Everything You Need to Know About Fixed Assets or Non-Current Assets

Table of contents:

- What Are Non-Current Fixed Assets?

- Why Are Fixed Assets Important?

- Why Are They Called Fixed Assets?

- What Are the Types of Fixed Assets or Non-Current Assets?

- Examples of Fixed Assets

- What Are the Characteristics of Fixed Assets?

- What Is the Difference Between Fixed Assets and Current Assets?

- What Is the Cost of a Fixed Asset?

- How Are Fixed Assets Inventoried?

- When Is Cash Considered a Non-Current Asset?

- What Is Depreciation of Fixed Assets?

- Why Are Fixed Assets Depreciated?

- How Can Fixed Asset Depreciation Be Calculated?

- What Are the Depreciation Rates for Fixed Assets?

- How to Improve Fixed Asset Accounting for an Enterprise?

- What Are the Tips for Improving the Treatment of Fixed Assets?

- What Are Long-Term Assets That Have No Physical Existence?

- General Definitions Related to Fixed Assets

- Adding Fixed Assets in Daftra

- Frequently Asked Questions

Fixed assets are indispensable and form the foundation of any enterprise. No project, whether small or large, can start without them.

They are considered the property of the project and are long-term assets that last for several years.

Therefore, it can be said that production line equipment, as well as the buildings and land of the enterprise, are fixed assets.

However, many questions arise regarding this topic, such as:

Do fixed assets depreciate? What are their types, and how are they calculated along with their depreciation? Can all non-current assets be purchased, or can they be leased?

All these questions can be answered in this article through several points that ultimately help you manage fixed assets efficiently and effectively.

What Are Non-Current Fixed Assets?

Fixed assets are long-term tangible assets. They are known to be permanent properties of an enterprise. They are considered a fundamental element in generating long-term profits because their productive life exceeds one year, unlike current assets.

Fixed assets are also referred to as capital assets because they reflect the capital of any organization.

Also read: Definition of Non-Current Fixed Assets

Why Are Fixed Assets Important?

The importance of fixed assets lies in their role as a vital element for any company. They help stabilize company operations and support its competitive ability in the market. Here are the main points that answer the question: What are the objectives of fixed assets?

- Generating Long-Term Gains: Fixed assets, such as buildings, equipment, and real estate, are used to generate long-term revenue for any organization.

- Increasing the Market Value of the Enterprise: Illiquid assets are an important source for external investment. They allow assessing the company’s ability to generate future sales and profits, which helps attract investors.

- Long Depreciation Period: Permanent assets have a productive life of more than one year, enabling them to contribute continuously to the company’s revenue generation.

- Financial Stability: Fixed assets can be used as collateral to obtain loans and financing needed for growth and expansion.

After understanding the nature of permanent assets, it becomes clear that converting them into cash is difficult. It is generally accepted that fixed assets are subject to depreciation, except for land.

Why Are They Called Fixed Assets?

They are called fixed assets because they remain stable and do not change quickly over time, such as land, buildings, and equipment. Fixed assets are used in production or in the operation of the company for long periods.

Non-current assets are considered an essential part of a company’s infrastructure. The value of fixed assets is calculated over their useful life through a process known as depreciation.

What Are the Types of Fixed Assets or Non-Current Assets?

There are two types of long-term assets that companies use to generate revenue, support operational activities, and form the company’s core capital. The types of fixed assets are:

- Tangible Assets

- Intangible Assets

- Tangible Assets: These are assets that have a physical presence, such as land, buildings, and equipment.

- Intangible Assets: These are assets that do not have a physical presence, such as trademarks, patents, and copyrights.

Examples of Fixed Assets

As mentioned earlier, fixed assets are a source of growth for an organization, and proper management of assets is an essential part of good financial management. Here, we will explore the most important fixed assets for any enterprise:

1. Buildings

These include administrative buildings, storage warehouses, retail stores, and factories. If the buildings are owned by the enterprise and not leased, depreciation can be calculated for the buildings only, while the land on which they are built cannot be depreciated.

