What Is Asset Turnover Ratio? And How to Calculate It and Its Importance

Table of contents:

- What Is the Asset Turnover Ratio?

- What Is the Formula for the Asset Turnover Ratio?

- What Is the Fixed Asset Turnover Ratio?

- What Is the Current Asset Turnover Ratio?

- How Do I Calculate the Asset Turnover Ratio?

- What Can the Asset Turnover Ratio Tell You?

- What Are the Other Factors and Indicators That Are Taken Into Account?

- How Can the Asset Turnover Ratio Be Measured in Enterprises and How Can It Be Improved?

- What Is the Importance of Calculating the Asset Turnover Ratio?

- What Are the Limitations of Using the Asset Turnover Ratio?

- What Is the Difference Between Fixed Asset Turnover and Current Asset Turnover?

- Daftra and the Asset Turnover Ratio

- Frequently Asked Questions

Assets are the company’s possessions and long-term investments if they are fixed assets, or short-term if they are current assets. Calculating the asset turnover ratio helps you determine the percentage contribution of assets to your net profit.

In other words, if your profits are $100,000, how much of these profits resulted directly from the assets you own? This offers many benefits for company owners and external evaluators, including banks and investors.

The asset turnover ratio is not the only such ratio in accounting; these ratios are among the most widely used financial analysis tools. Turnover ratios, also called activity or efficiency ratios, are used to analyze a company's financial position and inform appropriate decisions.

A set of turnover ratio calculations helps us assess the company’s efficiency in using its resources to increase profits. Among the most well-known of these ratios are:

- The asset turnover ratio can be calculated for total assets as a whole, or separately for fixed assets only and current assets only.

- Inventory turnover ratio is considered one of the most important measures of current assets, and it has distinct characteristics compared to other assets.

- Inventory holding period ratio, where the turnover rate is measured in time rather than money.

- Customer turnover ratio, also called accounts receivable turnover ratio, measures the average period it takes for your company to collect amounts owed by customers. It is used to assess liquidity and efficiency.

- Collection period turnover ratio.

Accounting ratios are derived from a larger set of financial ratios. Examples of financial ratios include the quick ratio, dividend payout ratio, and debt-to-equity ratio.

The Key Takeaways

- The asset turnover ratio is one of the main indicators of how efficiently a company manages its assets to generate profits. The ratio is based on comparison, as the company compares it with previous ratios or with commonly used ratios within the industry.

- The fixed asset turnover ratio equals total sales divided by the average value of fixed assets.

- The working capital turnover ratio can be calculated by dividing sales by the net result of subtracting the average current liabilities from the average current assets.

- Facilitating operational processes, better inventory management, and achieving customer satisfaction are all methods that contribute to increasing the asset turnover ratio.

- The asset turnover ratio may become a misleading indicator in cases where assets are sold to cover a lack of growth rates or when new assets are purchased to respond to high growth rates.

What Is the Asset Turnover Ratio?

The asset turnover ratio measures how efficiently an enterprise manages its fixed and current assets and generates good sales from them. The asset turnover ratio is an efficiency measure that aims to complete work in the least time and effort, with the highest possible quality.

A high asset turnover ratio indicates that the enterprise has cash liquidity and can meet its obligations. It involves comparing the value of generated revenues with the value of the assets and the payments made.

However, note that the turnover ratio may be affected. If you purchase a valuable asset immediately before calculating the asset turnover ratio and have not yet benefited from it to determine its profit-generating capacity, the accountant understands this, and a low turnover ratio is not evidence of the asset's failure to generate profits.

What Is the Formula for the Asset Turnover Ratio?

The asset turnover ratio formula is fixed regardless of the type of asset classified as fixed. Companies use it to measure efficiency, compare performance, and make decisions. Below is the asset turnover ratio formula:

Asset Turnover Ratio = Net Sales / Average Total Asset Value

- Total Sales: The revenues generated by the assets.

- Average Asset Value: The value of assets at the end of the accounting period plus the value of assets at the beginning of the accounting period, divided by 2.

