What is a Reversing Entry and How to Prepare It with Examples

Table of contents:

- Quick Points

- What is a Reversing Entry?

- What is the Importance and Uses of Reversing Entries?

- How are Reversing Entries Prepared?

- What are the Advantages of Reversing Entries?

- What are the Disadvantages of Reversing Entries?

- What are Practical Examples of Reversing Entries?

- What is the Importance of Automating Reversing Entries?

- How Does Daftra Help You Apply Reversing Entries Easily?

- Frequently Asked Questions

Accounting is characterized by its dynamic and evolving nature, enabling it to keep pace with business operations, as its efficiency and effectiveness in recording processes have improved over time.

Due to this changing nature, financial statements and accounting operations are subject to certain errors and disruptions that were difficult to address initially before the creation of the reversing entry mechanism, through which accounting operations can be easily recorded and modified.

Thanks to this mechanism, accountants can improve the reliability of financial data and ensure that accounting information is accurate and dependable for making sound financial decisions. Therefore, in this article, we will explore what a reversing entry is, its importance, and its role in accounting transactions.

Quick Points

- Reversing entries are used to correct errors and adjustments in accounting records, helping maintain the accuracy of financial information.

- The reversing entry is made at the beginning of the fiscal year to cancel certain accounting entries and inputs from the previous accounting period.

- Reversing entries are used to correct accounting errors and record necessary adjustments to deal with specific matters, such as recording accrued salaries and prepaid expenses.

- Among the importance of reversing entries is canceling entries for future periods, reversing accruals at the end of the accounting period, and keeping matters efficiently organized.

- The main advantages of reversing entries include improving the accuracy of accounting information, facilitating closing processes and financial reporting, increasing transparency and credibility in financial data, and providing strategic financial guidance.

- Among the disadvantages of reversing entries may include complexity in their preparation and implementation, the possibility of errors occurring in the recording and correction process, and their impact on time and human resource effort.

- It should be noted that the journal entry recording date is on the last day of the previous accounting period, while the reversing entry is recorded at the beginning of the following year, so as soon as the next fiscal year begins, the reversing entry cancels the original entry.

- In each account related to the original entry in the journal, we reverse the debit accounts that were already recorded and the credit accounts that were already charged.

- Thanks to reversing entries, the accuracy of financial information and reports is improved, enhancing transparency and credibility in accounting reports.

- Automation of reversing entries is considered one of the best practices that prevents manual work, reduces errors, and improves efficiency during period-end closing. Accounting software makes it easy to organize accounting transactions.

What is a Reversing Entry?

A reversing entry is an accounting journal entry executed in a specific period, made at the beginning of the fiscal year, to cancel certain entries and inputs from the previous accounting period. Its purpose is to simplify record keeping and improve the accuracy of financial data. Reversing entries include some basic inputs that can be modified or changed, such as:

Accrued Expenses: These are expenses that have been charged to the accounting books but have not yet been paid or recorded.

Deferred Revenue: This is revenue that has been recorded but has not yet been earned or collected.

Depreciation: The allocation of a fixed asset's cost over its useful life.

Prepaid Expenses: Expenses that have been paid but have not yet been consumed.

At the end of the fiscal year or accounting period, these entries and inputs are adjusted to recognize them. Then, the entries are reversed at the beginning of the following period to cancel some of the inputs mentioned previously. This simplifies the recording process by avoiding the need for repetition and complexity. Instead, the original entry is reversed, and balance sheet accounts are canceled, replacing them with the original accounts.

What is the Importance and Uses of Reversing Entries?

Reversing entries have numerous benefits and strong positive impacts as they correct errors, work to cancel any future period entries, and reverse accruals, in addition to many other benefits. Here is the importance and uses of reversing entries in detail:

- Correcting Accounting Errors: If an incorrect entry was recorded, a reversing entry can be created in the following accounting period to reverse it. This allows for fixing the error without needing to restate previous financial statements.

