Everything You Want to Know About the Balance Sheet

Table of contents:

- Summary of Key Points

- What is the Balance Sheet?

- What is the Importance of the Balance Sheet?

- How to Prepare the Balance Sheet?

- Types of Balance Sheets

- What are the Balance Sheet Items?

- Practical Example of Preparing a Balance Sheet

- The Purpose and Uses of the Balance Sheet

- What Appears in the Balance Sheet?

- What Account Does Not Appear in the Balance Sheet?

- Balance Sheet Calculation

- What Factors Affect the Balance Sheet?

- Common Errors to Avoid When Preparing the Balance Sheet

- 4 Steps to Avoid Balance Sheet Preparation Errors

- How to Improve the Balance Sheet?

- Is the Statement of Financial Position the Same as the Balance Sheet?

- How to Read the Balance Sheet?

- What is the Difference Between a Trial Balance and a Balance Sheet?

- What is the Difference Between a Balance Sheet and a Budget?

- What is the Difference Between Balance Sheets and Income Statements?

- What is the Difference Between a General Budget and a Balance Sheet?

- How to Prepare a Balance Sheet in Daftra

- Frequently Asked Questions

Business owners, especially those with startups, need to understand the concept of the balance sheet as it helps them clarify their companies' financial position. The balance sheet can protect your company from collapse and help you solve all financial problems that may befall you. It also provides you with methods to develop your business project and makes you more aware of all events that may affect your profits in the future.

Now, are you a business owner or startup founder struggling with preparing the balance sheet and understanding its nature? Do you feel panic when looking at your financial data and want to know how to use this data to make better financial decisions for the company? You may face difficulty understanding the financial terminology used in the balance sheet, and you may not know how to gather the necessary financial data to prepare the balance sheet correctly. Therefore, we will provide a comprehensive guide about the balance sheet and its purpose, components, and uses, and we will explain the basic steps for preparing the balance sheet with a detailed illustrative example.

Summary of Key Points

- The balance sheet is a financial statement that reflects the company's financial health during a specific time period, providing clear information about what the entity owns in terms of assets, what it owes in terms of liabilities, and shareholders' rights.

- The objectives and uses of the balance sheet include revealing the financial position, displaying the picture of assets and liabilities, and providing information about creditors and debtors. It is also used as a tool for financial analysis and revealing the liquidity position. The balance sheet also aims to clarify the company's solvency position and calculate financial ratios.

- Balance sheet types vary, and the appropriate balance sheet for the entity is determined according to its objectives and financial capabilities. Among the most prominent types of balance sheets are the market value balance sheet, cost-based balance sheet, fair value balance sheet, and composite balance sheet.

- The balance sheet includes several basic items represented in current assets, fixed assets, current liabilities, long-term liabilities, and shareholders' equity or "stockholders' equity."

- The balance sheet is prepared by determining the time period for preparation, gathering all financial records, calculating assets, liabilities, and shareholders' equity, and finally balancing the balance sheet.

- The equation for calculating the balance sheet is (Assets = Liabilities + Shareholders' Equity).

What is the Balance Sheet?

The balance sheet is defined as a financial statement that displays the company's assets, liabilities, and shareholders' equity during a specific financial period. The balance sheet reflects the company's financial health and helps inform lenders, investors, or stakeholders about its performance during the previous period and predict its performance in the near future. It also provides essential insights for making important financial decisions.

The balance sheet provides data about what the company owns, what it owes, and the amount invested by shareholders. Company assets are listed on the right side of the balance sheet, while company liabilities and shareholders' equity are listed on the left side. Both sides of the balance sheet must be balanced through the following equation:

Assets = Liabilities + Shareholders' Equity

The balance sheet is one of five components of financial statements, which are:

1- Balance Sheet

2- Income Statement

3- Cash Flow Statement

4- Statement of Comprehensive Income

5- Statement of Shareholders' Equity

The benefits of the balance sheet are not limited to profitable companies only, but also represent importance for non-profit organizations, as it provides them with information about the organization's financial position, which helps them calculate their own funding that they possess or potential funding organized from different entities.

What is the Importance of the Balance Sheet?

The balance sheet is one of several different methods used to know and track expenses and profits, and it is also called the "statement of financial position." The balance sheet can reveal a lot of data and information that you were unaware of about your company. The importance of the balance sheet lies in the following factors:

- Analyzing Company Growth: The balance sheet serves as a means to analyze company growth by comparing it with the company's level in previous years.

- Revealing Business Expansion: Through the balance sheet, potential business expansion and future company expenses can be revealed.

- Supporting Financing Acquisition: The balance sheet helps you obtain necessary loans and financing, because when you apply for a financing loan, the bank refers to the balance sheet to determine whether your business project is qualified for investment and what the returns and profits are.

- Helping Investors Make Decisions: It helps investors understand the project they're investing in and what they will receive in return by presenting information such as the assets the company owns, the obligations the company must pay, alongside the financial value for shareholders.

The importance of the balance sheet lies in providing a comprehensive view of the company's financial position through analyzing company growth, revealing potential expansion opportunities, helping obtain financing, and supporting investors in making their decisions.

How to Prepare the Balance Sheet?

