Periodic Inventory System and Perpetual Inventory System and the Difference Between Them

Table of contents:

- What Is Periodic Inventory?

- What Is Perpetual Inventory?

- What Is the Difference Between Periodic Inventory and Perpetual Inventory?

- Effectiveness of Perpetual and Periodic Inventory

- Perpetual Inventory and Periodic Inventory Entries

- Periodic Inventory Entries

- Which Accounts Do Not Appear in the Trial Balance Before Inventory and Adjustments?

- How Does Daftra Help You With Periodic and Perpetual Inventory?

- Frequently Asked Questions

Every organization needs to identify its inventory of products or raw materials to manage it appropriately, in line with market demand, so that no sudden shortages occur and no excessive surpluses accumulate and become useless.

Here, the role of inventory counting appears. It is a system used to monitor goods, raw materials, and products in specific warehouses by physically verifying quantities on hand and comparing them with records in official documents and the company’s systems, and by ensuring the condition of the stored materials.

There is more than one system for inventory counting, and each differs in the method used in the inventory process, the tools relied upon, and the time period between inventory counts.

Each organization uses the inventory system that best suits it. But what is the difference between periodic and perpetual inventory, and how do we choose between them? If you are the person assigned to select the best system for counting your company’s inventory, you should first understand the differences between the various types of inventory systems. But first, what does the term “inventory” mean?

Quick Points (At a Glance)

- The Periodic Inventory System is linked to a specific date on which the items and goods received and issued from inventory during a defined period are reviewed.

- Perpetual Inventory System tracks inventory in real time and is not tied to a specific period or date. Continuous recording keeps you constantly informed about inventory and its transactions; therefore, it is considered more accurate.

- When preparing accounting entries, the Purchases Account is used for periodic inventory, whereas the Inventory Account is used for perpetual inventory.

- The calculation of Cost of Goods Sold (COGS) becomes more accurate under the perpetual inventory system because it is updated after each sale, while under the periodic inventory system, COGS is calculated at the end of the accounting period.

- The perpetual inventory system helps verify whether the units available in the warehouse match the records, whereas the periodic inventory system determines the cost of goods sold for a specific period.

What Is Periodic Inventory?

The Periodic Inventory System is a method by which a company updates its inventory records at regular intervals, typically weekly, monthly, quarterly, or annually. It is an inventory system that was commonly used in the past, in the absence of modern continuous inventory-tracking systems.

At the end of each period, the company calculates the physical inventory and records all merchandise purchases in the Purchases Account.

The cost of goods sold is an important accounting measure because it shows the company’s gross margin after deducting the cost of goods sold from revenues. To calculate the cost of goods sold using the periodic inventory system, the following equation is used:

Beginning Inventory Balance + Cost of Inventory Purchases – Ending Inventory Cost = Cost of Goods Sold

Despite the emergence of other inventory systems, many stores still use the periodic inventory system, particularly in the absence of modern digital tools.

What Is Perpetual Inventory?

The Perpetual Inventory System is a method for tracking inventory balances in real time, continuously, using modern technology. Inventory management systems or records are automatically updated with increases upon purchasing or returning a product, and with decreases upon sale or damage.

These updates adhere to the highest standards of accuracy, provided no malfunctions or embezzlement occur.

The perpetual inventory system facilitates control over your company’s inventory account by recording every purchase and adding it to the database immediately. Each item in the warehouse is recorded in a ledger that contains information about its purchase, and the cost of goods sold is recorded continuously.

Each item in inventory is assigned a serial number to help classify it, determine how long it remains in storage, and enable easy access whenever needed.

What Is the Difference Between Periodic Inventory and Perpetual Inventory?

There are clear differences between periodic and perpetual inventory in many aspects, such as the preparation of accounting entries, the method of application, the calculation of the cost of goods, closing entries, inventory accounting, as well as differences in recording purchases, usage, costs, and many other aspects that you will learn about in the following points.

Below are the differences between periodic and perpetual inventory in terms of:

- Preparation of Entries: In the periodic inventory system, the Purchases Account is used when preparing accounting entries. In the perpetual inventory system, the Inventory Account is used.