- Canceling Future Period Entries: Some entries are recorded in advance, such as accumulated expenses that were previously recorded. The reversing entry is used to remove the accrual in the following financial period. This prevents double recording of expenses.

- Reversing Period-End Accruals: Accrual accounting requires matching expenses with revenues in the correct period. Adjusting entries are prepared at the end of each period to cover unrecorded expenses. Reversing these entries in the following period ensures proper recognition of these expenses.

- Reversing Accrual Adjustments: This improves the accuracy of financial data and increases compliance with accounting principles. The reverse prevents counting expenses or revenues twice, or in the wrong period.

- Simplifying Procedures: Reversing entries contributes to organizing and simplifying procedures, enhancing the efficiency of financial operations.

- Adjusting Books: If a company's financial results are unpredictable, reversing entries can be used to adjust the books and verify data derived from historical records, market trends, and similar expectations in the same field to obtain more reliable and accurate judgments for analyzing financial performance and making strategic decisions.

- Reducing Errors: An organization may accidentally duplicate payment for a good or service, and in this case, the company's books can be balanced with correct entries after receiving the amount or shipment.

How are Reversing Entries Prepared?

You will learn through some steps how to prepare reversing entries, starting from preparing the journal entry, updating, and up to recording. Here are these steps:

- Identify the Journal Entry: Identify the original journal entry that needs to be reversed so we can classify whether it is a credit or debit account.

- Update: Create a new entry in the journal dated from the first day of the following accounting period.

- For each account related to the original entry in the journal, we reverse the following:

- Debit accounts that were already recorded

- Credit accounts that were already charged

- Transaction Type: Use the same type of currency used in the original entry, but reverse the credit nature to debit and the debit nature to credit.

- Recording Date: It should be noted that the journal entry recording date is on the last day of the previous accounting period, while the reversing entry is recorded at the beginning of the following year, so as soon as the next fiscal year begins, the reversing entry cancels the original entry.

- Debit and Credit Amounts: This correctly reverses the debit and credit amounts from the original journal entry, so that the books are accurate at the beginning of the new period. Temporary accounts that were adjusted at the end of the previous period are returned with zero balances.

What are the Advantages of Reversing Entries?

By reversing entries in accounting, accountants enjoy numerous advantages that help them simplify their operations and improve the accuracy of accounting records, in addition to simplifying bookkeeping processes, improving financial planning, and providing financial guidance. Among the main advantages of reversing entries are the following:

1- Efficient Error Correction:

One of the most important advantages of reversing entries is the ability to correct errors more quickly and efficiently. For example, if the wrong amount was recorded at the end of the previous fiscal year for accrued expenses or deferred revenue, making a reversing entry allows for reversing the incorrect entry and replacing it with the correct amount at the beginning of the following fiscal year.

2- Improved Understanding of Accruals:

Reversing entries can help enhance understanding of accrual-based accounting. By recording and reversing adjusting entries, accountants gain practical experience in how accruals work through reversing entries. The process shows how adjusting entries affect the accounting equation and financial statements. Then, reversing those entries in the following accounting period reinforces accrual adjustments.

3- Simplifying Bookkeeping Process:

Instead of accumulating adjusting entries over time in accounts such as prepaid expenses or accrued expenses payable, reversing entries clear the account so it is ready for new activity in the following year without needing to adjust the previous year's statement. This makes it easier to understand transactions in each period.

4- Improving and Facilitating Financial Planning:

By using reversing entries effectively, companies can improve the financial planning process and better predict future financial results. They can help identify financial trends and plan revenues and expenses more accurately, and financial analysts can understand the actual impact of financial transactions and operational processes on the company's financial performance.

5- Providing Strategic Financial Guidance:

Reversing entries can be used as a tool to guide strategic financial decisions. For example, reversing entries can be applied in reversing new company strategies, such as reallocating resources or changing the cost structure.

