Best accounting software in Saudi Arabia

Accounting software is a specialized computer Software that enables tracking account transactions, financial reporting, creating e-invoices, and managing payroll, among other essential accounting tools and Softwares.

Regardless of your company's size and field, the adoption of accounting software is a top priority, especially in Saudi Arabia, due to the rapidly growing economy and the strict regulations regarding financial reporting and tax compliance, particularly with the introduction of VAT.

That’s why when you choose the accounting software in Saudi Arabia, it must be trusted by ZATCA (the Zakat, Tax, and Customs Authority).

Here is a comprehensive understanding of the top 10 accounting software in Saudi Arabia, presented in a detailed list of features and pricing.

The Top 10 Accounting Software in Saudi Arabia

If you are in the process of searching for and comparing the right accounting software that is trusted by ZATCA in Saudi Arabia, and this takes time and effort, this list will help streamline your decision-making.

- Daftra

- Qoyod

- Wafeq

- VoM

- XERO

- QuickBooks

- Odoo Accounting & Finance

Starting the list with the most well-known and used accounting software in Saudi Arabia for the last 10 years:

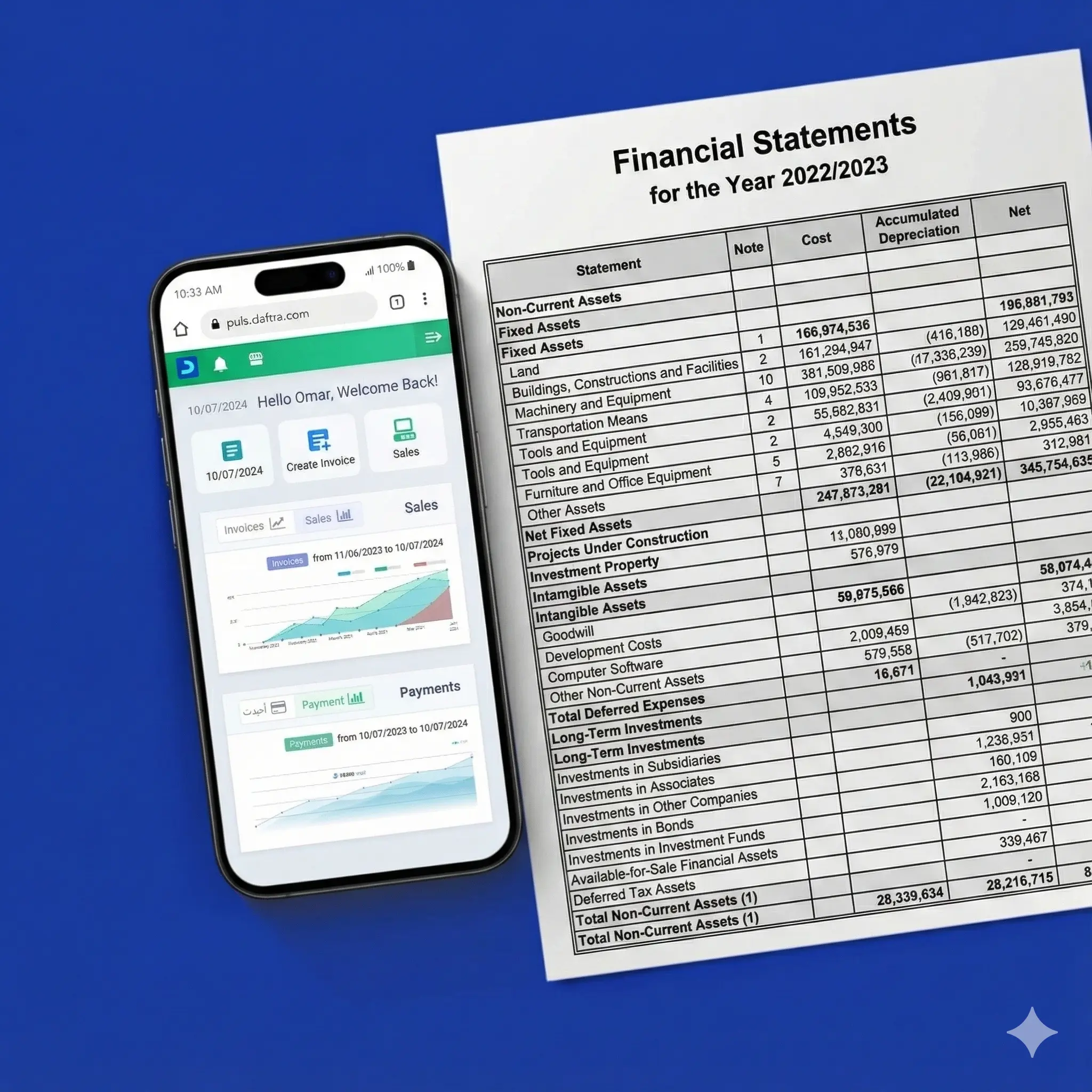

1- Daftra

Daftra is an ERP system that manages your entire business, enabling six apps that provide sales invoicing, Financial Reports, Stock Tracking, Attendance & Leave Management, Project Management, Client Follow-Up, and more.

How Daftra Protects Your Data with 256-bit Encryption and Advanced Security

Daftra accounting software offers secure hosting servers with 256-bit SSL encryption technology, which means the accounts' data are safe, private, and recoverable at all times.

Daftra features daily auto backups that are stored separately for more security, plus the location is secured against losing data due to server failures or cyberattacks.

Customer Service Around The Clock

Daftra provides a whole team to support all requests, responding and resolving the issue immediately with no additional fees available for all users, regardless of the plan subscription.

Reach out to the customer service team through live chat, phone, or email. Available to respond to technical troubleshooting or how-to guides, accounts and bill questions, and lastly, advice on using the software effectively.

Daftar's Integrated Accounting Software Apps

Simplify the process of analyzing the audits and financial books to improve the reporting process and decision-making by relying on integrated accounting software like Daftra.

It assists in tracking the income and expenses of the receivable and payable accounts and creating reports on the financial and analytical statements, besides the cash management of the bank accounts, reconciliation, credit cards, and others.