- Application: When using the periodic inventory system, the beginning and ending inventory accounts are used. In the perpetual inventory system, the Cost of Sales Account is used.

- Cost of Goods Calculation: The cost of goods sold calculation is more accurate under the perpetual inventory system because it is updated after each sale. In the periodic inventory system, the cost of goods sold is calculated at the end of the accounting period.

- Closing Entries: These are entries made at the end of any accounting period. They are required in the periodic inventory system, but not in the perpetual inventory system.

- Inventory Account: In the periodic inventory system, available inventory is physically counted by employees. In the perpetual inventory system, a computerized software system is used to track available products in real time.

- Recording Purchases: In the perpetual inventory system, purchases are recorded in the general ledger or subsidiary ledger, and the inventory unit entry is updated individually. In the periodic inventory system, an entry for the cost of goods sold is added when the physical inventory count is conducted at the end of the reporting period.

- Usage: The perpetual inventory system helps verify whether the units available in the warehouse match the records, while the periodic inventory system determines the cost of goods sold for a specific period.

- Cost: The perpetual inventory system requires higher costs, as it needs specialized employees and the purchase of software to facilitate the inventory process. The periodic inventory system is cheaper and requires less work.

- Record Updates: Inventory records are updated regularly in perpetual inventory systems and periodically in periodic inventory systems.

Read also:Inventory and Warehouse Management, Its Importance, and Its Conditions

Effectiveness of Perpetual and Periodic Inventory

To understand the effectiveness of perpetual and periodic inventory, let us first examine how inventory is managed under each method.

Inventory records in the perpetual (continuous) inventory system are updated continuously after every purchase or sale. This system enables the company to know the quantity and value of available inventory at any time. It is commonly used through accounting information systems and electronic inventory management software to track costs and revenues more accurately and in real time.

In the periodic inventory system, inventory records are not updated after each transaction. Instead, a physical inventory count is conducted at the end of the accounting period. It is commonly used in small companies or in specific cases where maintaining a perpetual inventory system is not justified.

Therefore, the perpetual inventory system is considered more effective at providing up-to-date, accurate inventory information, though it may require a greater investment in systems and technology. The periodic inventory system is simpler but less accurate. The advantages of the perpetual inventory system can be summarized as follows:

- Inventory Updates: The perpetual inventory system provides continuous inventory updates with every purchase or sale, helping make faster, more accurate decisions regarding purchasing and inventory management.

- Error Detection: Early detection of errors and embezzlement in the perpetual inventory system, since inventory records are continuously updated. This allows rapid identification of inventory errors or discrepancies, helping detect and address issues such as theft, loss, or record errors much faster than in a periodic inventory system.

- Improving Supply Chain Management: The perpetual inventory system enables quick responses to demand changes and reduces the risk of stockouts or excess inventory.

- Planning and Forecasting: Improved planning and forecasting through the perpetual inventory system, as continuous and updated data allow for better analysis of trends and patterns, helping with accurate planning and forecasting of sales and purchases.

- Improving Customer Service: Thanks to accurate, up-to-date inventory information from a perpetual inventory system, companies can provide customers with more precise information on product availability and delivery times.

- Cost Reduction: Although the perpetual inventory system may require a higher initial investment in information technology and systems, it can lead to long-term cost savings by improving inventory management efficiency and reducing losses and unnecessary expenses.

After presenting the differences between periodic and perpetual inventory and clarifying the advantages of the perpetual inventory system, we will explain the conditions required to implement each system. Below are the accounting entries for periodic and perpetual inventory systems.

Read also:

- What Is an Item Card in Warehouses

- What Is a Receipt Voucher, Its Contents, and How It Works

- What Is Inventory, Its Types, and the Best Methods for Calculating Inventory

Perpetual Inventory and Periodic Inventory Entries

There are many accounting entries that accountants deal with in both periodic and perpetual inventory systems. In this section, we address the most important of these entries and the fundamental differences in their recording.

Perpetual Inventory Entries

The perpetual inventory system aims to identify the level of inventory in warehouses at any time. Therefore, daily accounting entries are made whenever items are added to or issued from the warehouse. These entries include recording the purchase of goods, the sale of goods, the cost of goods sold, sales returns, purchase expenses, and closing entries.

