What Is a Promissory Note and How Is It Issued

There are several types of documents that result from financial transactions between a creditor and a debtor. These documents serve various organizational, administrative, and even accounting purposes, including receipt and payment vouchers.

There is a special type of these documents known as commercial paper, which is considered an acknowledgment of debt by one party to another, such as a check. Some commercial papers stand out for their reliability and for being used as a guarantee instrument, as is the case with promissory notes.

In this guide, we explore the promissory note, its characteristics, and the difference between it and other types of commercial papers, such as checks and bills of exchange.

What Is a Promissory Note?

A promissory note is a written undertaking to pay a sum of money between a debtor and a creditor, whether the payment is restricted to a future date specified in the promissory note or left open so that payment becomes due when the creditor requests it from the debtor.

A promissory note is a legally binding document recognized by official authorities, such as enforcement courts.

What Are the Characteristics of a Promissory Note?

Commercial papers related to financing are divided into papers used solely for payment, such as checks, and other papers that are recognized as instruments of payment and guarantee, such as bills of exchange and promissory notes.

Bills of exchange are relatively complex, which makes their use less widespread, while promissory notes have characteristics and advantages that make them more common. The main characteristics of a promissory note include the following:

1- A promissory note is legally binding

A promissory note is a clear document that provides sufficient transparency and contains all required information, making it legally binding once the mandatory details are established and both parties have signed it.

2- A promissory note is a simple document

Unlike bills of exchange, which rely on many detailed conditions, a promissory note is a simple document that is quick to issue, and its form and requirements are easy for any party, whether an individual or a company, to fulfill.

3- Protection of creditors against financial fraud risks

This concern is often present in financing operations, as the debtor may fail to meet their obligations or may delay payment beyond the agreed date.

Here lies the importance of the promissory note as an instrument of payment that guarantees the financier’s right to recover their funds legally by resorting to enforcement courts, once both parties agree to the terms of the note by signing it.

4- Considered assets that promissory note holders can borrow against

If the financer of the promissory note (the creditor) wishes to borrow, the lender may consider the promissory note as an asset that can be used as collateral. In the event of default on loan repayments, the creditor can recover the amount due under the promissory note from the debtor to settle the loan.

5- An effective tool for recording and classifying accounts

Accounting pays great attention to the process of recording all transactions, and all accounting documents are considered tools that support accurate recording. The promissory note also serves this accounting purpose, as it serves as both documentation and a guarantee.

To help organize your company’s accounts and issue and record promissory notes accurately within the company’s financial system, you can rely on Daftra’s business and accounting management software, which facilitates tracking promissory notes and all financial documents in a simple electronic manner.

6- Ease of ownership transfer

Ownership of a promissory note can be easily transferred from one party to another, which greatly facilitates many financial transactions.

It becomes clear that the characteristics of a promissory note combine legal simplicity with accounting efficiency. It is a legally binding document, simple to draft and use, and provides creditors with legal protection against fraud and payment delays.

It is also considered an asset that can be used as collateral for borrowing, contributes to account documentation, and allows for the easy transfer of ownership between parties, enhancing its flexibility and increasing its prevalence in financial and commercial circles.

What Are the Contents of a Promissory Note?

Any promissory note contains basic details about the creditor and the debtor, the amount of the debt, the payment terms, and the due date, if specified, details sufficient to make the promissory note clear and simple at the same time. These are the essential elements of a promissory note:

- Titling the document as “Promissory Note”.

- The name and address of both the creditor and the debtor.

- The amount of the note.

- The due date.

- Payment installments by amount and payment date, if there is a payment schedule.

- The interest rate, how it is applied, and the interest associated with delayed payment.

- The terms, conditions, and laws related to the promissory note.

- The signatures of both parties confirm their agreement to the terms and conditions of the promissory note.

- Guarantees from assets that enable the creditor to recover the debt through them in the event of cash payment default.

- Stating the place of payment (country and city); if it is not stated, the place of issuance is considered the place of payment.

The availability of the basic data of a promissory note, such as the amount, the parties, and the due date, along with the terms, guarantees, and signatures, makes the promissory note a comprehensive accounting and financial document that helps preserve rights and facilitate claim procedures when needed.

What Invalidates a Promissory Note?

Despite the enforceability and reliability of a promissory note, there are cases in which a promissory note is legally invalid. Therefore, it is necessary to be familiar with the common grounds for invalidating a promissory note:

1- Forgery of the signature

If the authenticity of one party’s signature on the promissory note is challenged and forgery is proven, the note is considered invalid, and its legal reliability is not recognized, even if all conditions are otherwise fulfilled.