The accounting software apps in Daftra are:

- Sales Management

- Customer Relationship Management (CRM)

- Inventory And Purchases Management

- Accounting Management

- Operation Management

- Human Resources Management

The Customization of Accounting Software for Diverse Industries

Daftra accounting software can be customized for more than 50 industries in Saudi Arabia, which contributes to maintaining compliance and improving overall efficiency by providing a personalized interface for users to navigate and reducing manual tasks that consume time and effort, among other things.

Creating Advanced Financial Reporting

The importance of creating advanced financial reports in all industries is getting deeper insights into the company's performance over a period of time to analyze and make decisions that impact the company's future.

Daftra provides interactive reporting tools, data analysis, customizable reports, automated generation, multi-currency support, and software integration.

Company Expense and Revenue Tracking

The Daftra expense and revenue tracking system enables you to categorize expenses into multiple types, such as depreciation, taxes, employee salaries, and other expense items. Daftra then automatically records and tracks these expenses, linking them to cost centers. This helps regulate spending, control costs, and improve financial efficiency. In addition, Daftra generates detailed reports to monitor expenses and compare them against revenues.

Furthermore, expenses and revenues can be recorded automatically through payment and receipt vouchers, including descriptions for each transaction. Supporting documents, such as receipts or invoices, can also be attached when necessary. This ensures accurate calculations of costs and income, contributing to more informed financial decision-making.

Chart of Accounts Management

With Daftra’s chart of accounts feature, you can fully customize your accounts to match your business needs. The system allows you to record and post journal entries automatically into the chart of accounts, while giving you access to total revenues, expenses, assets, and liabilities. You can also add additional accounts, such as profits or losses. All of this—and more—can be managed from Daftra’s dashboard with just a single click.

Journal Entries Creation

Daftra enables the creation of accurate and precise journal entries for all business and financial transactions. Whenever a new transaction occurs in the system, Daftra automatically generates the corresponding accounting entries and posts them to the chart of accounts. These entries can then be used to prepare the trial balance and various financial statements.

