What are direct costs and indirect costs, and what is the difference between them?

Table of contents:

- What are direct costs?

- Methods for calculating direct costs

- What are indirect costs?

- The Difference Between Direct and Indirect Costs

- Examples of Direct and Indirect Costs

- The Importance of Distinguishing Between Direct and Indirect Costs

- How to Manage Your Costs Using Daftra

- Frequently Asked Questions About Direct and Indirect Costs

Every beginner in the business field faces some challenges related to how to optimally plan financial aspects to improve the chances of new projects continuing and expanding in the long term.

Understanding basic financial concepts helps in better planning and reducing the risks of starting a project. This article aims to contribute to that by explaining two fundamental concepts: direct costs and indirect costs. It provides a simplified explanation of both concepts, clarifies the differences between them, and gives some examples.

What are direct costs?

Direct costs can be defined as all expenses that can be directly linked to the process of manufacturing a product or providing a service, without which production would be disrupted.

Direct costs usually affect the final price of the product or service, meaning any change in these costs, whether an increase or decrease, will be reflected in what the consumer pays for that good or service.

The total direct costs of a project may fluctuate, while the direct cost incurred to produce a single unit of product or service generally remains fixed. This analysis assumes that the value of everything used in production remains constant, so the project’s direct costs increase only if the production rate rises, i.e., more units are produced.

Although direct costs are generally considered variable because they depend on production levels, certain items, such as employee wages, often remain fixed, even though they fall under direct costs.

Methods for calculating direct costs

When there are changes in the price of materials used in production, commercial establishments typically choose between two main methods for calculating direct costs: First-In, First-Out (FIFO) and Last-In, First-Out (LIFO). Here are the details of each method:

First-In, First-Out (FIFO):

With this method, priority is given to using the oldest purchased materials, and expenses are recorded accordingly.

Last-In, First-Out (LIFO):

Conversely, this method prioritizes the use of the most recently purchased materials, and expenses are recorded based on that.

What are indirect costs?

Indirect costs, also called operating expenses, are costs that are not directly related to production but are important for managing the project as a whole. These costs do not directly affect the final price of the product or service and can be divided into two types: fixed indirect costs and variable indirect costs.

Fixed indirect costs:

This category includes expenses not directly related to production that cover the entire operational period of the project, and, as the name suggests, these amounts are fixed.

Variable indirect costs:

These are expenses paid periodically that are subject to change, such as electricity and utility costs.

Read also: What is Contribution Margin and How to Calculate It.

The Difference Between Direct and Indirect Costs

The main difference between direct and indirect costs is that direct costs are directly associated with the process of manufacturing the profit-generating product. Indirect costs, on the other hand, are not directly linked to the main product that generates revenue for the company. However, not all costs can be classified solely based on this criterion.

For example, you might have some operational processes involved in producing the main product, but you cannot trace or assign them to a single unit of production or to the production as a whole, such as the amount of electricity needed to manufacture a desk or chair.

In this case, the cost is classified as an indirect cost, since it relates to expenses that are difficult to trace. If you have an employee working in the marketing department, and you consider the marketing department a cost center, their salary would be considered a direct cost charged to that department.

However, if this employee supervises the marketing, technical support, and operational sites, their salary would be allocated as an indirect cost, even if each of the aforementioned departments has its own separate cost center.

This is because direct costs must be associated with a single cost center, while costs linked to multiple cost centers are considered indirect costs. Download a ready-to-use product cost calculation template from Dofterah for free and edit it.

Examples of Direct and Indirect Costs

After understanding the concepts of direct and indirect costs and their differences, the following paragraphs provide practical examples for better clarification:

1- Examples of Direct Costs

The most prominent examples of direct costs include raw material costs, labor costs for production, and factory expenses such as rent, utilities, and other necessary services, essentially everything required for production.

Direct costs can also extend to intellectual property rights if the final product is, for example, a book, or licensing fees for certain applications if they are essential for the final product rather than for routine operations.

2- Examples of Indirect Costs

Indirect costs can be divided into three main categories: administrative and office expenses, marketing expenses, and other miscellaneous costs. Detailed examples are as follows:

- Administrative and Office Expenses These include employee salaries, company rent, utilities, insurance, taxes, as well as all expenses related to office supplies, printing, and similar items.

- Marketing, Sales, and Distribution Expenses Examples include advertising expenses, marketing commissions, discounts, free sample distribution, packaging, warehouse rent, and expenses for sales outlets.

- Other Expenses A business may incur additional expenses related to losses from fire, theft, or product damage, maintenance and repair costs, or amounts owed to financial institutions such as bank fees or interest on loans financing the project.

The Importance of Distinguishing Between Direct and Indirect Costs

By distinguishing between direct and indirect costs, business owners can offer their products and services at more competitive prices. A precise understanding of these costs also helps in planning the future operations of the business.

Knowing the direct costs ensures a clear understanding of production expenses, while knowing the indirect costs provides a realistic picture of the business’s actual income.