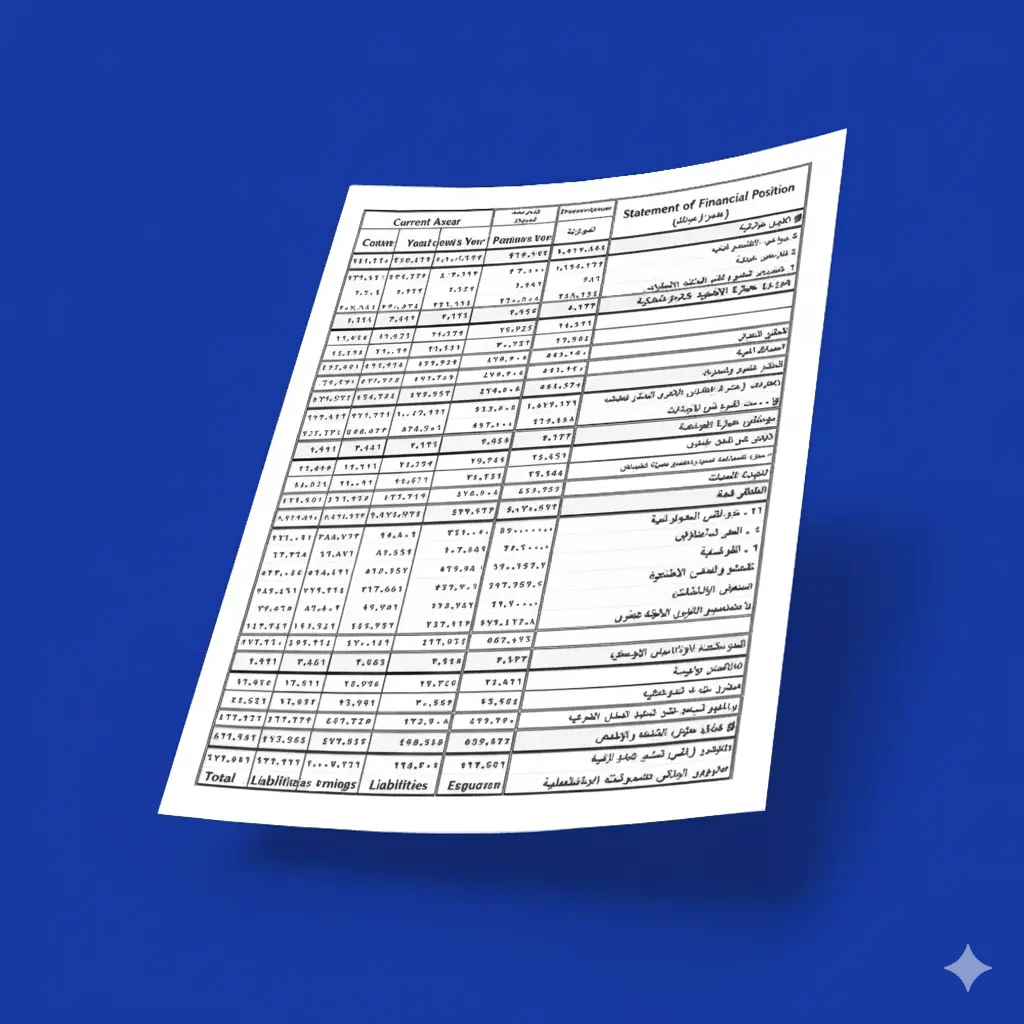

Daftra simplifies the asset turnover ratio calculation—not only by making it easier, but also by ensuring more accurate results. Daftra’s software automatically calculates any transaction, including the asset turnover ratio, by aggregating net sales and total assets at the beginning and end of the period from its reports.

The system collects the required data from the profit and loss and balance sheet reports within Daftra’s chart of accounts system.

What Is the Fixed Asset Turnover Ratio?

The fixed asset turnover ratio answers the question of whether the company has used its assets effectively to generate sales. If it has achieved profits, the methods that generated the most profit should be identified. If it did not achieve the desired results, other effective strategies should be sought.

What Is the Current Asset Turnover Ratio?

To measure the turnover of current assets, we use the working capital turnover ratio. This is because the value of current assets is not fixed at any given moment, as they include inventory, customer accounts, cash, and other assets. Below is the formula for calculating the working capital turnover ratio:

Working Capital Turnover Ratio = Total Sales / Average Current Assets – Average Current Liabilities

- Average Current Assets = Current assets at the beginning of the accounting period + current assets at the end of the accounting period ÷ 2

- Average Current Liabilities = Current liabilities at the beginning of the accounting period + current liabilities at the end of the accounting period ÷ 2

Calculate the working capital turnover ratio using the integrated Daftra accounting system, given its interconnected programs and accounts.

Here is an example to help you understand the working capital turnover ratio. One company had current liabilities of $400,000 at the beginning of the accounting period, which increased to $500,000 at the end of the period.

The value of current assets was $1,000,000 at the beginning of the accounting period and reached $1,200,000 at the end of the period. Sales amounted to $2,000,000.

- Average Current Liabilities = (400,000 + 500,000) ÷ 2 = $450,000.