Daftra Key Features

- ZATCA e-Invoicing Compliance

- Full Arabic & RTL Support

- Automated VAT & Zakat Reporting

- Advanced Reporting & Audit Trails

- Seamless Integrations

- Cloud-Based Access & Security

- Ease of Use & Dual-Language Interface

- Flexible Pricing & Scalability

- Mobile App Integration

Read more: Best accounting software for mobiles (Android / IOS)

Daftra’s Pricing Plan

Daftar’s pricing plan features a free 14-day trial, No Credit Card Required, No Setups, and All-App Inclusive. Here are the three plans in detail:

| Plan | Basic | Advanced | Premium |

| Yearly | 1140 SR Per Year 95 SR Billed monthly | 1860 SR Per Year 155 SR Billed monthly | 2700 SR Per Year 225 SR Billed monthly |

| Monthly | 120 SAR Billed monthly | 220 SAR Billed monthly | 320 SAR Billed monthly |

Pros

- Cloud-Based & Secure

- Easy & Customizable Interface

- Comprehensive Integration

- Advanced Reports & Analytics

- 24/7 Technical Support

- High Flexibility in Customization

- Fully Integrated Mobile App

- Accurate Accounting

- Automated HR & Payroll Management

- Multi-Language & Multi-Currency Support

- 14-Day Free Trial

Read Also: Best Bookkeeping Software in Saudi Arabia

2- Qoyod

Qoyod is a cloud-based accounting platform from Saudi Arabia, founded in 2016, built mainly for small and medium businesses in the local market. It helps companies manage day-to-day accounting while staying aligned with Saudi requirements.

What you can do with Qoyod

ZATCA-approved e-invoicing to support Saudi e-invoicing compliance

Inventory + expense tracking for basic operational control

Cost center reporting to understand performance by department, branch, or project

Pricing

| Plan | Monthly | Annual (discounted) |

|---|---|---|

| Basic | 120 SAR/month | 100 SAR/month (1,200 SAR/year) |

| Pro | 180 SAR/month | 150 SAR/month (1,800 SAR/year) |

| Advanced | 330 SAR/month | 184 SAR/month (2,211 SAR/year) |

| Enterprise | Custom | Custom |

Read also: Best Sole Trader Accounting Software

3- Wafeq

Wafeq is a cloud accounting platform built for businesses in the Gulf—especially Saudi Arabia and the UAE—with a focus on making invoicing, tax workflows, and day-to-day accounting easier for business owners and accountants. It supports Saudi requirements like ZATCA-compliant e-invoicing and related VAT reporting.

Key features

Invoicing, quotes, and credit notes (with tax/VAT support)

ZATCA e-invoicing (Phase 2 support on higher plans)

Expenses + purchasing workflows (bills, POs, debit notes)

Projects & cost centers (available on certain plans)

Payroll, inventory, fixed assets (Premium and above)

Reporting & insights (dozens of financial reports)

Pricing

| Plan | Monthly | Annual (discounted) |

|---|---|---|

| Starter | 119 SAR/month | 99 SAR/month (1,190 SAR/year) |

| Plus | 149 SAR/month | 119 SAR/month (1,430 SAR/year) |

| Premium | 249 SAR/month | 199 SAR/month (2,390 SAR/year) |

| Enterprise | Custom | Custom |

4- VoM

VoM is one of the widely used accounting systems in Saudi Arabia. It offers a streamlined version designed to support contracting and construction businesses. However, its pricing is noticeably higher than many similar tools in the market—some alternatives may match or even outperform it at half (or even a third) of VoM’s subscription cost.

Key Features of VoM

10 invoice templates with light customization (show/hide fields, add terms & conditions).

Project accounting to manage finances by project.

Cost centers, fixed assets, and chart of accounts, plus creating journal entries.

Monthly payroll processing.

Role-based access control to manage employee permissions by responsibility.

Unlimited products, with categorization to keep items organized and easier to manage.