Below are the perpetual inventory entries in detail with a full explanation:

1- Entry to Record the Purchase of Goods

Inventory is recorded as a debit, while the supplier is considered a credit, as follows:

(Debit Inventory Account / Credit Supplier Account).

| Entry in Case of Purchase | ||||

| Entry No. | Date | Subsidiary Account | Debit | Credit |

| ……. | ……. | Inventory Account | xxxx | |

| Supplier Account | xxxx | |||

2- Entry to Record the Sale of Goods

The cost of inventory must be calculated before it is sold, and this is recorded in an entry that precedes the sales entry. The entry is as follows:

| Entry to Record Sales and Their Cost | ||||

| Entry | Date | Description | Debit | Credit |

| ……. | ……. | Cost of Sales Account | xxxx | |

| Inventory Account | xxxx | |||

3- Entry to Record the Cost of Goods Sold and Issued from the Warehouse

The cost of goods sold account is considered a debit, while the inventory account is considered a credit, as follows:

(From Cost of Goods Sold Account to Inventory Account)

| Entry to Record the Cost of Goods Sold | ||||

| Entry | Date | Subsidiary Account | Debit | Credit |

| ……. | ……. | Cost of Goods Sold Account | xxxx | |

| Inventory Account | xxxx | |||

4- Sales Returns Entries in the Perpetual Inventory System

The sales returns account is considered a debit, while the customer account is considered a credit, as follows:

(From Sales Returns Account to Customer Account). When applying value-added tax (VAT), it should be noted in the entry.

| Entry in Case of Sales Returns | ||||

| Entry | Date | Subsidiary Account | Debit | Credit |

| ……. | ……. | Sales Returns Account

Value Added Tax Account | xxxx

xxxx | |

| Customer Account | xxxx | |||

5- Selling Expenses

These are the seller's expenses. The sales expenses account is considered a debit, while the cash account is considered a credit, as follows:

(From Sales Expenses Account to Cash Account).

| Entry for Selling Expenses | ||||

| Entry | Date | Subsidiary Account | Debit | Credit |

| ……. | ……. | Sales Expenses Account | xxxx | |

| Cash Account | xxxx | |||

6- Purchase Expenses

These are the expenses borne by the buyer, such as transportation from one city to another, customs clearance, and other related costs, if the shipment is from abroad. The purchase expenses account is considered a debit, while the supplier account is considered a credit, as follows:

(From Purchases Expenses Account to Cash Account).

| Entry for Purchase Expenses | ||||

| Entry | Date | Subsidiary Account | Debit | Credit |

| ……. | ……. | Inventory Account | xxxx | |

| Suppliers Account | xxxx | |||

7- Closing Entries

The Income Summary Account is used as an intermediary account, sometimes as a credit and sometimes as a debit, to close revenue and sales accounts as temporary accounts.

| Entry to Close Revenues | ||||

| Entry | Date | Subsidiary Account | Debit | Credit |

| ……. | ……. | Sales Revenue Account | xxxx | |

| Income Summary Account | xxxx | |||

The Income Summary Account is used as an intermediary account, sometimes as a credit and sometimes as a debit, to close revenue and sales accounts as temporary accounts.

| Entry to Close Expenses and Debit Balances | ||||

| Entry | Date | Subsidiary Account | Debit | Credit |

| ……. | ……. | Income Summary Account | xxxx | |

Sales Returns and Allowances Account Cash Discount Account Cost of Goods Sold Account | xxxx | |||

There are two cases for closing the Income Summary Account: in the case of profit or in the case of loss. In the case of profit, the income summary appears as a debit. In the case of loss, it appears as a credit.