2- Issuance of the note under threat

If the signature and all conditions of the promissory note are proven valid, but one or both parties signed under threat and against their will, the promissory note is considered invalid.

3- Loss of legal capacity

There are general conditions for persons with legal capacity to sign contracts and other legal documents, including reaching the legal age and having mental capacity. Therefore, if one of the parties to the note is under the legal age, for example, the promissory note is invalid.

4- Non-compliance of the note’s contents with the prescribed formal requirements

As mentioned in the previous section, a promissory note must contain certain data necessary for its legal effectiveness. If the note does not meet the basic formal requirements, it is rendered invalid.

Any deficiency or defect in the basic data, such as the absence of a signature, the omission of one party’s name, or violation of legal conditions, constitutes grounds for invalidating the promissory note and stripping it of its legal value.

Therefore, accuracy in drafting the note and full compliance with mandatory elements are essential to ensure its validity and enforceability before the competent authorities.

What Is the Difference Between a Promissory Note and a Check?

Although both documents, the promissory note and the check, prove amounts of money owed to one of the parties, there are fundamental differences that give each document a purpose different from the other.

| Check | Promissory Note |

| A check represents a relationship between three parties, where the bank acts on behalf of the debtor to pay the check amount from the debtor’s bank balance. The creditor deals directly with the bank to receive the funds. | A promissory note involves no parties other than those directly concerned with the note, namely the creditor and the debtor. |

| A check is payable upon issuance and contains only the date of issuance. It is payable from the moment it is issued, even if it is dated later. | A promissory note includes both an issuance date and a maturity date, which may differ, making the maturity date linked to a future period. |

| A check is a payment instrument, not a guarantee instrument, and is not considered the most reliable document for ensuring receipt of funds. The creditor must ensure that sufficient funds are available in the debtor’s bank account at the time of issuing the check. | A promissory note is considered by law to be both a payment and a guarantee instrument. It is legally enforceable, and the creditor may resort to the court to enforce their rights. The debtor may not evade payment of the liabilities they have signed for in the note. |

| A check requires dealing with banks and cannot be issued without a bank account and balances. | A promissory note relationship may exist independently of banks and their transactions, whether between individuals or between commercial institutions and companies. |

It becomes clear that the differences between a promissory note and a check lie in the nature of the parties and their financial relationship, the method of enforcement, and the purpose of each document.

A promissory note is considered both a payment and a guarantee instrument between only two parties, and it enjoys legal force that allows the creditor to recover their right through enforcement courts, even without the involvement of banks.

A check, on the other hand, is an immediate payment instrument between three parties and requires a bank account, with weaker guarantees in the absence of sufficient funds. Therefore, the choice between them depends on the nature of the financial relationship and the extent of the need for guarantee and legal enforcement.

What Is the Difference Between a Promissory Note and a Bill of Exchange?

A promissory note and a bill of exchange are more similar than they are different, as both are considered payment and guarantee instruments. The promissory note is more modern and more commonly used compared to the bill of exchange, but there are some simple differences between the two that should be known.

| Bill of Exchange | Promissory Note |

| A bill of exchange involves three parties: the drawer of the bill, the debtor who is obligated to pay, and the beneficiary, the creditor to whom the amount must be paid. | A promissory note involves only two parties: the creditor and the debtor. |

| Payment of the bill of exchange is made to the drawer. | Payment of the promissory note is made in favor of the beneficiary. |

The fundamental differences between a promissory note and a bill of exchange relate to the number of parties and the nature of the relationship between them.

A bill of exchange includes three parties and directs payment in favor of the drawer, whereas a promissory note is limited to only two parties, with payment made directly to the beneficiary.

The promissory note is more commonly used in daily transactions, while the bill of exchange remains less widespread.