6- Reducing Pressure on Monthly Operations:

When reversing entries are applied effectively, they can reduce the need to make frequent adjustments to accounting records during subsequent months. This reduces pressure on monthly operations and saves time and effort.

7- Providing Transparency and Credibility:

Companies can provide more accurate and reliable financial reports. By correcting errors and providing accuracy in accounting records, the quality of financial reports presented to investors and regulatory bodies is improved, helping to build confidence among investors and other stakeholders.

What are the Disadvantages of Reversing Entries?

Reversing entries has some disadvantages that affect their users, such as duplication of efforts, complex auditing, consumption of human resources, and an impact on financial analysis. In the following paragraphs, you will clearly learn about the problems and disadvantages of reversing entries:

1- Duplication of Efforts:

If both the original entry and the reversing entry are posted, this may lead to double-counting of the transaction. Therefore, it must be ensured that the original entry is reversed before recording it again to avoid duplicating recording and modification efforts. Reversing entry processes can increase human input errors, especially when it comes to complex modifications to accounting records, and errors in financial reports affect management and investor decisions.

2- Complexity of Internal and External Auditing:

The use of reversing entries may increase the complexity of internal and external auditing processes, as audit teams must examine the details of modifications and ensure their accuracy. This can lead to increased audit costs and increased pressure on audit teams. Without clear documentation about the purpose of the reversing entry, this may confuse auditors and investors. Comments should be included to explain the reason for the reversal.

3- Depletion of Human Resources and Increased Additional Work:

Using reversing entries may require allocating additional human resources to manage accounting and auditing processes, which can increase costs and pressure on work teams. With the increase in accounting work steps, the monthly or annual accounting cycle closing process may be delayed, affecting the financial schedule and the company's ability to provide financial reports in a timely manner.

4- Impact on Financial Analysis:

Reversing entries makes financial analysis more complex and difficult, as it becomes difficult to properly understand and evaluate the company's financial performance. They may lead to changes in the previous balance of accounts, requiring additional adjustments to ensure alignment between reversed entries and previous recordings.

What are Practical Examples of Reversing Entries?

Practical examples of reversing entries relate to accounting operations that are recorded in the period following the period in which the accounting event applies, to correct errors or provide an accurate balance in financial data. The following are some examples of reversing entries:

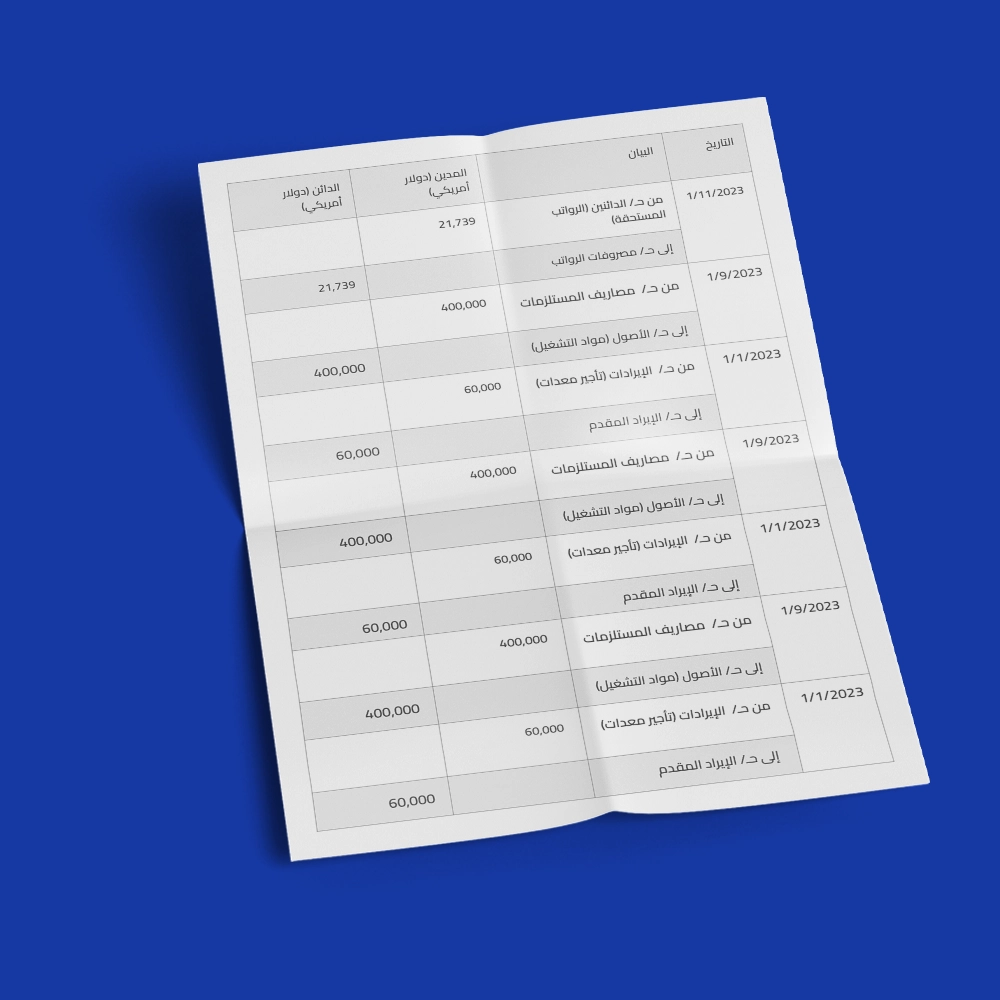

Example of Reversing Accrued Expenses:

Accrued expenses are expenses that have been charged but have not yet been paid or recorded in the accounting period in which they were charged. An example of this is salaries where employees work throughout the month, but are paid at the end of the month. Salary expenses are charged throughout the month, even though the cash payment occurs later. In the following accounting period, when accruals are paid, the accountant reverses the original entry in the journal. This reduces expenses and liabilities. The ITN records the payment. Example:

In January 2020, employees were paid salaries worth $10,000, but cash flow difficulties occurred, and the company did not pay employee salaries until February. The accountant did the following:

Adjusting Entry

| Date | Description | Debit | Credit |

| 31/1/2020 | Dr. Salary Expense | 10,000 | |

| Cr. Accrued Salaries | 10,000 |

Reversing Entry

| Date | Description | Debit | Credit |

| 1/2/2020 | Dr. Accrued Salaries | 10,000 | |

| Cr. Salary Expense | 10,000 |

In February, the accountant reversed the accruals that occurred in January. This cancels the liabilities and expenses of $10,000. When the company pays the $10,000 salaries in February, it is recorded as cash. The net result is salary expenses of $10,000 in January and cash payments of $10,000 in February.

Example of Reversing Deferred Revenue:

Deferred revenue arises when a company receives payments before delivering goods or services. For example, a customer may pay an annual subscription to an electronic platform in January, covering the services they want during the coming year. Example:

A customer subscribed to an electronic magazine at the beginning of 2023 for $6,000, and the company recorded an adjusting entry using the income system to record deferred revenue. At the end of 2023, the company provided services worth $2,000, so the company must record deferred revenue worth $4,000. The accountant did the following:

Service Receipt Entry

| Date | Description | Debit | Credit |

| 1/12/2023 | Dr. Cash | 6,000 | |

| Cr. Service Revenue | 6,000 |

Adjusting Entry

| Date | Description | Debit | Credit |

| 31/12/2023 | Dr. Unearned Revenue | 4,000 | |

| Cr. Deferred Revenue | 4,000 |

Reversing Entry

| Date | Description | Debit | Credit |

| 1/1/2024 | Dr. Deferred Revenue | 4,000 | |

| Cr. Unearned Revenue | 4,000 |

The reversing entry enables the company to properly show its obligation and remaining performance as of January 1. This matches revenues with the periods in which they are earned. Without the reversing entry, revenues and deferred revenues would be understated for January and in the future until the service ends.