| Entry to Close the Income Summary Account in Case of Profit | ||||

| Entry | Date | Subsidiary Account | Debit | Credit |

| ……. | ……. | Income Summary Account | xxxx | |

| Capital Account | xxxx | |||

| Entry to Close the Income Summary Account in Case of Loss | ||||

| Entry | Date | Subsidiary Account | Debit | Credit |

| ……. | ……. | Capital Account | xxxx | |

| Income Summary Account | xxxx | |||

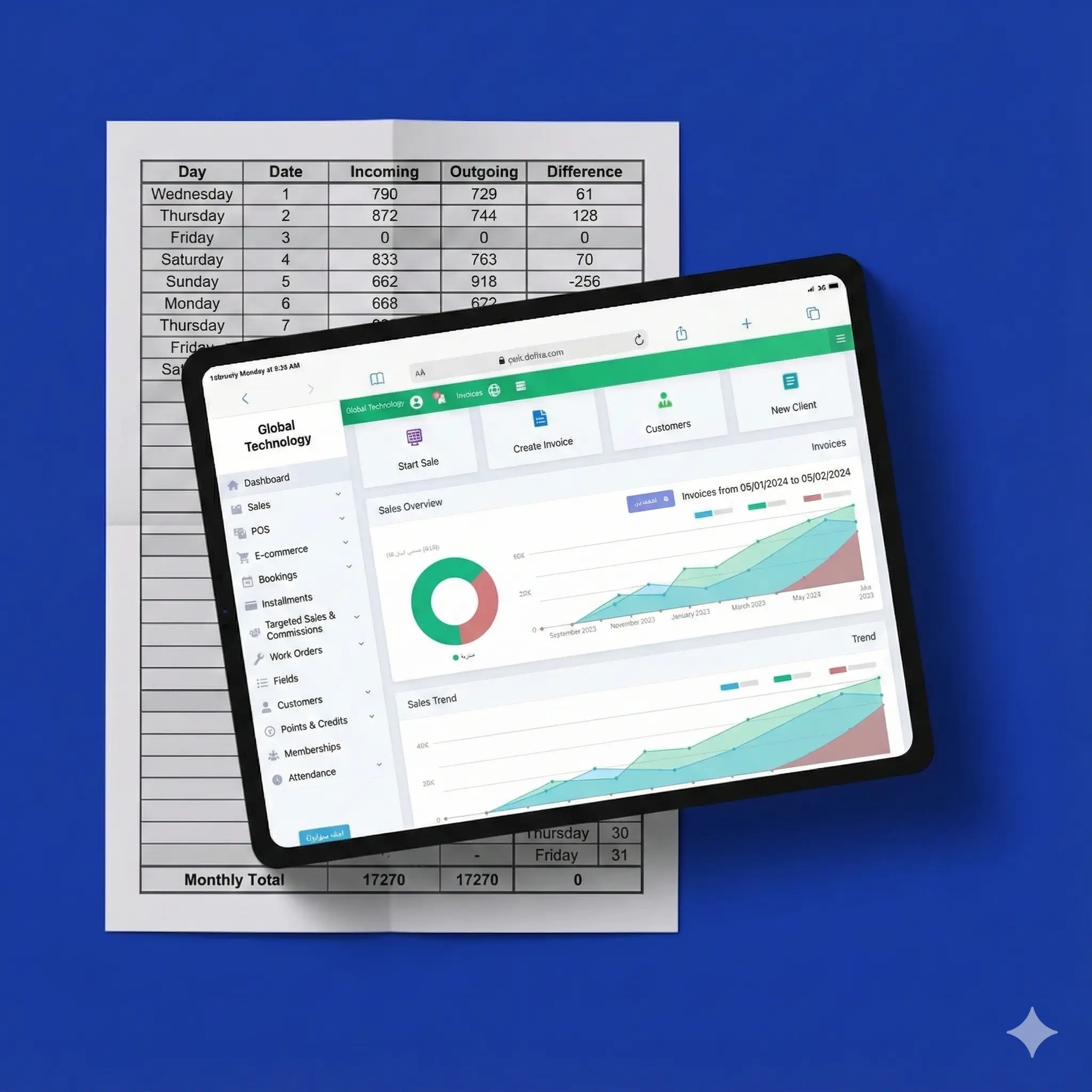

You can rely on Daftra’s Warehouse Journal template to track inventory movement on a daily basis.

Use the Profit Margin Calculator to determine the value of gross profit, net profit, or operating profit.