Additionally, distinguishing between these types of costs is essential for meeting tax obligations and benefiting from available exemptions on certain expense items.

Small business funders may require their financing to be directed toward specific expense items, often those directly related to production, or they may set a maximum limit on indirect costs in order to approve funding for the project.

How to Manage Your Costs Using Daftra

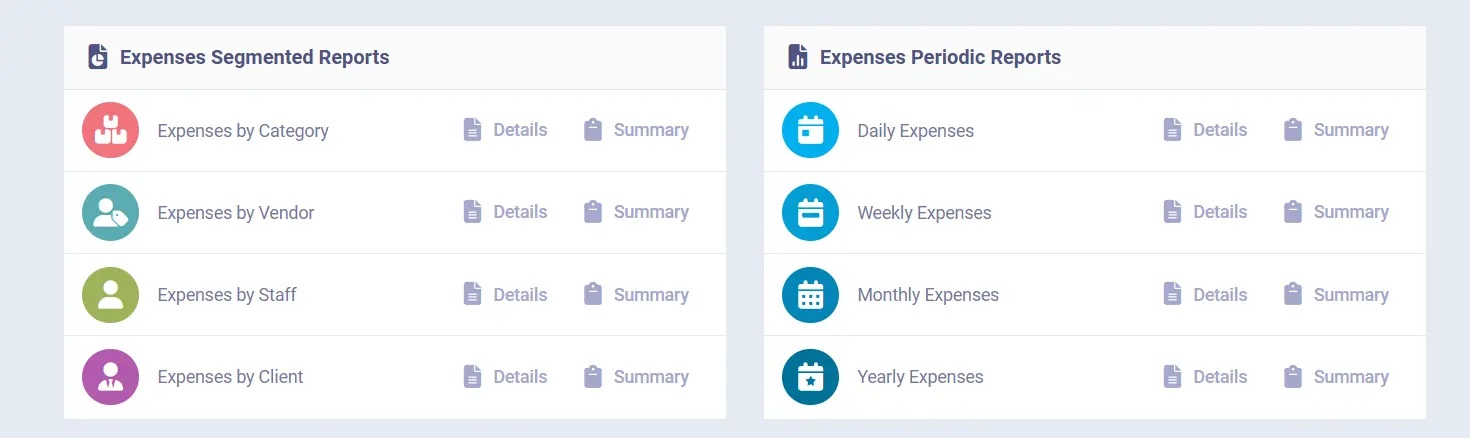

Daftra’s accounting software allows you to categorize your expenses into classified groups, which is the first step in gaining a more precise understanding of your spending. This helps you make informed decisions, whether to reduce expenses in one area or increase spending in areas that generate higher financial returns and impact profits.

In addition to accurately recording all costs and comparing them against revenues to calculate net profit, the system allows you to easily track expenses for a specific department, project, or time period, such as last week or last month. You can distinguish operational expenses from non-operational ones, and the system provides real-time, comprehensive reports for any expense category.

Frequently Asked Questions About Direct and Indirect Costs

In which type of profit calculation are direct costs used?

Direct costs are used in calculating Gross Profit.

In which type of profit calculation are indirect costs used?

Indirect costs are used in calculating Net Profit.

On which side are direct costs included in the income statement/account statement?

Both direct and indirect costs are recorded on the debit side of the income statement/account statement.

Are direct costs the same as variable costs?

Direct costs and variable costs are often used interchangeably to refer to expenses that change directly with the level of production and operational activity and can be measured easily. They increase as production and operations increase, and decrease when production and operations decrease.

Is rent considered a direct cost?

Rent is generally not classified as a direct cost; it is considered a fixed cost that does not change with production or operational activities. However, in exceptional cases, rent may be classified as a direct cost, for example, renting a machine specifically for producing a particular product for a defined period.

Read also: Fixed Costs vs. Variable Costs and Key Differences

What are the elements of direct costs?

- Direct materials: Materials used directly in manufacturing the product or providing the service.

- Direct labor: Wages paid to workers directly involved in production.

- Manufacturing costs: Costs such as energy and machinery usage.

What are the elements of indirect costs?

- Administrative expenses

- Marketing expenses

- Other expenses, such as maintenance and losses

Conclusion

This article explained direct and indirect costs and the differences between them. Expense items can be classified into either category by assessing how directly the expense relates to the final product or service.

If the expense contributes directly to producing the product or delivering the service, it is classified as a direct cost; all other business expenses are classified as indirect costs.

For example, factory production expenses are considered direct costs, while administrative building expenses for managing the project are classified as indirect costs. Indirect costs can be further divided into fixed and variable costs, while direct costs are usually fixed per unit of product or service, with few exceptions.

It is essential to distinguish between direct and indirect costs in project accounting and maintain accurate records. Accurate tracking of direct costs helps determine competitive pricing for project products, while monitoring indirect costs reflects the overall financial position of the project and identifies areas where spending can be reduced to increase profits.

Investors in project development also review indirect cost ratios, which may determine whether financing is provided, in addition to tax authorities that may grant exemptions on certain indirect cost items.