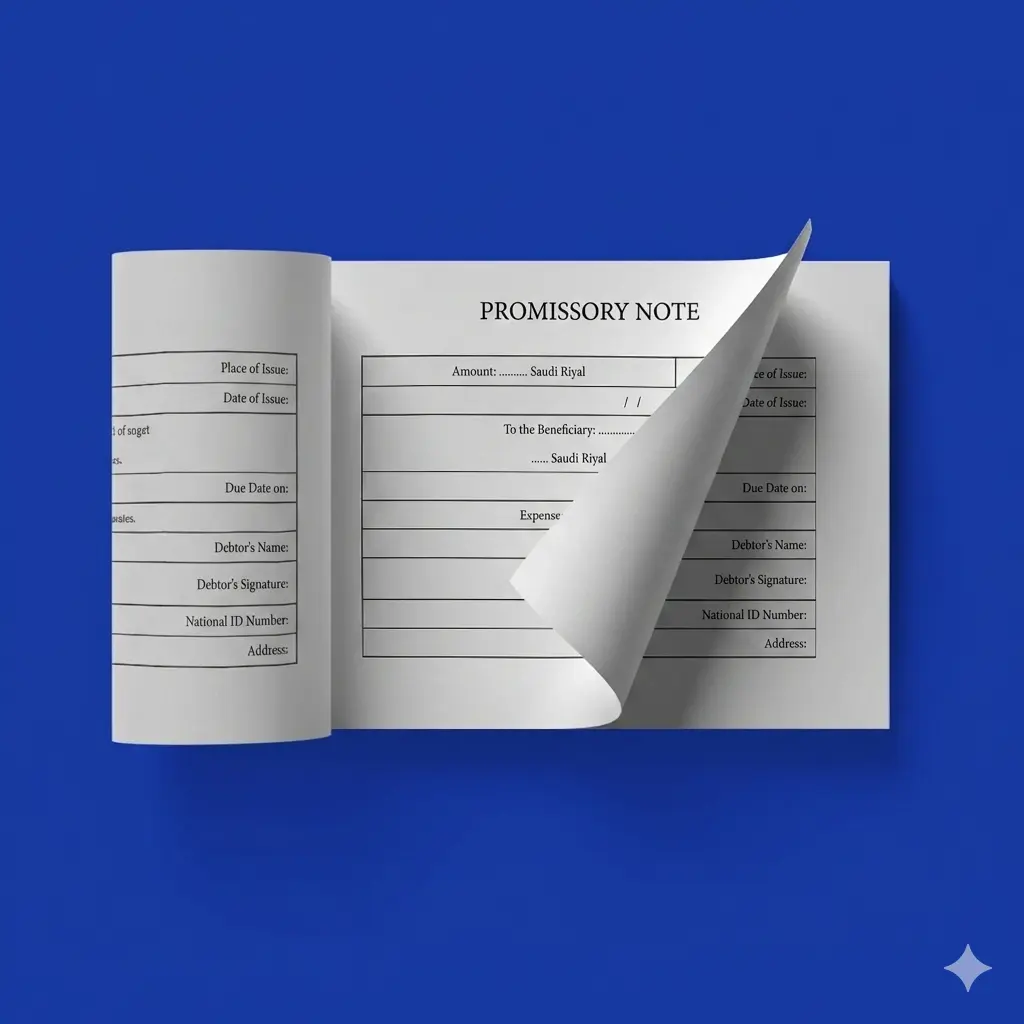

What Is the Promissory Note Form According to the Saudi System?

There are certain requirements that must be met under the Saudi system for a promissory note to be legally acceptable. Below is a sample form of a promissory note:

Promissory Note

Promissory Note Date /

City of Issuance /

I hereby undertake, under this promissory note, to pay an amount of /

On the maturity date /

This note is stipulated under Council of Ministers Resolution No. 692 dated 26/09/1383 AH, and enacted by Royal Decree No. 37 dated 11/10/1383 AH, from the Commercial Papers Law.

Debtor’s Name /

Debtor’s ID Number /

Debtor’s Address /

Debtor’s Signature /

Debtor’s Mobile Number /

Creditor’s Name /

Creditor’s ID Number /

Creditor’s Address /

Creditor’s Signature /

Creditor’s Mobile Number /

You can also download a ready-made promissory note template in different formats.

The promissory note form, according to the Saudi system, includes essential elements that ensure the clarity and legality of the document, such as the document title, the date and place of issuance, the amount due, and the maturity date, in addition to the full details of the debtor and creditor along with their signatures. This form makes the promissory note a legally binding and officially recognized document.

How Does Daftra Help You Manage Your Business?

Daftra is an integrated business management system that helps you manage human resources, customers, operations, manufacturing, finance, and accounting.

You can also issue payment and receipt vouchers through Daftra’s accounting software after issuing promissory notes on the Nafeth platform.

This applies if you wish to convert a promissory note into payment and receipt vouchers that are officially recognized in your accounting transactions, which helps with revenue and expense recognition and the issuance of accurate financial statements.

You can download a free receipt voucher template.

Frequently Asked Questions

What Is the Definition of a Promissory Note?

A promissory note is a written undertaking by which the debtor commits to paying a specific amount of money to the creditor. Payment may be linked to a specific maturity date stated in the note, or it may be unrestricted by time, making the amount due upon the creditor's demand.

A promissory note is a legally binding document recognized by competent authorities, such as enforcement courts.

Is a Promissory Note Considered an Ordinary Instrument?

Yes, a promissory note is considered an ordinary instrument, but it also carries special characteristics that make it stronger than ordinary instruments. It is a financial paper that may result in the suspension of its issuer's services if the amount is not paid, without the need for litigation.