Example of Reversing Prepaid Expenses:

Prepaid expenses refer to expenses that are paid in advance before the expense actually arrives. For example, a company may pay 6 months of rent in advance. Initially, it is recorded as an asset (prepaid rent) on the balance sheet. Then, each month, the rent expense statement for that month is adjusted by debiting rent expense and crediting prepaid rent. Example:

The owner of a contracting company opened a new office to expand his branches and investments at the beginning of December 2021. The monthly rent for the office was $3,000, but the company owner paid 3 months in advance for rent totaling $9,000. At the end of 2021, one month's rent period had already ended. The prepaid rent system should be prepared for the remaining two months. The accountant did the following:

Service Payment Entry

| Date | Description | Debit | Credit |

| 1/12/2021 | Dr. Rent Expense | 9,000 | |

| Cr. Cash | 9,000 |

Adjusting Entry

| Date | Description | Debit | Credit |

| 31/12/2021 | Dr. Prepaid Rent | 6,000 | |

| Cr. Rent Expense | 6,000 |

Reversing Entry

| Date | Description | Debit | Credit |

| 1/1/2022 | Dr. Rent Expense | 6,000 | |

| Cr. Prepaid Rent | 6,000 |

This entry reverses the remaining prepaid rent balance. Then, each month, an adjustment can be made to the original entry to account for other monthly portions of rent expenses.

What is the Importance of Automating Reversing Entries?

Modern accounting software helps automate the reversing entry process and improve efficiency. It also organizes journal entries, creates journals, prepares reminder schedules, and activates user permissions. Here are the benefits and importance of automating reversing entries in detail:

- Organization: Continuously organizing journal entries in the accounting program, facilitating the preparation of financial data at the beginning of each period.

- Creating an Integrated Journal: Creating a journal in your chart of accounts and financial systems using accounting software, facilitating data analysis and tracking financial operations.

- Preparing Automatic Reminder Schedules: To check reversing entries periodically and accurately, ensuring they comply with accounting policies and standards.

- Easy Entry Deletion: Providing an easy way to delete reversing entries in case of errors, reducing the time and effort required to correct potential mistakes.

- User Permissions: Activating special permissions for users and employees, allowing only employees responsible for accounting operations to access data, contributing to enhanced security, and ensuring information confidentiality and accuracy of entered data.

How Does Daftra Help You Apply Reversing Entries Easily?

The Daftra accounting software helps you apply reversing entries with ease as it copies the original entry and modifies it to cancel the old entry and create a new, correct entry, automatically recording the reversing entry with the new period date. Additionally, the Daftra program saves original entries without deleting them and creates a reverse entry against them, maintaining the integrity and completeness of financial reports.

Subscribe now to the Daftra accounting program and get many facilities, privileges, and complete accounting tools.

Conclusion: The use of reversing entries in accounting shows great importance in correcting accounting records and facilitating the monthly or annual closing process. These entries help improve the accuracy of financial information and reports, and contribute to simplifying adjustment and correction processes in cases of previous errors. However, companies must be careful in using reversing entries and ensure their proper application according to international accounting principles, as they may involve some disadvantages and challenges that must be handled carefully. Therefore, companies should adopt effective procedures to monitor and evaluate the use of reversing entries to improve financial performance and ensure full compliance with accounting standards.

Frequently Asked Questions

When do we use reversing entries?

Reversing entries are used to correct errors that were recorded in previous entries or to cancel an entry that was recorded by mistake.

Who benefits from reversing entries?

Those who benefit from reversing entries are companies and individuals working in accounting fields and businesses that need them in their work.

Do reversing entries affect financial statements?

Yes, reversing entries affect financial statements because they work to correct errors in previous entries, which changes the figures in the financial statements.