What is the accounting equation, its main components, and its limitations?

Table of contents:

- What is the accounting equation?

- What are the main components of the basic accounting equation?

- What are the fundamentals of the accounting equation?

- What are the forms and types of accounting equations?

- What is the expanded accounting equation?

- Limitations of the accounting equation

- Frequently Asked Questions

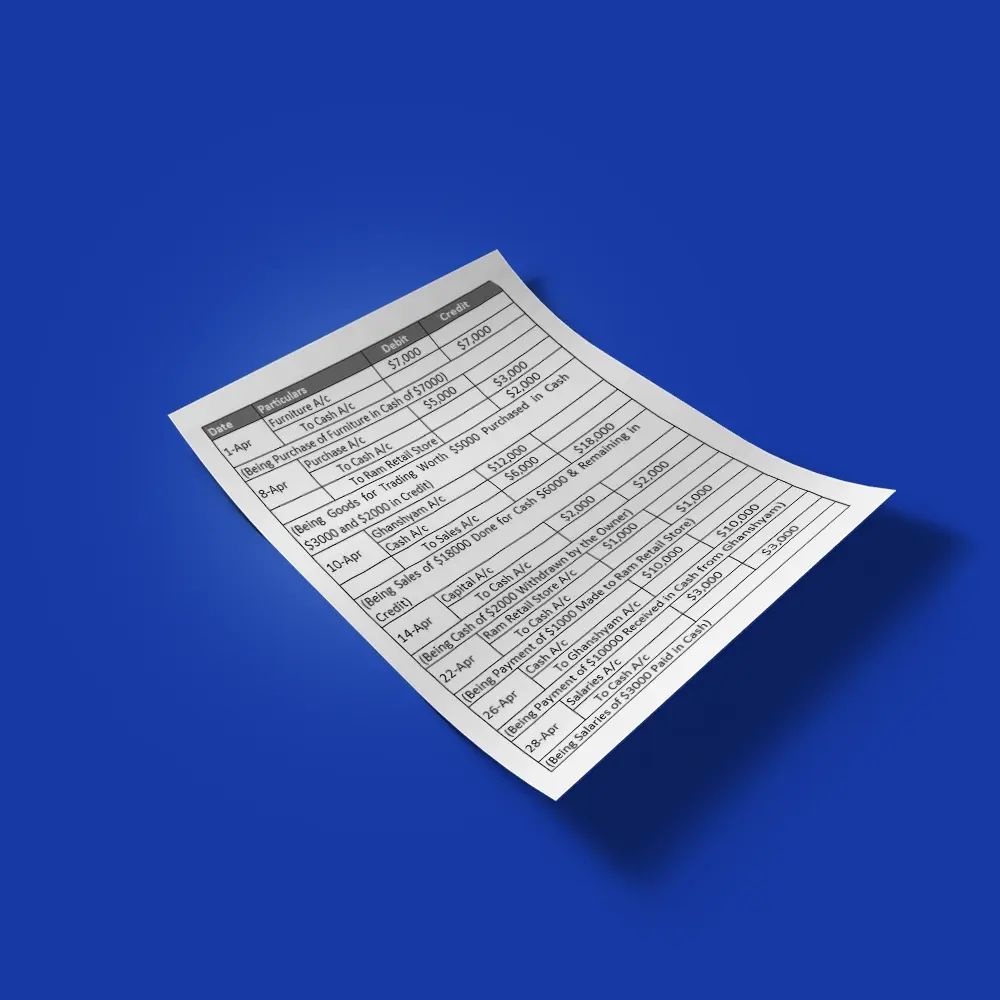

The accounting equation is considered one of the most important mathematical equations used by any company when applying the double-entry system in accounting.

This equation represents the relationship between assets, liabilities, and equity (also known as capital). Therefore, in this article, we will highlight the meaning of the accounting equation and how to apply it correctly.

What is the accounting equation?

The accounting equation, sometimes referred to as the basic accounting equation or the balance sheet equation, indicates that a company's total assets are the result of the sum of its liabilities and shareholders’ equity. The relationship between these elements forms the foundation of the double-entry accounting system.

This equation ensures that a company's balance sheet remains balanced for as long as possible by maintaining that each recorded debit entry has a corresponding credit entry.

In this equation, assets represent all valuable resources owned or controlled by the company, while liabilities refer to what the company is obligated to pay. Liabilities and shareholders’ equity illustrate how the company finances its assets.

If a company finances its assets through debt, it is recorded under liabilities. If the financing is obtained by issuing shares, it falls under shareholders’ equity.

What are the main components of the basic accounting equation?

The accounting equation expresses the balanced relationship between the resources owned by the company, the obligations it owes, and the shareholders’ equity. The components of the accounting equation are divided into three main sections, which are explained as follows:

1. Assets

Assets are defined as all economic resources owned by the organization that have future economic value.

These assets can be tangible, such as equipment, devices, land, company buildings, inventory, or cash. They can also be intangible, such as patents, the company’s reputation, its brand, and other similar items.

2. Liabilities

Liabilities include all obligations the company must fulfill to others within a specific period. These may include debts that the company must repay, loan installments, accounts payable to suppliers, and other obligations. Liabilities are divided into two main types:

- Current liabilities: obligations that must be settled in the short term, such as short-term loans or accounts payable.