2. Computer Hardware and Software

Any devices owned by the enterprise are considered fixed assets, including computers, mobile phones, and tablets.

3. Furniture and Fixtures

All furniture belonging to the enterprise, such as tables, chairs, kitchen appliances, refrigerators, and others, is considered company furniture and is classified as a fixed asset.

4. Land

Land is the only fixed asset that is not depreciated because its value generally increases over time. All land owned by the enterprise can be accounted for, whether it has buildings on it or not.

5. Machinery and Equipment

All manufacturing equipment, transportation machinery, and construction tools are considered fixed assets.

6. Vehicles

Enterprises may own various vehicles such as cars, trucks, airplanes, and boats. Certain businesses, such as shipping companies, transport companies, and car rental agencies, specifically maintain these assets.

Download a Fixed Assets Register template now to track your company’s assets from acquisition to depreciation, ready to edit for free from Daftra.

What Are the Characteristics of Fixed Assets?

Fixed assets have a set of characteristics that reflect their importance in business management and achieving the strategic and operational goals of the enterprise. Here are the main criteria for fixed assets:

- Long-Term: Fixed assets are used in the company’s operational processes for periods longer than one year, making them non-current assets that cannot be quickly converted to cash.

- Depreciable: Most fixed assets (except land) wear out and lose value over time. Therefore, they are subject to depreciation, and their cost is allocated over their productive life.

- High Value: Fixed assets typically have significant monetary value and are tangible, allowing them to be directly seen and utilized.

- Operational Use: Fixed assets are used for operational and production purposes, not for resale.

What Is the Difference Between Fixed Assets and Current Assets?

The main difference between fixed assets and current assets lies in their usage and useful life. Non-current (fixed) assets are used to meet long-term operational needs, while current assets are used to meet daily and operational requirements. Here are the key differences between long-term assets and short-term assets:

1. Definition

Fixed assets refer to long-term properties that generate profits for the enterprise. Current assets, on the other hand, are short-term properties that are not held for more than one year.

2. Value

The value of fixed assets is calculated as the cost of the asset minus depreciation. For current assets, the value is usually the lower of cost or market value.

3. Duration

Fixed assets are long-term and remain with the enterprise for more than a year. Current assets are short-term and typically do not exceed one year.

4. Depreciation

Depreciation is not applied to current assets, whereas fixed assets are depreciated.

5. Liquidity

Current assets are easily convertible to cash, while fixed assets are difficult to liquidate quickly.

6. Type of Investment

Current assets are considered short-term investments, whereas fixed assets can be invested in for the long term. Use an investment calculator to determine the return on investments and get a clear understanding of the true value of the asset.

7. Examples of Current and Fixed Assets

Examples of current assets include cash, securities, and inventory. Examples of fixed assets include buildings, equipment, machinery, and land. Based on the previously mentioned differences between fixed assets and current assets, we can conclude the following:

- A current asset is an asset that can be disposed of or planned to be sold within 12 months, meaning it can be easily converted into cash.

- A fixed asset, on the other hand, is an asset that is not planned for sale, remains for more than 12 months, and is difficult to convert into cash.

- It is easy to finance and purchase current assets, but investing in fixed assets is more challenging because they require long-term funds.

What Is the Cost of a Fixed Asset?

The cost of a fixed asset includes all expenses necessary to make the asset ready for use, such as the purchase price of the asset, transportation and installation costs related to the asset, any fees or taxes imposed on its purchase, as well as costs of testing and preparation to make the asset operational.

How Are Fixed Assets Inventoried?

A fixed assets inventory program, such as the one provided by Daftra, involves recording and tracking all long-term assets owned by the company. The procedures for reviewing fixed assets include several steps:

- Identify all fixed assets in the company’s records.