- Average Current Assets = (1,000,000 + 1,200,000) ÷ 2 = $1,100,000.

In this case, the working capital turnover ratio becomes:

2,000,000 ÷ (1,100,000 − 450,000) = 3.08.

How Do I Calculate the Asset Turnover Ratio?

The method of calculating the turnover ratio is the same as calculating any average using the usual simple mathematical method, by dividing net sales by the average total assets:

Asset Turnover Ratio = (Net Sales / Average Total Assets)

Whether the turnover ratio is for fixed assets or current assets, the same formula is applied.

- Net Sales = Total Sales − Returns, Allowances, and Discounts

- Average Total Assets = (Value of assets at the beginning of the period + value of assets at the end of the period) ÷ 2

Note: Idle assets are included in the asset base when calculating the proper asset turnover ratio.

Example of Calculating the Asset Turnover Ratio

If a company’s total sales amounted to $4 million, and returns, allowances, and discounts amounted to $1 million.

The value of fixed assets at the beginning of the period was $2 million, and at the end of the period it was $3 million.

Meanwhile, current assets were valued at $1 million at the beginning of the period and $1.5 million at the end.

Solution

- Average Total Fixed Assets = (2 + 3) ÷ 2 = $2.5 million

- Average Total Current Assets = (1 + 1.5) ÷ 2 = $1.25 million

- Average Total Assets = $3.75 million

- Net Sales = 4 − 1 = $3 million

- Fixed Asset Turnover Ratio = 3.5 ÷ 2.5 = 140% times

- Current Asset Turnover Ratio = 3.5 ÷ 1.25 = 280% times

- Then, the overall turnover ratio is calculated as:

3.5 ÷ 3 = 0.857 × 100 = 85.7% times

The ratio is expressed as a percentage and shown as a “times” figure, representing the percentage of profits generated from assets relative to total net sales for the period. In this case, for every $1 of asset value, $0.857 in sales is generated.

You can download a complete template to calculate the asset turnover ratio and generate results without manual calculation.

What Can the Asset Turnover Ratio Tell You?

In one word, calculating the asset turnover ratio measures efficiency. But you may wonder: which efficiency exactly? Who benefits from it? And why is it requested? Below are the most critical matters that the asset turnover ratio helps you determine:

- The assets that should receive greater attention to achieve higher sales.

- Spending priorities on assets and identifying the elements that have priority in investments.

- New methods and approaches for managing assets in a way that helps achieve more profit.

- Expected profits and the extent to which assets can provide them, which you present to investors to encourage them to finance your project.

- The efficiency of financial management and the ability of those responsible for it to select assets that are capable of generating profits from every part of the project.

Did you know that the Daftra system can help you manage assets and track and analyze the asset turnover ratio, as it provides profit and loss reports, balance sheet reports, and other reports and analyses that benefit your business activity?

What Are the Other Factors and Indicators That Are Taken Into Account?

Many other factors and indicators are considered to monitor a company’s management efficiency relative to peers in the same industry. Learn about the main factors and indicators for monitoring company operations through the following points:

1- Working Capital Turnover Ratio

Companies use working capital to assess their overall working capital efficiency. Through it, they estimate profits and sales and compare them to it. This ratio indicates the company’s ability to generate high sales. This ratio can also be an essential indicator of the company’s need to increase its capital.

The ratio can be calculated as follows:

Working Capital Turnover Ratio = Annual Net Sales / Capital

2- Return on Assets Ratio

This is another indicator of the company’s asset utilization efficiency and its ability to generate high profits from them. The return on assets ratio is one of the indicators used to monitor business performance continuously. For this reason, you will find that the return on assets ratio is of interest to investors, analysts, and managers.

The ratio can be calculated as follows:

Return on Assets Ratio = Annual Net Sales / Capital

3- Asset Utilization Rate

The asset utilization rate is most commonly used in industrial environments with heavy equipment on production lines. This rate is often associated with the actual production of units.

The rate is also influenced by several factors, the most important of which are the defect rate, overall equipment effectiveness (OEE), maintenance costs, and the time spent on breakdowns.

The asset (equipment) production rate can be calculated as follows:

Y = P × G + P × (1 − G) × R

- Y: The remaining number of usable units after the end of the process

- P: The number of units planned to be produced

- G: The percentage of units operating efficiently

- R: The percentage of defective units

How Can the Asset Turnover Ratio Be Measured in Enterprises and How Can It Be Improved?

There are common turnover ratios across industries. The asset turnover ratio for the construction industry differs from that of the software development field and others. Therefore, when calculating the fixed asset turnover ratio, it should be reviewed against the available industry average.