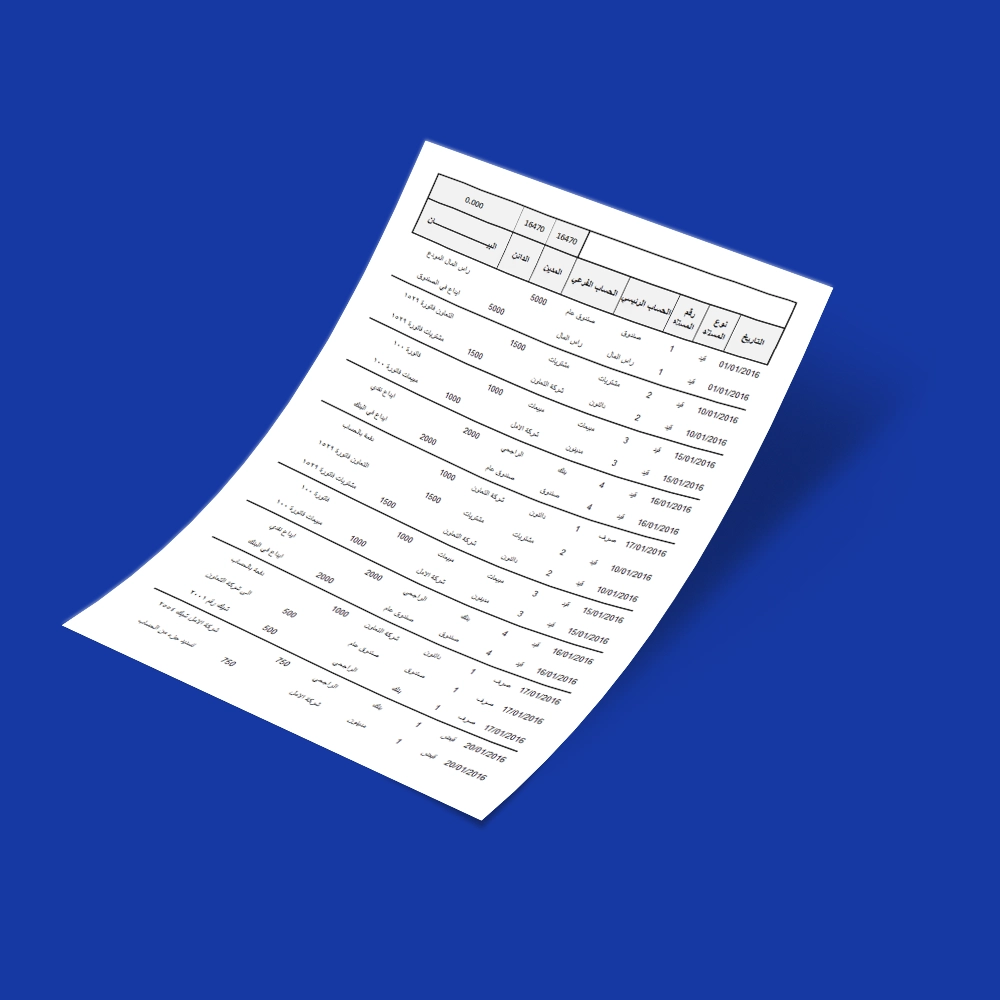

Periodic Inventory Entries

When a company adopts the periodic inventory system, it does not need to record daily accounting entries for adding or issuing goods from the warehouse. When the company purchases or sells goods, it only records sales and purchase entries, payments to suppliers, and collections from customers.

These entries include: the entry to record purchases, the entry for purchase expenses, the entry to return part of the purchased goods, the entry to sell part of the goods, and finally the entry to return part of the goods sold, in addition to closing entries. Below are the details of periodic inventory entries:

1- Entry to Record Purchases

Purchases are recorded as a debit, while the supplier is recorded as a credit, as follows:

(From Purchases Account to Supplier, Bank, or Cash Account).

| Entry in Case of Purchase | ||||

| Entry | Date | Subsidiary Account | Debit | Credit |

| ……. | ……. | Purchases Account | xxxx | |

| Supplier, Bank, or Cash Account | xxxx | |||

2- Entry for Purchase Expenses

When recording purchase expenses, the purchase expenses account is recorded as a debit, while the supplier or cash account is recorded as a credit, as follows:

(From Purchase Expenses Account to Supplier or Cash Account).