Preparing the balance sheet is a fundamental step for understanding the company's financial position at the end of a specific accounting period, where details of assets, liabilities, and equity are presented in an organized manner, making it easier to analyze the company's financial performance and make decisions based on it.

1- Determine the Financial Period for the Balance Sheet

The financial period for the balance sheet must be determined, which is usually prepared on a quarterly, semi-annual, or annual basis.

2- Collect All Financial Records

All transactions, invoices, and financial data related to the financial period for the balance sheet we will prepare must be gathered.

All this data can be found in the company's general ledger, which reflects all the company's financial transactions recorded during a specific period.

3- Calculate Assets

We list the company's assets in two separate categories: individual items and total assets, where individual assets are divided into current assets and non-current assets.

Company assets are calculated through the following equation: Assets = Current Assets + Non-current Assets

4- Calculate Liabilities or Obligations

We list the company's obligations in two separate categories: individual items and total obligations, where individual obligations are divided into current liabilities and non-current liabilities.

Company obligations are calculated through the following equation: Liabilities = Current Liabilities + Non-current Liabilities

5- Calculate Shareholders' Equity

Calculating shareholders' equity is easy in individual enterprises because there usually won't be a large number of investors. Conversely, matters become more complex if the company is large.

6- Balance the Balance Sheet

First, total liabilities must be added to shareholders' equity through the following equation: Liabilities = Total Liabilities + Shareholders' Equity

Then compare it with total assets using the following equation: Assets = Liabilities + Shareholders' Equity

Here, the balance sheet must be balanced, as what we're doing is comparing the value of assets (what the company owns) against liabilities or things that could potentially decrease the company's value.

The balance sheet can be prepared through a series of stages that begin with determining the financial period, then collecting financial records and data for this period. After that, assets and liabilities are classified and calculated accurately, followed by calculating shareholders' equity, and finally ensuring the balance sheet is balanced by comparing the value of assets (what the company owns) against liabilities.

Types of Balance Sheets

The forms and types of balance sheets vary according to their purpose and the size of the entity. There are simple balance sheets that suit individuals and small enterprises, and complex balance sheets for companies with multiple activities and large transaction volumes, often having more than one branch. The following are the most prominent types of balance sheets:

Market Value Balance Sheet:

Asset and liability values are based on prevailing market values, and in this case, the company has no control over the value of its assets and liabilities.

Cost-Based Balance Sheet:

Relies on tracking actual costs associated with assets and liabilities, and is used to track investment costs and profits over specific time periods.

Fair Value Balance Sheet:

The net value of the entity is calculated by subtracting liabilities from assets in a specific time period.

Composite Balance Sheet:

This combines more than one type of balance sheet to serve the institution's interests and provide a more comprehensive view of the entity's financial health, such as combining market value balance sheet and cost-based balance sheet to identify current asset prices and long-term investment costs.

Balance sheet types vary according to the entity's needs, including market-based, which relies on market values, cost-based, which focuses on actual costs, fair value that shows net value, and finally composite, which combines more than one type to provide a comprehensive picture of the financial position. Each type serves a different purpose depending on the company's nature and financial objectives.

What are the Balance Sheet Items?

Before starting to prepare the balance sheet, it's important to understand the main items it consists of, as these items help organize the company's financial information clearly, making it easier to understand the company's financial position comprehensively. The items are divided into:

1- Current Assets

Cash This is the money obtained during regular transactions through your business project. When you sell resources, you receive payment for them, and this is recorded in the cash account on the balance sheet and is considered a current asset for your company.

Accounts Receivable This records the balance of all sales revenue that is still on credit, meaning outstanding balances that have not yet been collected. When collected, they are deducted from this account on the balance sheet, and the cash account increases by the same amount.

Inventory This includes the quantity of raw materials the company has, materials being worked on, and produced resources. Companies use this account to record sales of those resources.

2- Non-Current Assets

Tangible Physical Assets Buildings, property, and equipment are considered non-current assets, tangible physical, so when recording this item on the balance sheet, accumulated depreciation is deducted from it. Many companies classify their buildings, property, and equipment as different types of assets, such as land, buildings, and various types of equipment.

Intangible Assets This item includes all fixed assets that are intangible or non-physical for the company, whether these assets can be identified, such as patents and licenses, or cannot be identified, such as goodwill and reputation of the commercial company.

You may also be interested in: How to calculate the depreciation of intangible assets.

3- Current Liabilities

Accounts Payable This is the amount the company owes to creditors for resources or services purchased on credit and not yet paid for.

Current Debt/Notes Payable This includes obligations due that are not in accounts payable, and notes payable are over a long period, such as more than a year.

Long-term Debt This account may seem similar to notes payable, but there's a significant difference. Long-term debt, for example, if the company took a bank loan to be paid over five years, this account includes the portion of the loan due for payment in the coming year.

4- Non-Current Liabilities

Due within one year, such as: supplier invoices, bond interest, salaries and wages, and others.

5- Shareholders' Equity

The term shareholders' equity refers to money attributed to business owners or shareholders in the business, and reflects the amount of money that would remain if all assets were sold and all liabilities were paid. Shareholders' equity is listed on the left side of the balance sheet and is calculated using the following equation: Shareholders' Equity = Assets – Liabilities

The shareholders' equity list includes the following:

Retained Earnings Represents net profits that the company reinvests in the business or uses to pay its debts, while the remaining amount is distributed to shareholders.

