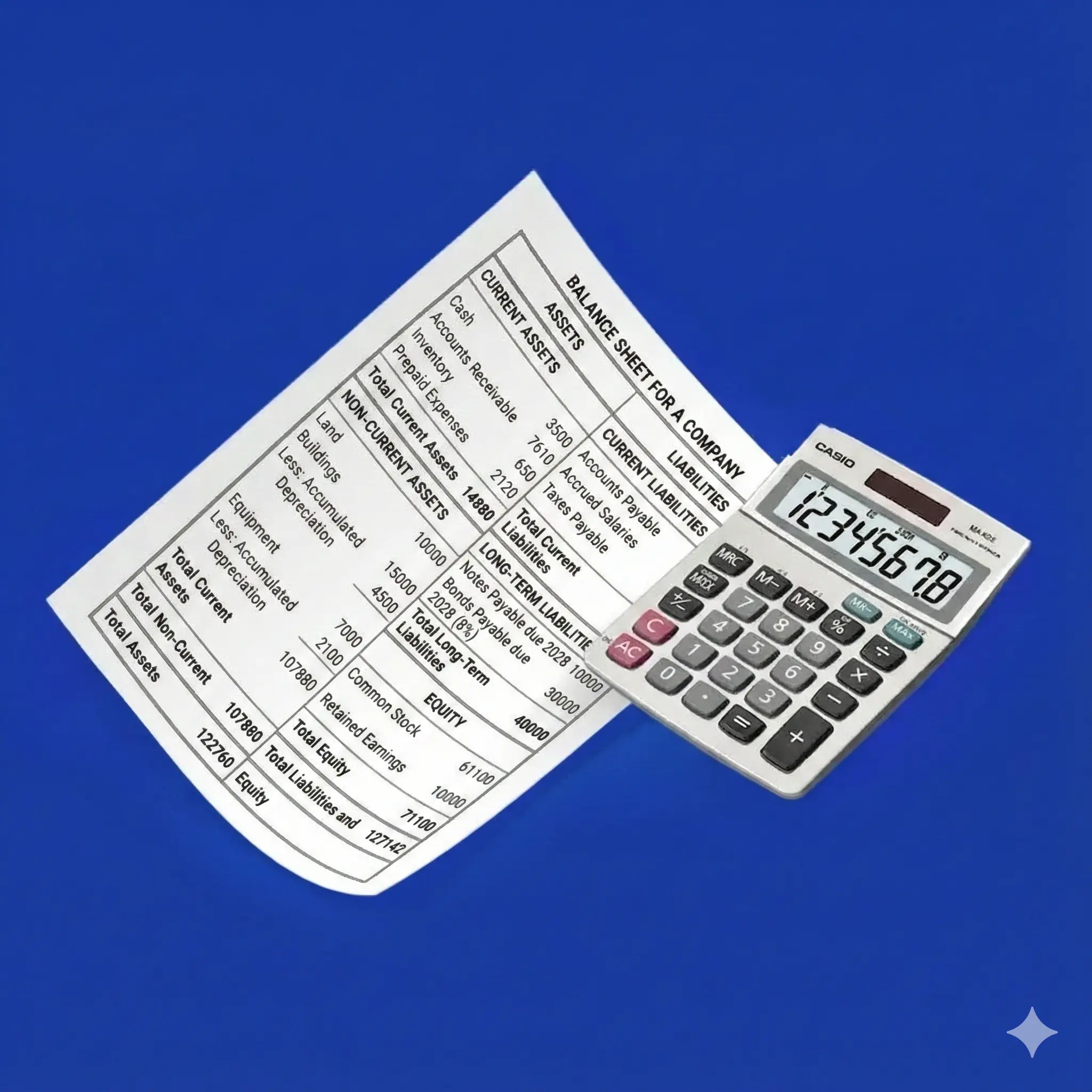

Daftra provides tools and techniques to help you calculate compound return. It offers the Accounting Rate of Return (ARR) model, which provides a lot of information to help you calculate compound return.

Daftra also provides detailed financial reports and data to help you obtain different types of information, which will be a strong support in calculating compound returns.

You can also use Daftra’s collection of free templates to calculate all types of returns:

- Return on Equity (ROE) Template

- Return on Investment (ROI) Calculation Template

- Cumulative Return Calculation Template

In conclusion, in this topic, we have explained the concept of compound return on investment in simple terms, clarified how to calculate it, and highlighted the key differences between it and compound interest.

You can rely on Daftra’s accounting software to help you calculate the compound return on your investment.