| Entry for Purchase Expenses | ||||

| Entry | Date | Subsidiary Account | Debit | Credit |

| ……. | ……. | Purchase Expenses Account | xxxx | |

| Supplier or Cash Account | xxxx | |||

3- Entry for Returning Part of the Goods

When recording the return of part of the goods, the supplier or cash account is debited, while the purchase returns account is credited, as follows:

(From Supplier Account to Purchases Returns Account).

| Entry for Returning Part of the Goods | ||||

| Entry | Date | Subsidiary Account | Debit | Credit |

| ……. | ……. | Supplier Account | xxxx | |

| Purchases Returns Account | xxxx | |||

4- Entry for Selling Part of the Goods

When recording the sale of part of the goods, the customer account is debited, while the sales account is credited, as follows:

| Entry for Selling Part of the Goods | ||||

| Entry | Date | Subsidiary Account | Debit | Credit |

| ……. | ……. | Customer Account | xxxx | |

| Sales Account | xxxx | |||

5- Entry for Returning Part of the Goods Sold

If a customer returns part or all of the goods sold, the sales returns account is debited, and the customer account is credited, as follows:

(From Sales Returns Account to Customer Account).

| Entry for Returning Part of the Goods Sold | ||||

| Entry | Date | Subsidiary Account | Debit | Credit |

| ……. | ……. | Sales Returns Account | xxxx | |

| Customer Account | xxxx | |||

6- Closing Entries

When recording ending inventory, it is recorded as a debit, while purchases are recorded as a credit. The entry is as follows:

| Closing Entries | ||||

| Entry | Date | Subsidiary Account | Debit | Credit |

| ……. | ……. | - Sales Revenue Account - Purchases, Returns, and Allowances Account - Cash Discount Earned Account (if any) - Ending Inventory Account | xxxx | |

| Purchases Account | xxxx | |||

You can now download Daftra’s Inbound and Outbound Template for free to help you manage inventory and operating expenses.

Which Accounts Do Not Appear in the Trial Balance Before Inventory and Adjustments?

- Provisions: Such as the allowance for doubtful debts or warranty provisions. These accounts require estimates determined at the end of the accounting period and are recorded through adjusting entries.

- Accumulated Depreciation: Depreciation may not be recorded periodically during the year and is added as an adjustment at the end of the accounting period.

- Cost of Goods Sold (COGS): Under the periodic inventory system, COGS is calculated at the end of the period following the physical inventory count.

- Accrued Revenues and Expenses: Revenues that have been earned but not yet collected, and expenses that have been incurred but not yet paid, may not appear until accounting adjustments are made.

- Ending Inventory: Under the periodic inventory system, the value of ending inventory is determined only after the physical inventory count at the end of the accounting period.

- Deferred Revenues and Expenses: Revenues collected in advance for services or goods not yet provided, and expenses paid in advance for services or goods not yet consumed.

Read also:Best stocktaking Software

How Does Daftra Help You With Periodic and Perpetual Inventory?