Treasury Stock Represents shares that the company has repurchased and can be sold later to raise funds.

Treasury shares Represents shares that the company has repurchased and that can later be sold to raise money.

You can calculate these shares through the Treasury Shares Account form, ready to use for free from Dafta.

Share Capital Represents the amount that shareholders have invested in the company since its establishment.

The balance sheet consists of basic components that enable you to display the company's financial position clearly and systematically, including current and non-current assets, which represent the company's resources and properties.

In addition to current and non-current liabilities that show what the company owes in debts and dues, there is finally shareholders' equity that reflects the value of money attributed to business owners after deducting liabilities.

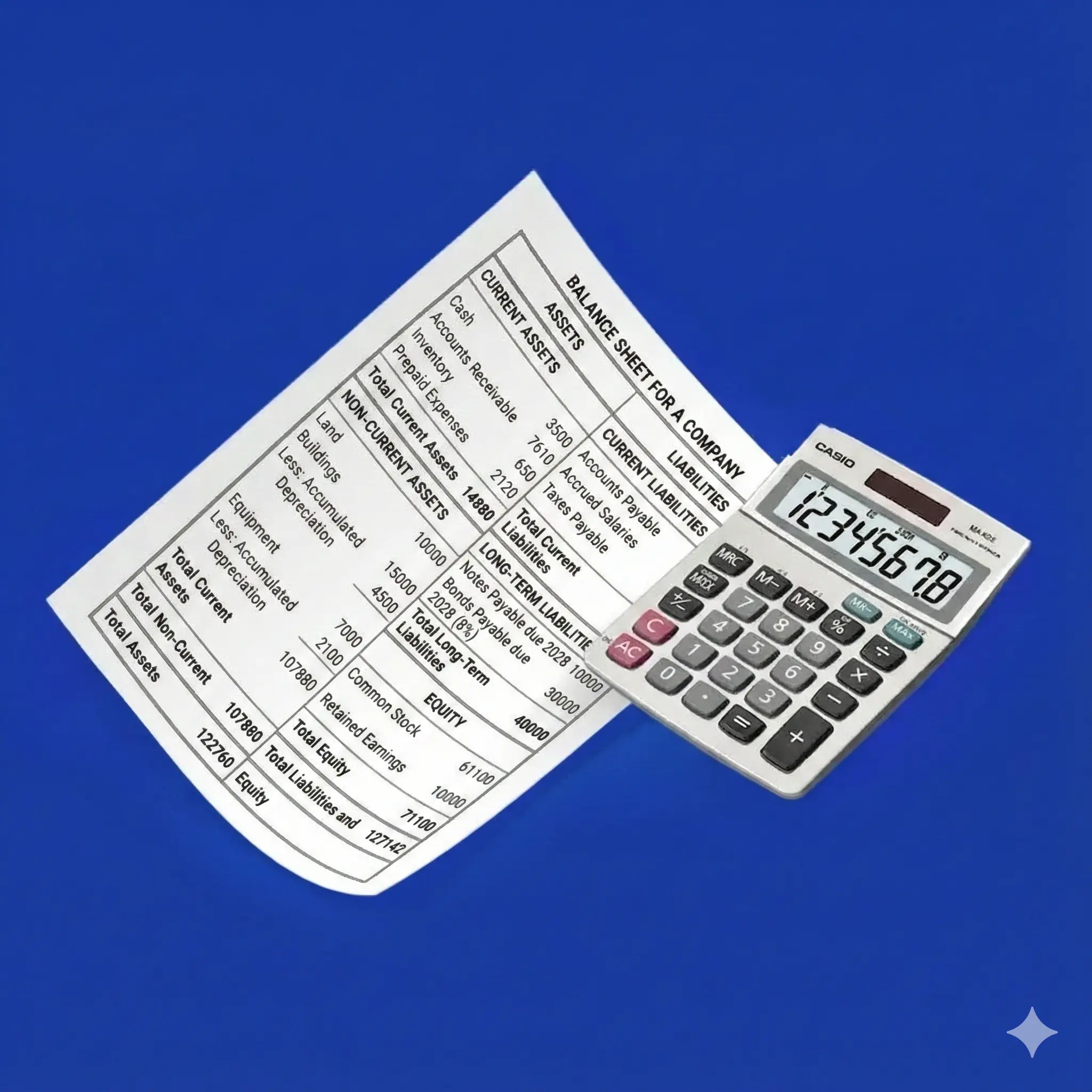

Practical Example of Preparing a Balance Sheet

Let's assume that Company "X" has the following financial data at the end of 2023:

Assets:

Cash and bank account: 200,000 Saudi Riyals Inventory: 500,000 Saudi Riyals Fixed assets: 1,000,000 Saudi Riyals Liabilities:

Accounts payable: 200,000 Saudi Riyals Long-term loans: 500,000 Saudi Riyals Shareholders' Equity:

Share capital: 1,000,000 Saudi Riyals

Let's now prepare the balance sheet together step by step:

1- Determine the Financial Period Preparing the balance sheet at the end of 2023

2- Gather Financial Data Gather financial data from the company's financial records for 2023 as listed above, and arrange them according to their nature.