- Assess the value of each fixed asset.

- Track the location and condition of each fixed asset.

- Conduct a physical inventory of fixed assets to ensure the accuracy of records. You can use a Fixed Assets Register template to monitor each asset from the moment it is acquired until it is fully depreciated.

Download a Fixed Assets Inventory Template now to track and monitor asset values, ready for editing from Daftra.

When Is Cash Considered a Non-Current Asset?

Cash is usually classified as a current asset because it is readily available for immediate use and can be easily converted into liquidity. However, in some cases, cash is classified as a non-current asset, such as:

- When there are legal or contractual restrictions preventing the company from using the cash for normal operational purposes, for example, funds are reserved to repay long-term debts or for specific investment projects.

- When the company allocates part of its cash for specific purposes and it is not expected to be used in daily operations during the current fiscal year.

- When the company invests part of its cash in long-term investments that are not expected to be converted into cash during the current fiscal year, the cash is then classified as a non-current or fixed asset.

What Is Depreciation of Fixed Assets?

Fixed assets such as equipment, machinery, and buildings can be used for several years, and their value decreases over time. Therefore, it is advisable to calculate depreciation for each fixed asset except land, since land is known not to depreciate and usually increases in value over time.

Why Are Fixed Assets Depreciated?

There are two main reasons for depreciating fixed assets:

- Wear and Tear: These assets are used in the production process and are subject to physical deterioration and possible damage.

- Decline in Value: The value of assets decreases over time; for example, you cannot buy a machine today and expect its price to remain the same after use.

Based on these reasons, depreciation is recorded as an expense deducted from the asset value on the company’s financial statements each accounting period. This is referred to as the accumulated depreciation provision.

How Can Fixed Asset Depreciation Be Calculated?

Methods for calculating fixed asset depreciation are divided into two main approaches. Depreciation can be easily calculated using the general accounts in Daftra. By clicking on Assets in the Daftra dashboard and then selecting Add New Asset, the system automatically calculates the depreciation value as a percentage of the current value of the fixed asset. Here are the main methods for calculating fixed asset depreciation:

- Straight-Line Method

- Declining Balance Method

1. Straight-Line Method

Depreciation can be calculated using the following formula:

Annual Depreciation = (Cost of Fixed Asset−Salvage Value) Total Useful Life of the Asset

Example:

If a machine is purchased for $30,000 with a useful life of 5 years and a salvage value of $3,000, the annual depreciation would be:

(30,000−3,000)5 = $5,400 per year

2. Declining Balance Method

In this method, the depreciation rate for the asset is calculated, and the depreciation for each year is determined by applying the rate to the asset’s remaining book value after deducting previous years’ depreciation.

Applying this to the previous example:

- Depreciation Rate = 2 × (1 / 5) = 40%

- First Year Depreciation = 30,000 × 40% = 12,000

- Second Year Depreciation = (30,000 - 12,000) × 40% = 7,200

- Third Year Depreciation = (30,000 - 12,000 - 7,200) × 40% = 4,320

This process continues for the fourth and fifth years. At the end of five years, the accumulated depreciation of the machine is calculated.

Download a Fixed Assets Depreciation Template now, ready for free editing from Daftra.

What Are the Depreciation Rates for Fixed Assets?

Depreciation rates depend on the type of asset and its useful life. These rates vary from country to country based on the applicable accounting principles and standards. Some commonly recognized annual depreciation rates using the straight-line method for certain asset categories are:

- Buildings: 2% – 5% per year

- Machinery and Equipment: 10% – 20% per year

- Furniture and Fixtures: 10% – 20% per year

- Computers and Software: 20% – 33.33% per year

- Vehicles: 20% – 25% per year

How to Improve Fixed Asset Accounting for an Enterprise?

Any enterprise acquires a fixed asset through cash purchase, a transaction, or as a gift.