- Long-term liabilities: obligations that are due over a period exceeding one year, such as long-term loans, bonds payable, and similar items.

3. Shareholders’ Equity

Shareholders’ equity, or owners’ equity, represents the remaining interest in the company’s assets after deducting its liabilities. It can also be considered the shares purchased by the company’s owners, general shareholders, or investors. The elements of the accounting equation include:

- Assets, representing what the company owns.

- Liabilities represent what the company owes.

- Shareholders’ equity represents the net ownership of the company’s owners.

Together, these components ensure the accounting equation remains balanced, which reflects the accuracy and integrity of the accounting system in any organization.

What are the fundamentals of the accounting equation?

The accounting equation is a core pillar of the financial system of any organization, serving as a tool to ensure accuracy in recording accounting transactions. To achieve its purpose of providing a clear picture of the financial position, the accounting equation has several key characteristics:

- Always balanced: When applying this equation, accountants ensure that both sides of the equation remain balanced at all times. Any change in the value of assets must have a corresponding effect on liabilities or shareholders’ equity, and vice versa.

- Debits equal credits: Due to the use of the double-entry system in the accounting equation, the total Debits and credits must always be equal whenever any changes occur in the accounts.

Thus, one of the most important principles of the accounting equation is its constant maintenance of balance between its elements. Any change in assets reflects on liabilities or shareholders’ equity. Additionally, the double-entry system ensures that total debits always equal total credits, which enhances the accuracy of accounting transactions and contributes to the preparation of reliable financial reports.

What are the forms and types of accounting equations?

Mathematically, it is known that for an equation consisting of three numerical values, knowing any two of them is enough to easily determine the third. These equations can be represented as follows:

1. Calculating the value of assets

Assets = Liabilities + Shareholders’ Equity

This equation shows how companies grow their assets, either through investments made by shareholders or through obligations the company assumes, such as loans, accounts payable to suppliers, and other liabilities.

2. Calculating the value of liabilities

Liabilities = Assets − Shareholders’ Equity

The difference between what the company owns (assets) and shareholders’ equity represents the value of liabilities that the company must fulfill within a specific period.

3. Calculating the value of shareholders’ equity

Shareholders’ Equity = Assets − Liabilities

To determine the value of shareholders’ equity, one must first know the value of the company’s assets and subtract the obligations it owes.

In summary, the accounting equation formulas can be expressed in three basic cases: calculating assets by adding liabilities and shareholders’ equity, calculating liabilities by subtracting shareholders’ equity from assets, and calculating shareholders’ equity by subtracting liabilities from assets.

The importance of these formulas lies in their simplicity and ability to derive any of the three values if the other two are known.

What is the expanded accounting equation?

Companies may use the expanded accounting equation to better and more clearly determine the company’s financial position. The expanded accounting equation provides more detailed insight into shareholders’ equity. This equation takes into account several factors affecting the company’s value and assets, including the company’s revenues, profits, shareholders’ capital, and expenses.

The expanded accounting equation can be expressed as follows:

Assets = Liabilities + Contributed Capital + Retained Earnings + Revenues − Expenses − Dividends Paid

Limitations of the accounting equation

Although the accounting equation always maintains balance, it does not indicate how successful a company is in achieving good performance. Analysts must carefully examine the numbers and analyze the size of the company’s assets and liabilities. Additionally, they assess whether the company’s financing is sufficient for growth in the short or long term, enabling them to make informed economic decisions regarding investment in that company.

Also read: Accounting methods and types, and the best method for your company Accounting spreadsheets: What are they, why are they important, and how can they be used?

Frequently Asked Questions

When is the accounting equation in balance?

The accounting equation is in balance when the total assets are exactly equal to the total liabilities and shareholders’ equity. This balance is achieved through the double-entry system, where any change in the value of assets must be matched by an equal change in liabilities or shareholders’ equity, and vice versa.

In which statement is the expanded accounting equation used?

The expanded accounting equation is used to understand the effects of financial transactions on the accounts of the financial statements—specifically the balance sheet—as it provides a clearer view of revenues, profits, expenses, and capital.

What is the formula for the accounting equation?

The basic formula of the accounting equation is: Assets = Liabilities + Shareholders’ Equity This formula reflects the balanced relationship between what the company owns, what it owes, and the net equity of its shareholders.

Where do revenues go in the accounting equation?

The accounting equation is: Assets = Liabilities + Equity, And revenues are part of equity. Or as shown in the expanded accounting equation: Assets = Liabilities + Contributed Capital + Retained Earnings + Revenues − Expenses − Dividends Paid

What are the effects of transactions on the accounting equation?

Every financial transaction affects at least two elements of the accounting equation but always maintains balance between the two sides. In other words, any transaction that affects assets, liabilities, equity, or a combination of them must preserve the equation’s balance.

How is the accounting equation expressed?

It is expressed in its basic form:

Assets = Liabilities + Shareholders’ Equity

It can also be expanded to include more detailed components, as in the expanded accounting equation:

Assets = Liabilities + Contributed Capital + Retained Earnings + Revenues − Expenses − Dividends Paid

In conclusion, this article covered the accounting equation in detail, explained its key components, and discussed the expanded accounting equation and related concepts. If you found this topic useful, feel free to share it with friends interested in business management and economics.

You can easily calculate the accounting equation using the Daftra accounting software, which helps you determine assets, liabilities, and shareholders’ equity automatically and with ease.