3- Calculate Assets We calculate the assets gathered from our financial records as follows: Assets = Current Assets + Non-current Assets Assets = (Cash + Bank Account + Inventory) + (Fixed Assets) Assets = 200,000 + 500,000 + 1,000,000 = 1,700,000

4- Calculate Liabilities We calculate the liabilities gathered from our financial records as follows: Liabilities = Current Liabilities + Non-current Liabilities Liabilities = Accounts Payable + Long-term Loans Liabilities = 200,000 + 500,000 = 700,000

5- Calculate Shareholders' Equity We calculate shareholders' equity from the following equation: Shareholders' Equity = Assets – Liabilities Shareholders' Equity = 1,700,000 – 700,000 = 1,000,000, which is exactly the share capital value listed in the financial records data.

6- Balance the Balance Sheet The following equation must be achieved to ensure the balance sheet is balanced: Assets = Liabilities + Shareholders' Equity 1,700,000 = 700,000 + 1,000,000 1,700,000 = 1,700,000

Balance Sheet Format

The balanced balance sheet format would be as follows:

BALANCE SHEET

| ASSETS | Partial Amount | Total Amount | LIABILITIES | Partial Amount | Total Amount |

| Fixed Assets | Long-term Liabilities | ||||

| Fixed Assets | 1,000,000 | Long-term Loans | 500,000 | ||

| Total Fixed Assets | 1,000,000 | Total Long-term Liabilities | 500,000 | ||

| Current Assets | Short-term Liabilities | ||||

| Cash and Bank Account | 200,000 | Accounts Payable | 200,000 | ||

| Inventory | 500,000 | Total Short-term Liabilities | 200,000 | ||

| Total Current Assets | 700,000 | Shareholders' Equity | |||

| Share Capital | 1,000,000 | ||||

| Net Shareholders' Equity | 1,000,000 | ||||

| TOTAL ASSETS | 1,700,000 | TOTAL LIABILITIES & EQUITY | 1,700,000 |

How to Read this Balance Sheet for Company "X" The balance sheet shows that Company X owns assets worth 1,700,000 at the end of 2023, of which 700,000 are current assets and 1,000,000 are non-current assets.

The balance sheet also shows that Company X has liabilities worth 700,000 at the end of 2023, of which 200,000 are short-term liabilities and 500,000 are long-term liabilities.

Additionally, the balance sheet shows that Company X has shareholders' equity worth 1,000,000 at the end of 2023.

You can download a free Excel balance sheet template through Daftra's accounting templates in Excel format instead of preparing it manually.

The Purpose and Uses of the Balance Sheet

Companies create balance sheets to understand the financial position of the organization, as the balance sheet interprets and clarifies the company's possessions, called assets, alongside the obligations, bonds, and loans that the company must pay, as well as the company's financial value. The objectives of the balance sheet are as follows:

Revealing the Financial Position

One of the main objectives of creating a balance sheet is to understand the financial position during both long-term and short-term periods for the company. It provides accurate and reliable information about the financial position for management, government, or shareholders, helping them make wise financial decisions.

Displaying the Picture of Assets and Liabilities

The balance sheet is prepared to determine the value of assets and liabilities that the company has at year-end.

Information about Creditors and Debtors

The balance sheet provides a complete picture of creditors and debtors and their financial transactions related to the entity during a specific period.

A Tool for Financial Analysis and Revealing Liquidity Position

The balance sheet reflects the company's liquidity; thus, the company's cash flow and working capital financing can be displayed.

Clarifying the Company's Solvency Position

Financial solvency is the company's ability to meet its fixed obligations and achieve expansion and growth over the long term, which is clearly shown in the balance sheet statement that identifies risks and returns from investments.

Calculating Financial Ratios

Financial ratios are one of the most important tools used in financial analysis, and financial ratios primarily depend on data provided by the balance sheet. They help management identify strengths and weaknesses in the organization by comparing data to analyze the current situation, and the balance sheet is also used to help banks evaluate the company's net worth, financial position, and future investment indicators.

The objectives of the balance sheet are to accurately reveal the company's financial position in the short and long term, provide a clear picture of asset and liability values, and provide complete information about creditors and debtors.

It is also used as a primary tool for financial analysis and revealing liquidity position, and clarifies the company's ability to meet its obligations and achieve financial growth. Management and banks also rely on it to calculate financial ratios that help evaluate strengths and weaknesses and make sound decisions regarding the company's investments and financial future.

What Appears in the Balance Sheet?

The balance sheet displays the company's financial position during a specific time period through its elements. Three main elements appear in the balance sheet:

- Assets: Show everything the company owns, including cash, inventory, receivables, real estate, equipment, and other assets.

- Liabilities: Show everything the company owes, including short-term debts such as accounts payable, and long-term debts such as loans.

- Shareholders' Equity: Show the value of shareholders' rights in the company after deducting liabilities from assets, including paid-in capital and retained earnings.

Thus, it becomes clear that the components of the balance sheet are: assets owned by the company, liabilities it is obligated to pay, and shareholders' equity representing the company's net value. These elements enable us to evaluate the institution's financial health in a balanced and transparent manner.

What Account Does Not Appear in the Balance Sheet?

Accounts that do not appear in the balance sheet are those related to revenues and expenses, which are recorded in the income statement, such as "goods sales" or "salary expenses" accounts. These do not appear in the balance sheet because they relate to financial performance during a specific period and not to the financial position at a point in time.