Each fixed asset is recorded in the general journal, and since every fixed asset has a life cycle with different stages, it is essential to manage fixed assets accurately.

These stages include:

- Acquisition of the Asset: This occurs when the asset is purchased, obtained through a transaction, or received as a gift. It includes all costs incurred to acquire the asset.

- Depreciation of the Asset: Depreciation is recorded in the general journal, calculated, and deducted as a negative value from the asset’s value on the company’s financial statements.

- Revaluation: This involves calculating the asset’s current market value.

- Impairment: This occurs when the asset’s market value is less than its book value on the financial statements.

- Disposal or Replacement: A fixed asset can be changed either by selling it or disposing of it in order to acquire a new one.

What Are the Tips for Improving the Treatment of Fixed Assets?

Several tips should be followed to improve the accounting treatment of long-term assets:

- Asset recognition:

Fixed assets should be recorded at their purchase cost, including all other expenses incurred until the asset is ready for use, such as shipping costs, sales tax, transportation, and installation expenses.

- Fixed asset valuation:

It is well known that fixed assets are subject to depreciation; therefore, accounting records must reflect the accurate value of each asset. This can only be achieved through periodic valuation of assets.

- Depreciation calculation:

Depreciation represents the true value of an asset over time and helps determine the company’s profits and revenues accurately. Therefore, calculating and recording depreciation for each fixed asset is one of the most important aspects of improvement.

- Considering depreciation-related expenses:

Certain expenses occur during the production process and cannot be ignored, such as maintenance costs for equipment and machinery, as well as renovation expenses for buildings.

- Asset insurance coverage:

It is preferable to have insurance coverage for fixed assets to enable proper treatment of any damages that may occur.

After applying all of the above, accurate accounting data and reports can be obtained, helping the organization improve, develop, and prevent theft.

What Are Long-Term Assets That Have No Physical Existence?

This type of asset represents significant value to a company but has no physical presence that can be touched or seen. Intangible fixed assets, or long-term assets with no physical existence, include items such as:

- Intellectual property rights: such as patents, copyrights, and trademarks.

- Software-related assets: such as software and databases.

- Goodwill: the excess value paid by a company when acquiring another company beyond the net value of its assets.

- Franchise rights: the right to conduct a specific business activity or sell a particular product.

- Customer relationships: the value of established and ongoing customer relationships.

- Licenses and permits: the right to conduct a specific activity under a license or permit.

You may also be interested in: What Is Depreciation of Intangible Assets

General Definitions Related to Fixed Assets

Below are some general definitions associated with fixed assets:

- Inventory

- Inventory Count

- Inventory Count Frequency

- Useful Life

- Fixed Asset Turnover Ratio

Inventory:

Some people believe that inventory is a fixed asset, but it is actually classified as a current asset due to its ease of conversion into cash.

Inventory Count:

It is the process carried out to determine the types and quantities of products in warehouses or stores. This process helps verify the accuracy of accounting data and reports.

Inventory Count Frequency:

It refers to how often inventory counting is conducted, whether annually, semi-annually, or quarterly.

Useful Life:

This is the period during which a fixed asset remains in use within the organization until it becomes worn out and needs to be replaced.

Fixed Asset Turnover Ratio:

It is the ratio between total sales and the average fixed assets, and it is considered an indicator of the organization’s efficiency in generating sales from its fixed assets.

In conclusion, fixed assets are considered one of the most important holdings of a company and play a major role in generating income and profits for any organization.

Therefore, attention must be given to all related details, whether depreciation or improving their accounting treatment. Follow us in the next article for more information that may interest you.