VoM Pricing (SAR)

Plan Monthly Price

Advanced Plan 270 SAR / month

Unlimited Plan 350 SAR / month

Business Plan Contact sales for pricing

Read Also: Best Self-Employed Accounting Software in Saudi Arabia

5- Xero Accounting Software

Xero Accounting Software is designed for small and medium-sized businesses in Saudi Arabia. It benefits the accountants and bookkeepers by providing diverse tools that help streamline the process of invoicing, bank reconciliation, and reporting.

Xero Accounting Software effortlessly tracks project costs, manages employee information, tracks expenses, and manages spending with ease.

Pros

- User-friendly interface.

- Cloud-based access

- Customizable financial insights

- Supports multiple currencies

- Mobile app

- Real-time collaboration with the team

- Regular updates for the features and security

- Transparent pricing and flexible plans

Xero Software Pricing Plan

- Basic: 75 SAR / month

- Advanced: 300 SAR / month (enterprise up to 75,200 SAR / year)

6- QuickBooks

QuickBooks is for small businesses and features a simple interface of income and expense accounts; it takes two to four weeks to learn how to use the software. The accounts can be easily used and organized by diverse devices at any time. As well, it offers a free 30-day trial and manages the day-to-day recording of bills.

Key Features

- Provides free technical support services for subscribed clients.

- Offers, among other additional features, electronic integration via API with external systems and applications.

- QuickBooks displays financial account reports within the software, as well as the history of all transactions carried out.

- Allows certain modifications to the software as a form of customization.

- QuickBooks offers tutorials and educational lessons on how to use the system; however, these resources are not currently available in Arabic.

Pros

- User-friendly interface

- Integration with third-party apps

- Good reporting and financial tracking

- Mobile app available

- One-time purchase option

QuickBooks Pricing Plan

- Basic (Online): 75–130 SAR / month

- Advanced (Online): 885 SAR / month

- Desktop one-time license: 940 SAR (Pro Plus 2024)

7- Odoo Accounting & Finance

Odoo Accounting and Finance software features a modern interface, which means no delayed reaction or overflowing email with response times of less than 90 milliseconds per click. The Odoo software is an AI-powered invoice data capture that dispenses with the process of tedious data entry.

Key Features

- Allows adding an unlimited number of users, with one primary user free of charge and $8 for each additional user.

- Odoo provides free technical support services for subscribed clients, similar to the other five systems.

- Supports the Arabic language, though with some limitations, as parts appear to be machine-translated rather than natively prepared. It is also approved by the Zakat Authority.

- Offers electronic integration via API with external systems and applications.

- Reports and performance tracking: Odoo provides reports within each account, along with a history of the transactions carried out.

Pros

- Customization

- Integration with other modules

- User-friendly interface

- Cost-effectiveness

- Multi-currency & multi-language support

Odoo Pricing Plan

- Basic: 0 SAR (one free app)

- Standard: 94 SAR / user/month

- Custom: 140 SAR / user/month

FAQs

Which is better, accounting software or Excel?

Excel is ideal for beginners and small businesses because it offers a basic accounting process that meets their specific needs. On the other hand, accounting software is a priority for business revenue growth and corporations, thanks to its real-time data updates and advanced reports, among other tools and apps.

Which is the best software for accounting?

The best accounting software internationally is QuickBooks, which supports 11 languages around the world and provides auto-tracking of business income and expenses. On the other hand, Daftra accounting software is preferred for Saudi Arabian businesses, as it is trusted by ZATCA.

What software do accountants normally use?

As mentioned above, the top 10 accounting software in Saudi Arabia and the Middle East are. The most used software by accountants is QuickBooks, XERO, Sage, and Daftra.

Conclusion

In conclusion, after reviewing the features and functions of the most important accounting software in Saudi Arabia to make it easier for you to choose the one that best fits the nature and size of your business, it can be said that investing in the best accounting software in Saudi Arabia that meets your specific needs and achieves your financial goals efficiently is not just a business decision—it is a necessary step to improve the management of your accounting operations.

From identifying financial transactions, recording them in daily journals, posting them to the general ledger, preparing the trial balance before and after adjustments, to generating financial statements and their reports, and finally closing the accounts, accounting software provides accurate data and results for all these processes. This ultimately supports you in making sound financial and investment decisions that benefit the growth of your business, increase profits, and maintain your competitive position in the market.