Balance Sheet Calculation

The method of calculating the balance sheet is based on the basic balance sheet equation, where assets owned by the company and to which it has rights are calculated, such as current or non-current assets, as well as obligations that the company must pay to creditors due to obtaining resources or services without paying the amount due, alongside shareholders' equity represented by company shares. The balance sheet calculation equation is as follows:

Assets = Liabilities + Shareholders' Equity

What Factors Affect the Balance Sheet?

The balance sheet reflects the financial position of any company, but this position doesn't remain constant; rather, it is affected by several factors that cause some changes. These are the factors affecting the balance sheet:

- Operating Performance: Revenues and expenses that occur during the company's daily activities can affect assets and liabilities.

- Investments and Financing: Decisions related to investments (such as purchasing fixed assets) and financing (such as issuing stocks or debt) affect the balance sheet composition.

- Valuations and Depreciation: Asset valuation and depreciation calculations can change asset values on the balance sheet.

- Changes in Accounting Policies: Any changes in accounting policies or standards can affect how assets and liabilities are recorded.

- Economic Events: Such as recession, inflation, or exchange rate changes can affect the value of assets and liabilities.

- Related Party Transactions: Transactions with related parties, such as loans from shareholders, can affect the balance sheet.

- Legal Events: Lawsuits, fines, and settlements can lead to changes in liabilities.

- Risks and Uncertainties: Risks such as natural disasters or political uncertainties can affect the value of assets and liabilities.

Thus, the balance sheet is affected by a variety of factors, such as operating performance, investment and financing decisions, asset valuation and depreciation, changes in accounting policies, alongside economic conditions, legal events, and potential risks.

Common Errors to Avoid When Preparing the Balance Sheet

When preparing the balance sheet, some accountants or business owners may fall into common errors that affect the accuracy of financial data and reflect an incorrect picture of the company's financial position. Therefore, it's important to identify these errors to avoid them. Here are some common errors that accountants make when preparing the balance sheet:

1- Overlooking the Inclusion of All Assets

Some may overlook including all asset elements within the balance sheet, which is considered one of the most common errors when preparing the balance sheet. Types of assets that are overlooked include:

- Tangible assets such as (land, equipment, inventory, and others).

- Intangible assets such as patents, trademarks, broadcasting and publishing rights, copyrights, and goodwill.

- Investment assets such as stocks, securities, various currencies, bonds, gold, silver, iron, and investment funds.

- Personal assets such as bank accounts and certificates, cars, and jewelry.

2- Failing to Include All Liabilities

Being careful to include all liabilities is just as important as assets, and many may overlook completing this important item when preparing the balance sheet. These forgotten liabilities may include:

- Some types of taxes.

- Interest on loans.

- Accrued expenses for warranties not fully paid.

- Mortgage.

- Deferred compensation.

- Pension obligations.

3- Incorrect Classification

One of the common errors when preparing the balance sheet is incorrectly classifying asset and liability items, such as accounts receivable and accounts payable, that can be recorded on both sides depending on their specific situation, such as bank accounts, customer accounts, or supplier accounts.

4- Neglecting to Update the Balance Sheet Regularly

The balance sheet's main purpose is to provide a comprehensive view of the entity's financial health during a specific time period, so its data should be updated and accurate on a monthly or quarterly basis. Some may neglect this update, resulting in inaccurate financial information about the institution's financial position and status.

It becomes clear that there are some common errors when preparing the balance sheet that should be avoided, such as overlooking the inclusion of all assets or liabilities, incorrect classification of items, or neglecting to update data regularly. Avoiding these errors ensures preparing a balance sheet that accurately reflects the entity's true financial position and helps make sound and well-considered financial decisions.

4 Steps to Avoid Balance Sheet Preparation Errors

Making errors when preparing this balance sheet may lead to inaccurate financial results that negatively affect decision-making. From this perspective, following clear steps helps avoid those errors and ensure the integrity of financial information, which are as follows:

- Clearly Define the Entity's Financial Objectives: These objectives should be measurable and trackable, such as revenue increase rate or expense reduction.

- Rely on Accurate Financial Data: Ensure the accuracy and reliability of financial data used in preparing the balance sheet and use previous financial reports, documents, and records for comparison, auditing, and reviewing accounting information.

- Regular Review: Review the balance sheet regularly, update its information, and make necessary adjustments, settlements, and corrections in a timely manner.

- Consult Financial Experts and Accounting Advisors: Appoint specialists to review and evaluate the balance sheet.

It becomes clear that when adhering to the steps to avoid balance sheet preparation errors, we can obtain a balance sheet that ensures the company's financial stability. These steps begin with accurately defining financial objectives, relying on reliable data, regular review, and consulting experts, which is fundamental to avoiding accounting errors and ensuring the preparation of a balance sheet that accurately reflects the financial reality.

How to Improve the Balance Sheet?

Companies should continuously work on improving their balance sheet through effective strategies that contribute to enhancing their financial strength. These are the ways to improve the balance sheet:

- Reviewing Underutilized Assets: Reviewing company assets that are not being used as required or necessary, as selling those assets at that time would be a positive factor for the company.