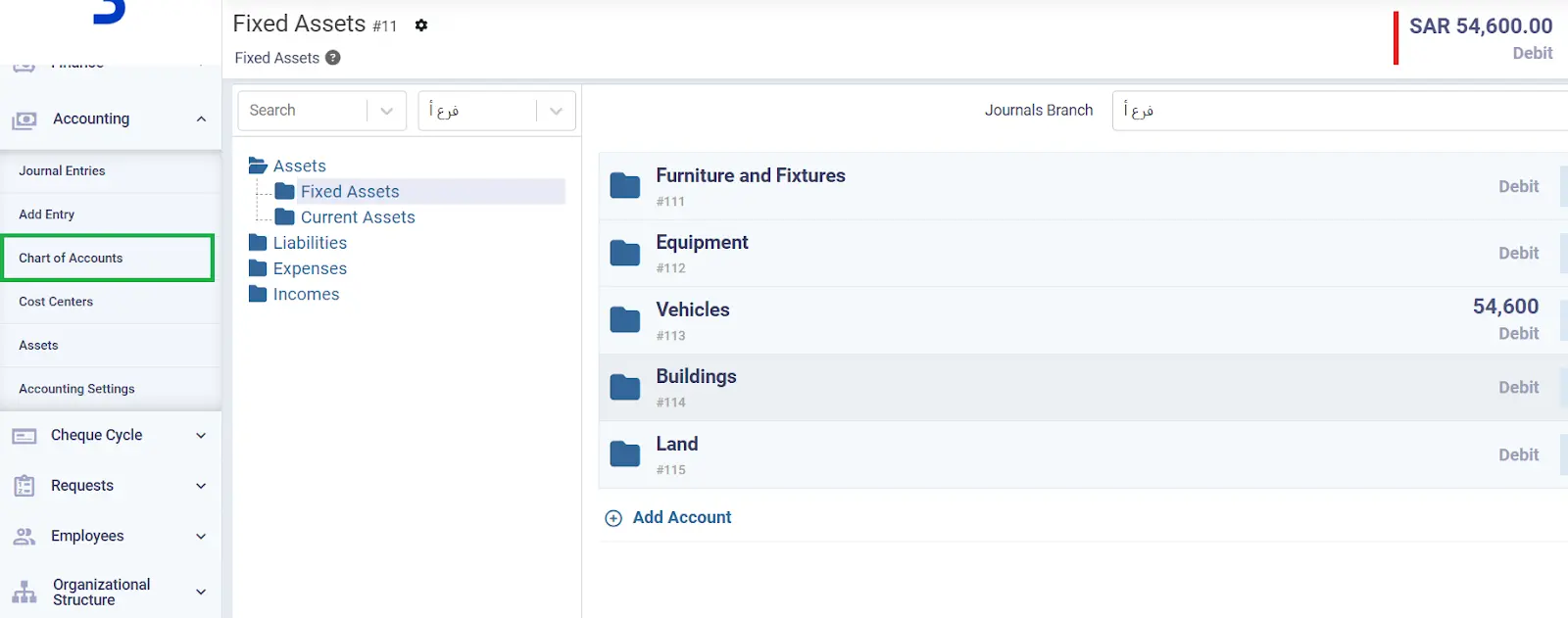

Adding Fixed Assets in Daftra

In Daftra’s asset management software, you can add fixed assets of all types and calculate depreciation for each asset, whether your accounting system uses the straight-line method, the declining balance method, or the units of production method. The depreciation period is calculated based on the asset’s useful life, and the asset is assigned to the employee responsible for it.

Assets are posted to the appropriate detailed account they belong to, such as furniture, buildings, or machinery. You will find a well-structured and ready-made chart of accounts, allowing you to start working immediately without having to create it from scratch, with full flexibility to edit, delete, or add accounts.

You can learn more about how to manage fixed assets in Daftra here.

Frequently Asked Questions

Is land a fixed asset?

Yes, land is considered a type of fixed asset. However, unlike buildings and equipment, land does not depreciate over time, so it is usually not depreciated in the financial statements.

Is capital considered a fixed asset?

No, capital is not considered a fixed asset. For example, if a company purchases equipment, the equipment is classified as a fixed asset, while the funds used to purchase it represent capital.