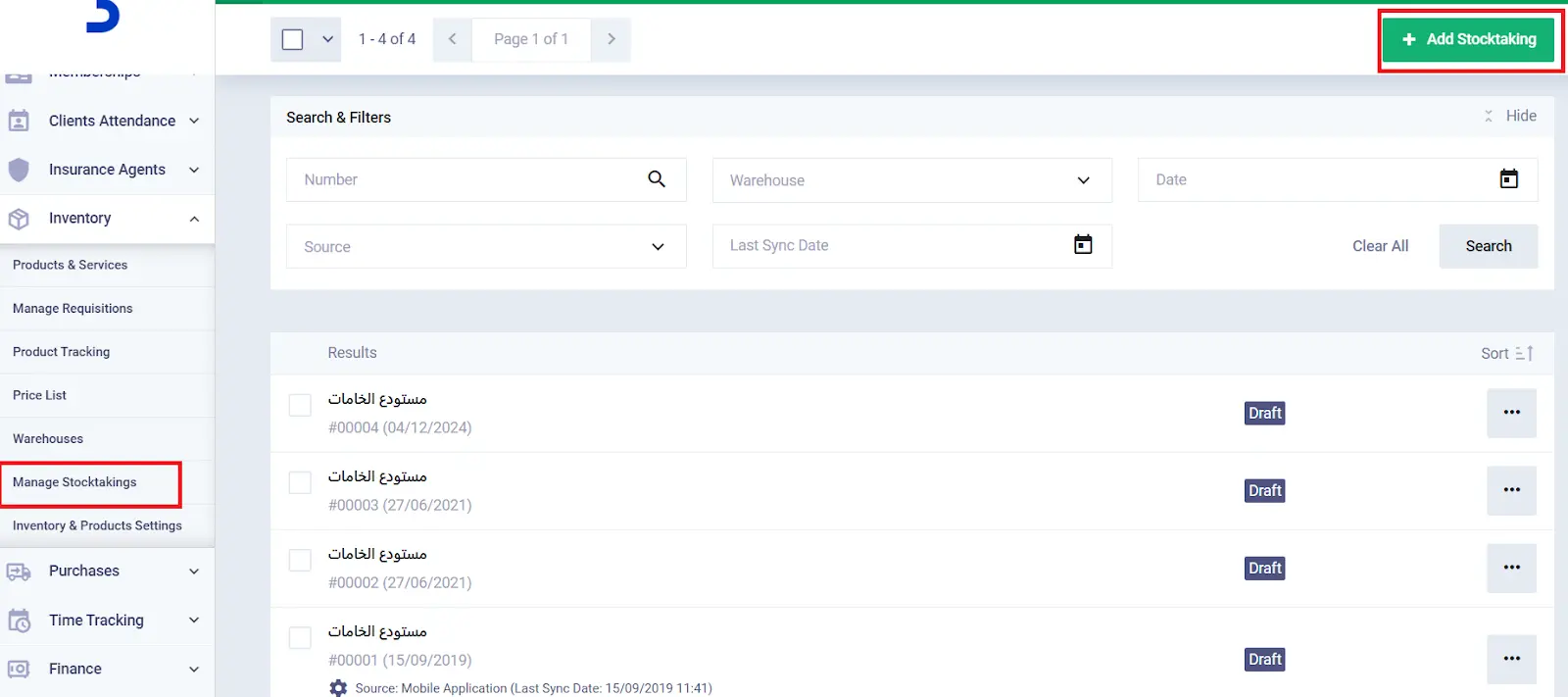

Through Daftra’s Stocktaking Management Software, you can perform inventory counts of all types at times that suit you, whether periodic or perpetual, every three months, annually, or even on a daily basis.

Daftra helps you easily manage inventory and compare actual inventory with the inventory recorded in the software and accounting books, enabling you to act quickly in cases of shortages or to detect accounting errors and manipulation.

You can also download the inventory counting application from Google Play or the App Store.

Related Articles

- What Are Inventory Adjustments in Accounting and Their Objectives

- What Is the Warehouse Documentation Cycle

Frequently Asked Questions

What are the disadvantages of perpetual inventory?

- Establishing and maintaining a perpetual inventory system can be costly, especially in terms of the technology and software required.

- The perpetual inventory system can be complex to implement and maintain, and may require employee training to use it properly.

- The perpetual inventory system relies heavily on electronic systems, so any technical failures can disrupt inventory tracking.

- Despite automation, there is still room for human error in perpetual inventory, especially in data entry.

- The need to verify the accuracy of records and match them with the actual physical inventory.

What are the disadvantages of periodic inventory?

- It does not provide continuous, real-time updates on inventory status.

- It requires time and effort.

- Errors or manipulation may occur in periodic inventory.

- It does not allow for year-round monitoring.

- It may negatively affect planning or decision-making.

- It may not be suitable for companies with large inventories.

When is perpetual inventory conducted?

Perpetual inventory should be carried out after every sales transaction.

When does a company use the perpetual inventory system?

A company uses a perpetual inventory system when it needs continuous, detailed tracking after every sales or purchase transaction, allowing it to remain fully and continuously aware of its inventory status.

What is the chart of accounts for perpetual inventory?

It is an accounting system that records every inventory transaction, sale, or purchase immediately and continuously.

In conclusion, this topic covered the definition of periodic and perpetual inventory, the differences between them, and the entries and methods for implementing each, explained in a simplified manner. If you have any questions, feel free to share them in the comments.