- Reducing Liabilities and Expenses: Limiting liabilities or obligations and reducing expenses, alongside having a reserve amount to be used for immediate spending in necessary cases.

Improving the balance sheet depends on making strategic decisions such as disposing of underutilized assets and reducing obligations while having a financial reserve, thus enabling companies to enhance their financial stability.

Is the Statement of Financial Position the Same as the Balance Sheet?

Yes, the statement of financial position is another term used to refer to the balance sheet. Both terms are used interchangeably and refer to the same financial statement, where the balance sheet represents a document containing the distribution of financial resources and expenses for the government or state over a specific time period, usually one fiscal year, and the balance sheet can be considered a reference for understanding the government's financial performance and spending directions.

On the other hand, we find that the statement of financial position is part of the balance sheet and contains more details of revenues, expenses, debts, assets, and liabilities in a specific time period.

How to Read the Balance Sheet?

Reading the balance sheet provides a comprehensive view of assets, liabilities, and equity, and helps evaluate financial performance and make strategic decisions. To read the balance sheet correctly and accurately, the following points should be considered:

- Maintaining Balance Sheet Equation Balance: Ensuring the balance of the balance sheet equation: Assets = Liabilities + Equity.

- Arranging Elements by Liquidity: Assets and liabilities are usually arranged by liquidity, from most liquid to least liquid.

- Analyzing Financial Trends: Numbers in the balance sheet should be compared with previous financial periods to analyze trends and changes in the company's financial position.

- Using Financial Ratios: Such as current ratio, debt-to-equity ratio, and return on assets, can provide deep insights into the company's financial position.

Also, when reading the balance sheet, the following elements should be taken into consideration:

- Revenues: Include all sources from which the government generates income, such as taxes, service fees, donations, loans, external grants, and others.

- Expenses: Include all expenditures made by the government, such as salaries and wages, infrastructure spending, education, health, defense, public services, and public debt.

- Surplus or Deficit: Surplus is calculated when revenues are greater than expenses, while a deficit occurs when expenses are greater than revenues.

- Debt: Refers to amounts that the government must borrow to finance the budget deficit or finance other government projects.

Reading the balance sheet correctly requires attention to some important points, such as balancing the accounting equation, arranging elements by liquidity, and analyzing financial trends using financial ratios.

Alongside understanding the basic elements, which are details of revenues, expenses, surplus or deficit, and debt. These elements combined enable the reader to accurately assess the financial position, whether in the private or public sector, and enhance the ability for sound financial planning and making decisions based on clear and reliable information.

Read also: Arithmetic tables: what are they? What is its importance? How to use it

What is the Difference Between a Trial Balance and a Balance Sheet?

Both the trial balance and the balance sheet are fundamental tools in the financial system of institutions, but each has a different function and specific role in the accounting cycle. The difference between a trial balance and a balance sheet can be identified through the following elements:

Purpose

We find that the trial balance serves as a temporary report used to verify the accuracy of accounting records and ensures that the final totals of debits and credits are balanced before preparing financial statements, while the balance sheet is one of the main financial statements that shows the company's financial position at a specific point in time, reflecting assets, liabilities, and equity.

Content

The trial balance contains all accounts in the general ledger, including assets, liabilities, revenues, and expenses, with totals for each account, while the balance sheet contains only assets, liabilities, and equity on a specific date.

Timing

The trial balance is usually prepared at the end of each accounting period as a preparatory step for closing accounts and preparing financial statements, while the balance sheet is prepared at the end of the fiscal year or when needed to provide a report on the company's financial position.

The difference between a trial balance and a balance sheet lies in purpose, content, and timing. The trial balance is used to verify account balances before preparing financial statements and includes all general ledger accounts.

The balance sheet shows the financial position on a specific date and is limited to assets, liabilities, and equity. The trial balance is prepared periodically, while the balance sheet is usually prepared at the end of the fiscal year.

What is the Difference Between a Balance Sheet and a Budget?

Often, some people confuse the balance sheet and budget due to name similarity, but in reality, each has a different role in financial management. The difference between the balance sheet and the budget can be identified through the following items:

Definition

The balance sheet is defined as a financial statement that shows assets, liabilities, and equity on a specific date, while the budget is defined as a financial plan that shows financial estimates of revenues and expenses for a future period.

Purpose

The purpose of the balance sheet is to evaluate the company's current financial position, while the purpose of the budget is to use it as a tool for financial planning and control, helping guide the company toward achieving its financial objectives.

Operating Mechanism

The balance sheet shows actual values as they are on a specific date, while the budget shows expected or planned values for a future period.

The difference between a balance sheet and a budget is that the balance sheet is a financial statement that shows assets, liabilities, and equity on a specific date and aims to evaluate the company's current financial position, relying on actual data.

In contrast, the budget is an estimated financial plan that shows expected revenues and expenses for a future period, and is used as a tool for financial planning and control to achieve desired objectives.

What is the Difference Between Balance Sheets and Income Statements?

The balance sheet and income statement are fundamental financial statements used to analyze the financial performance of institutions, but each serves a different purpose. The difference between the balance sheet and the income statement is based on the following factors:

Purpose

The balance sheet shows the company's financial position at a specific point in time, such as the end of the fiscal year, while the income statement or profit and loss statement shows the company's financial performance over a period of time, such as a month, quarter, or year.