Is your company’s asset turnover ratio higher or lower than the average? If the answer is higher, then your company is moving in the right direction. If it is below average, there was an error during the accounting period that negatively affected the entire business.

For example, in the banking sector, the safe asset turnover ratio is typically above 1. In the real estate sector, the safe ratio is generally 2.5 or higher.

Learn how to improve the asset turnover ratio through the following points:

1- Simplifying Operations

By streamlining procedures and activities that help complete work faster without waste or other factors that negatively affect costs or time.

2- Developing Inventory Management

Random inventory consumption and exposure to damage or spoilage incur costs that reduce the asset turnover ratio. Therefore, digital systems should be used to manage inventory effectively.

3- Improving Fixed Asset Management

These are all activities that aim to utilize assets more efficiently. If your company has equipment or machinery that is not in use, it can be leased and its revenues utilized, which improves the asset turnover ratio.

4- Achieving Better Customer Relationship Management:

Increasing repeat sales is one of the most important ways to improve the asset turnover ratio. This is achieved by gaining customer satisfaction and retaining them through policies that meet their needs and products and services that interest them.

What Is the Importance of Calculating the Asset Turnover Ratio?

Calculating the asset turnover ratio measures efficiency. But you may wonder which efficiency exactly, who benefits from it, and why it is requested. Below are the most important purposes and uses of the asset turnover ratio:

- Knowing your ability to invest in your assets: Do you understand the importance of the resources you have and realize that assets are among the most important investments that deserve your attention, and that you should know the best ways to utilize and benefit from them?

- Are you able to generate revenue in the short or long term? This is what investors ask before injecting any funds into your project. They may buy land for you worth millions of dollars, but how can you generate money from this land, and to what extent does this asset affect your total revenues?

- The asset turnover ratio is one of the components of return on investment (ROI), a key KPI used to evaluate projects and objectives.

- Evaluating financial management: And the ability of those responsible for it to carefully select assets and their effectiveness in generating profits from every part of the project. The higher the asset turnover ratio, the better and more efficient the management.

- Identifying the sectors in which the company excels and helping determine which fields are most beneficial to invest in.

- The asset turnover ratio is considered more stable than the inventory turnover ratio, providing investors with a more reliable indicator when analyzing the company’s financial position.

- Helping the business owner choose the more profitable company to expand into, as it is more productive and profitable, thereby increasing capital over time and reducing risk ratios from investing in unprofitable fields.

- Judging the efficiency of management and managers and appointing the most efficient individuals to leadership and influential positions.

Note: The asset turnover ratio varies across business sectors based on the nature of the work, and it is not a standalone indicator of business success.

For example, real estate companies have expensive assets that do not generate profits as readily or quickly as assets in fast-moving sales sectors such as supermarkets. This does not mean that every supermarket is always more profitable as a project than real estate marketing companies.

What Are the Limitations of Using the Asset Turnover Ratio?

The asset turnover ratio is not a reliable indicator in all cases. Therefore, the asset turnover ratio should be applied in the following situation:

- Comparing similar companies with each other to evaluate the financial position of a company based on its efficiency in using assets to generate more profits through sales.

In some cases, the turnover ratio may become a misleading indicator and may not reflect reality, as follows:

- The asset turnover ratio may decline when a company purchases large assets in anticipation of future growth.

- The asset turnover ratio may increase when a company liquidates some of its assets to offset declining growth rates.

What Is the Difference Between Fixed Asset Turnover and Current Asset Turnover?

In most cases, the total asset turnover ratio is used to assess which assets generate profits for the company. However, it is not possible to determine whether to use the turnover ratio, as it is unclear what each asset generates in profit.

Therefore, you will not be able to make a decisive decision based on figures that guide you to conclude that asset X generates more profits while another asset generates less.

For this reason, some resort to a type of classification. While not the most precise and not indicating each asset individually, the fixed asset turnover ratio is calculated separately from the current asset turnover ratio.

This means you will know the ability of fixed assets to generate revenue, as well as that of current assets, enabling you to compare and assess the efficiency of each asset type.