Is a bank considered a fixed asset?

No, a bank as an institution cannot be classified as a fixed asset. However, some items on a bank’s balance sheet can be classified as fixed assets, such as buildings, office equipment, surveillance devices, and information technology systems.

What is the difference between fixed assets and non-current assets?

There is no difference between fixed assets and non-current assets; they refer to the same concept, with only a difference in terminology. Both describe assets that cannot be converted into cash within a short period and are used for long-term investments.

What is the depreciation period of fixed assets?

There is no fixed depreciation period for fixed assets. The period depends on the type of asset, how it is used, and technological developments that affect its useful life.

How can I calculate net fixed assets?

Net fixed assets can be calculated using the following accounting equation: Net Fixed Assets = Total Cost of Fixed Assets − Accumulated Depreciation.

How are fixed assets recognized?

Long-term assets are recognized through the fixed asset documentation cycle, which also represents the capitalization rules of fixed assets. The steps include:

- Calculating the purchase cost of the asset and all expenses incurred to make it ready for use.

- Recording the asset in the accounting records at its historical cost.

- Determining the asset’s useful life.

- Calculating depreciation.

- Preparing journal entries for transactions related to the asset.

- Conducting periodic physical counts of fixed assets to ensure the accuracy of accounting records.

What are the conditions of fixed assets?

The conditions of fixed assets can be summarized as follows:

- They are long-term assets.

- They have a tangible physical existence.

- The value of non-current assets is higher than that of current assets.

- They are subject to depreciation.

How can fixed assets be disposed of?

Fixed assets can be disposed of through sale, scrapping, donation, replacement, or transfer.

What are the objectives of the fixed asset cycle?

The objectives of the fixed asset cycle include:

- Determining the market and accounting value of fixed assets.

- Managing the use of fixed assets.

- Identifying and implementing maintenance programs to preserve assets, thereby reducing costs associated with managing and maintaining long-term assets.

- Analyzing and evaluating returns related to non-current assets and their efficiency in achieving strategic and investment objectives.

How are fixed assets valued?

Fixed assets are valued by determining their fair market value, using price comparison methods or income-based valuation methods derived from selling the asset in the market during the valuation period.

What are the procedures for selling fixed assets?

The procedures for selling fixed assets can be summarized as follows:

- Determining the book value and market value of the asset.

- Calculating depreciation.

- Preparing an asset sale form.

- Preparing all documents related to the sale, such as invoices and contracts.

- Recording the sale of the fixed asset in the journal entries.

- Calculating the profit or loss resulting from the sale and recording it in the income statement.

- Removing the asset from the fixed asset records.

- Transferring ownership of the asset and delivering it to the buyer.

When does depreciation of fixed assets begin?

Depreciation begins from the date the asset is put into use in operating activities and starts generating revenue.

Is gold considered a fixed asset?

Yes, gold is considered a fixed asset, as it can be used for long-term investments and stored to benefit from its value.

What is fixed asset tax?

Fixed asset tax refers to taxes imposed on the use of these assets, whether owned or leased, for production, operation, and profit generation purposes.

What is a fixed asset system?

A fixed asset system refers to the set of procedures and steps followed by an organization to manage its long-term assets efficiently and effectively.

How can fixed assets be coded?

Fixed assets can be coded by assigning each asset a unique number or code that distinguishes it from other assets, making tracking and review easier.

What is the scrapping of fixed assets?

Scrapping fixed assets refers to disposing of an asset due to the end of its useful life, reduced efficiency, or damage.

What is a fixed asset depreciation schedule?

A fixed asset depreciation schedule is a document that lists all information related to fixed assets and is used to track changes in the asset’s value over time.

What is the fixed asset law?

It is a set of rules and conditions governing the handling of liquid or permanent assets.

What is the useful life of fixed assets?

It is the period during which an asset can be used to achieve the intended economic benefits.