Contents

The balance sheet includes assets, liabilities, and equity, while the income statement includes revenues, expenses, and the final result as profits or losses.

The difference between the balance sheet and income statement lies in purpose and content. The balance sheet shows the company's financial position at a specific point in time by stating assets, liabilities, and equity, while the income statement shows financial performance during a specific time period, displaying revenues, expenses, and the final result of profits or losses.

What is the Difference Between a General Budget and a Balance Sheet?

The general budget is usually used in the context of governments and public administrations and includes revenue and expenditure estimates for the state or government entity for a future financial period, serving as a tool for planning and financial control of public funds. The balance sheet is used in the context of companies and commercial institutions to evaluate the company's current financial health through items of assets, liabilities, and equity.

How to Prepare a Balance Sheet in Daftra

In Daftra accounting software, you won't need any additional effort to generate your balance sheet, as it's sufficient to enter your primary accounting data, including assets, liabilities, and equity, then go to the reports and financial statements menu and click on the balance sheet list for Daftra to prepare it in seconds. This helps you understand the company's financial position, reveal your financial status, estimate available liquidity, and assess your ability to meet current and future financial obligations.

Frequently Asked Questions

When is the balance sheet prepared?

The balance sheet is usually prepared at the end of an accounting period, such as month-end, quarter-end, or year-end, and you shouldn't wait until the end of the accounting period to complete the balance sheet.

Who is responsible for preparing the balance sheet?

This depends on the company size. If the company is small, the owner or company accountant prepares the balance sheet, but if the company is medium or large-sized, it's prepared internally and then examined by an external accountant or financial officer.

Does the balance sheet always balance?

Yes, the balance sheet must always balance. If it doesn't balance, it may be for one of the following reasons:

- Data is incomplete or entered in the wrong place

- Incorrect entry of financial transactions and their amounts

- Errors in currency exchange rates

- Errors in stock calculations

- Errors in inventory calculations

What are the principles of the balance sheet?

The principles or characteristics of the balance sheet include:

- Displaying the company's financial picture: Through recording assets, liabilities, and shareholders' equity

- Financial balance: Asset value must equal the sum of liabilities and equity

- Accuracy and reliability: Data must reflect the true financial position

- Reliance on specific financial periods: Whether annual, semi-annual, or quarterly

- Accurate accounting classification: For assets, liabilities, and equity

What is the balance sheet equation?

The balance sheet equation is: Assets = Liabilities + Equity

This represents the foundation upon which the balance sheet is prepared, where what the company owns (assets) is assumed to equal what it owes (liabilities) plus what shareholders own (equity).

What is the difference between a balance sheet and financial position?

There is no fundamental difference between the terms; balance sheet and statement of financial position are two names for the same accounting document. Both show the entity's financial position during a specific time period.

How do you calculate the balance sheet?

The balance sheet is calculated through the following steps:

- Determine the financial period

- Gather financial data from records such as the general ledger

- Calculate assets = current assets + non-current assets

- Calculate liabilities = current liabilities + non-current liabilities

- Calculate shareholders' equity = assets – liabilities

- Balance the balance sheet: Ensure the equation balances (Assets = Liabilities + Equity)