Daftra and the Asset Turnover Ratio

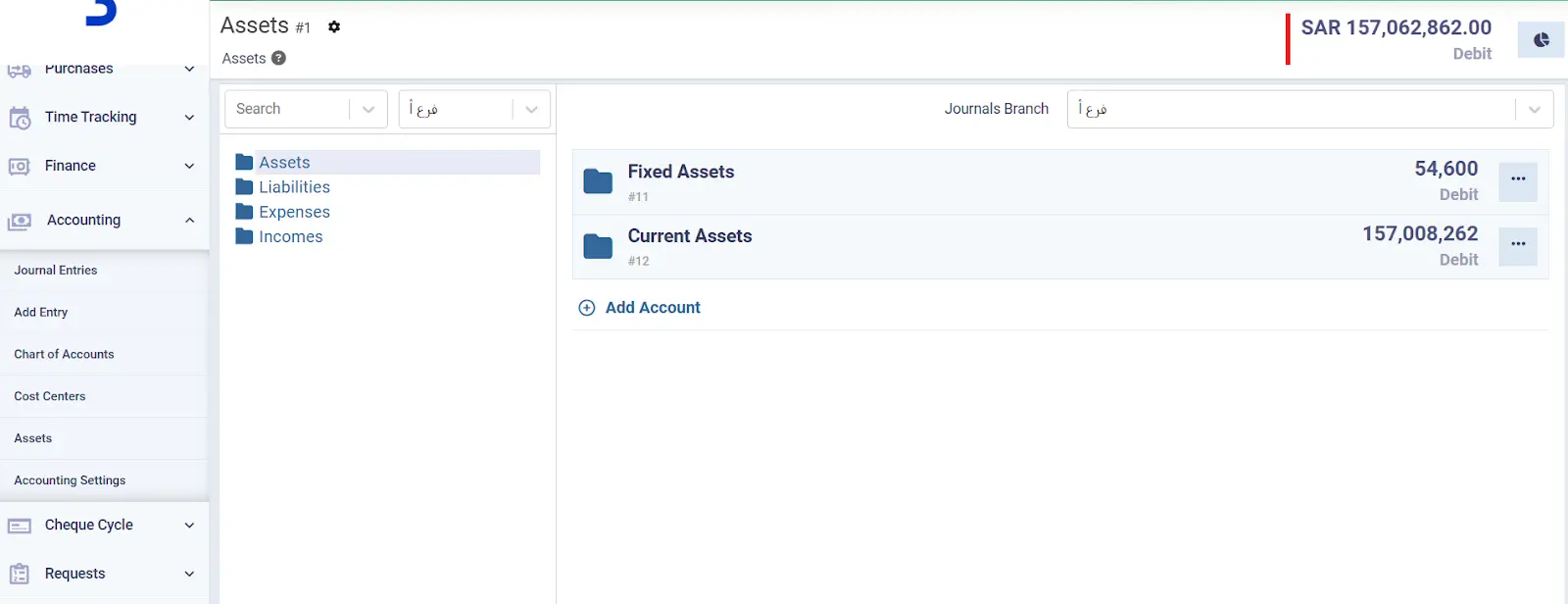

In Daftra’s general accounting software, you will find the chart of accounts that separates fixed assets from current assets and calculates the total for each separately, then the overall total. From there, you can find total assets in just a few seconds.

You can then issue sales reports for the period in which you want to calculate the asset turnover ratio to extract net sales and divide them by the average assets. This will take minimal time or effort, and you will not need accounting knowledge to determine the total asset turnover ratio or the fixed and current asset turnover ratios.

Frequently Asked Questions

What does the asset turnover ratio measure?

The asset turnover ratio measures how efficiently a company uses its assets to generate profits and achieve sales. The ratio indicates how many times the company has recovered the value of its assets.

What are the disadvantages of the fixed asset turnover ratio?

One disadvantage of the fixed asset turnover ratio is the lack of sufficient detail to fully analyze inventory.

Is an asset turnover ratio of 0.8 good?

An asset turnover ratio of 0.8 is considered good for some industries and low for others.

Can the asset turnover ratio be greater than 1?

Yes, the asset turnover ratio can be greater than 1, and this ratio indicates that the company uses its assets with high efficiency in achieving sales.

Is a high asset turnover ratio good?

Yes, a high asset turnover ratio is good, as it indicates the company’s efficiency in using its assets to generate revenues and sales.

What does a high asset turnover ratio mean?

A high asset turnover ratio indicates the company is efficient in using its assets to generate profits and revenue.

How is the asset turnover ratio analyzed?

The asset turnover ratio is analyzed by dividing net sales by the average total assets. This clarifies the company’s asset utilization and revenue generation by comparing results with industry peers or by analyzing the company’s data across different time periods.

What affects the asset turnover ratio?

The asset turnover ratio is affected by the type of industry, how assets are managed, company policy, product life cycle, and other various factors.

What are the benefits of the asset turnover ratio?

The benefits of calculating the asset turnover ratio include evaluating asset utilization efficiency and comparing company performance to inform investment decisions aimed at improving financial management.