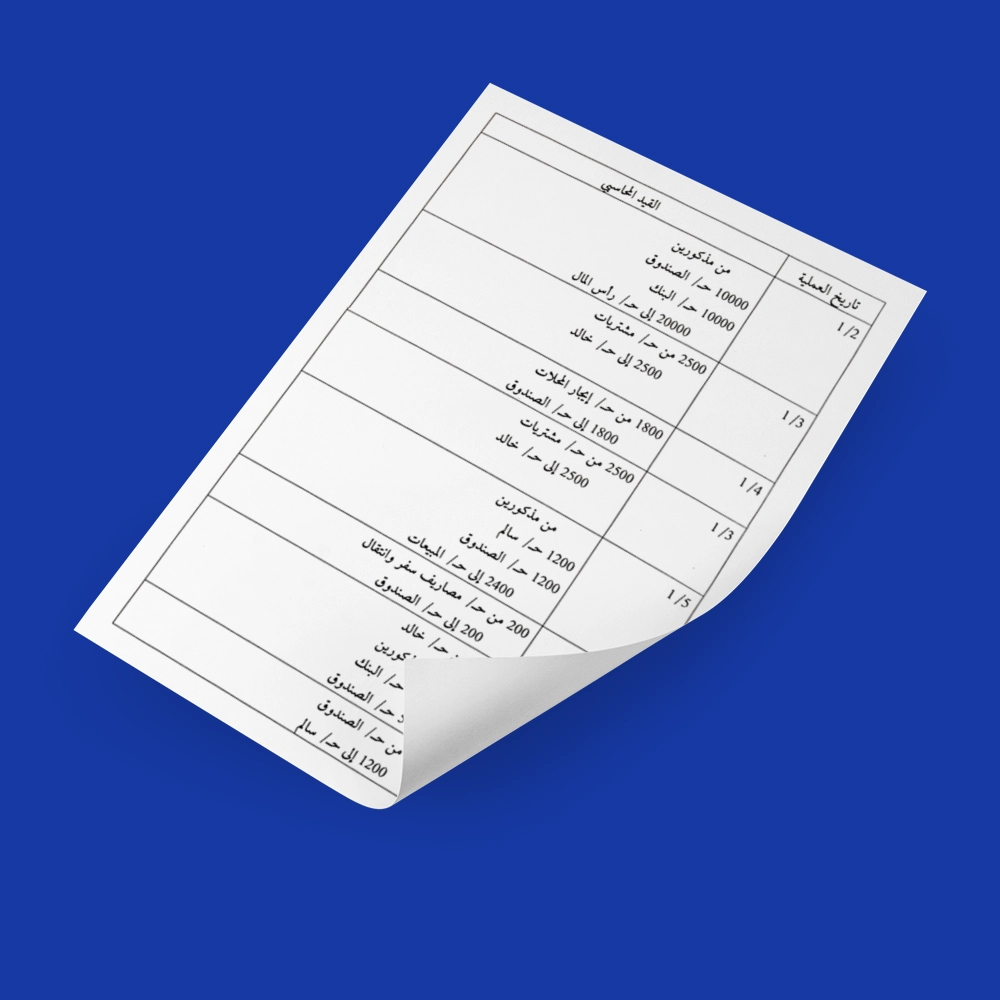

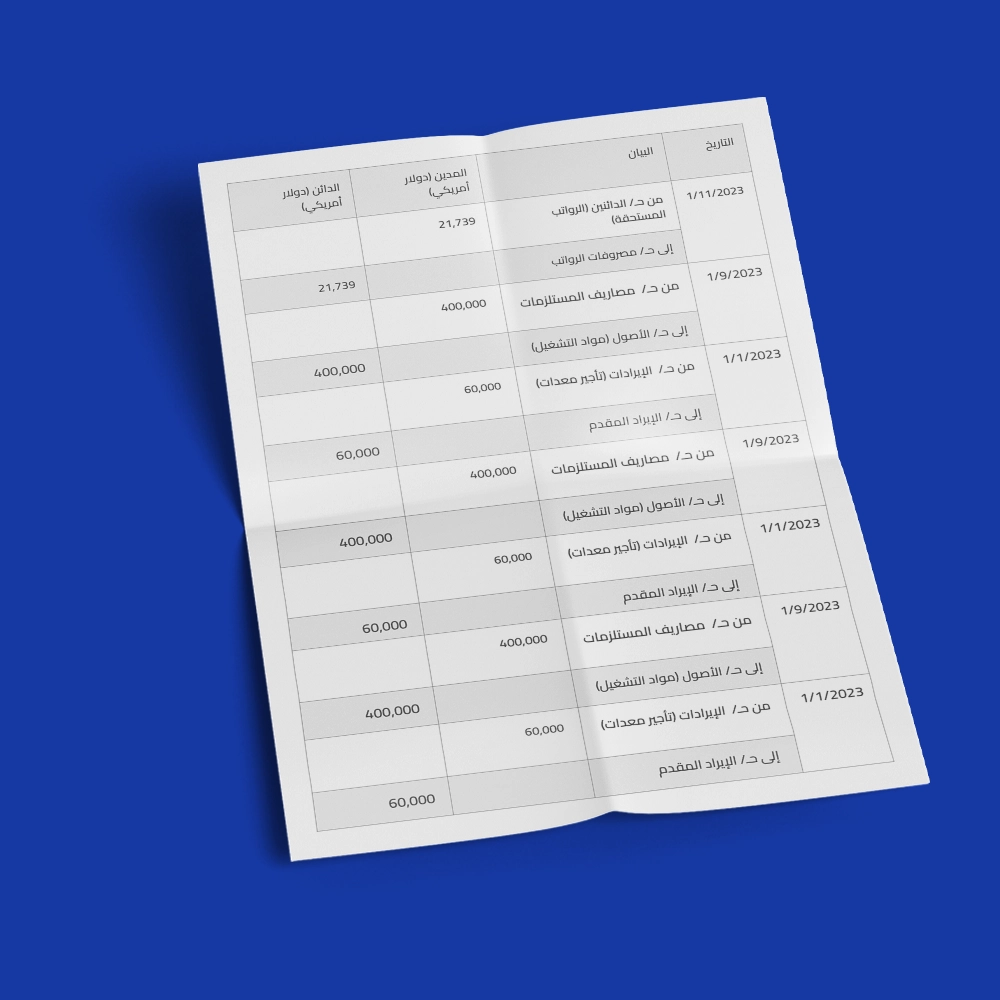

What are balance sheet closing entries?

Balance sheet closing entries are a set of accounting entries recorded at the end of the financial period to zero out temporary accounts, such as revenue and expense accounts, and transfer their balances to permanent accounts, such as capital or retained earnings accounts.

Conclusion The balance sheet is the knowledge foundation that will help you stand on solid ground by clarifying the assets, liabilities, and equity of your business project. We see that many startup company owners are unaware of their importance and don't prioritize hiring a financial manager for the company, which causes most companies to appear and suddenly disappear because they drown in debts and obligations, and they have no direction or financial planning for the future. This prevents them from knowing their companies' economic position or their strengths and weaknesses. Therefore, if you're planning to start your project, you should first focus on the balance sheet and understand its accounting equations, and commit to properly applying the steps for its preparation to ensure its accuracy and completeness.