Is a Promissory Note a Guarantee Instrument?

Yes, a promissory note is a guarantee instrument and is used to secure financial rights between parties.

How Do I Issue a Promissory Note to Someone?

These are the steps to issue a promissory note: first, register on the Nafeth platform, then choose the request to issue a note, fill in the required form after reviewing the terms, enter the other party’s details, document the debtor’s approval, and after which the promissory note is created and archived on the platform.

Does a Promissory Note Result in Imprisonment?

Yes, a person obligated under a promissory note may be imprisoned according to Article 46 of the Enforcement Law, which explains the consequences of the debtor’s failure to execute or disclose sufficient assets to satisfy the debt within five days from the date of being notified of the enforcement order.

Forgery of a promissory note also leads to imprisonment if there is a clear intent to commit fraud.

Is the Issuer of a Promissory Note Subject to Imprisonment?

Yes, the issuer of a promissory note may be imprisoned for forgery, and, in cases of failure to pay, they may face imprisonment or other legal measures.

What Are the Fees for a Promissory Note?

The fee for creating a promissory note service is 86.09 Saudi riyals.

How Long Does a Promissory Note Last?

A promissory note may be issued with a specific term or maturity date. Generally, a promissory note is enforceable for up to three years from the maturity date. After this period, the note may lapse and become unenforceable.

What Are the Conditions for Enforcing a Promissory Note?

For a promissory note to meet legal requirements, it must include:

- A clear title stating “Promissory Note”.

- The names and addresses of the creditor and debtor.

- The amount of the note and the maturity date.

- The signatures of both parties.

- Payment terms (lump sum or installments).

- Interest and penalties for delay, if any.

- Guarantees, if any.

- The place of payment (or the place of issuance is deemed the place of payment).

What Are the Conditions for a Promissory Note Without an Amount?

There is no promissory note without an amount, as a promissory note is related to the payment of a specific amount with a defined maturity date.

What Happens When a Promissory Note Is Enforced?

When a promissory note is enforced, it is submitted to the competent court, and a request for an enforcement order is filed, ensuring the fulfillment of financial obligations within a legal framework.

When Does a Promissory Note Become Void?

A promissory note becomes void in cases of forgery, whether total or partial, fraud used to obtain the signature, the absence of consideration, or upon the expiration of the note after three years from the maturity date.

Does a Promissory Note Guarantee My Rights?

Yes, a promissory note guarantees the creditor's financial rights. Through simple, clear procedures, it can be used to secure your rights without resorting to lengthy court proceedings.

What Invalidates a Promissory Note?

A promissory note is invalidated in the following cases:

- Forgery of the signature of either party.

- Proof that it was issued under threat or coercion.

- Loss of legal capacity of one of the parties (such as minors or those lacking mental capacity).

- Missing essential data, such as the absence of a signature, the name of one party, or the maturity date.

How Can a Promissory Note Be Invalidated?

To invalidate a promissory note, the following steps must be taken: filing a lawsuit in the competent court to challenge the note if there is a dispute over its validity, and requesting a technical expert to determine its authenticity.

When Does a Promissory Note Become Invalid?

A promissory note becomes invalid if the signatures of any of the parties are forged, if the signatures were made under threat, if one of the parties is under the legal age, or if essential data is missing from the note.

What Is the Benefit of a Promissory Note?

It serves as a guarantee of the creditor’s financial rights and is considered a binding document obligating the debtor to pay the debt on its due date.

Does a Promissory Note Prevent Exit and Re-Entry?

Yes, a person may be prevented from traveling if they fail to fulfill the financial obligation under a promissory note.

What Is the Validity Period of a Promissory Note?

The validity period of a promissory note is determined by its maturity date. The note becomes unenforceable after three years from the maturity date.

When Does a Promissory Note Expire?

A promissory note expires after four years from the date of issuance if no maturity date is stated, or after three years from the maturity date if one is specified.

When Is a Promissory Note Due?

If a maturity date is stated, it must be adhered to. If no maturity date is mentioned, the note becomes due upon the creditor’s demand.

Does a Promissory Note Result in Suspension of Services?

Yes, failure to pay a promissory note may directly result in the suspension of services by a decision of the competent judicial authority.

Is a Promissory Note Considered an Obligation?

Yes, a promissory note is considered a legal instrument by which the debtor is obligated to pay the amount due to the creditor on the maturity date, ensuring the rights of the contracting parties.

What Is the Duration of a Promissory Note?

A promissory note usually has a maturity date on which the creditor can claim the amount. In some cases, the maturity date is not stated; in such cases, its validity is four years from the date of issuance, one year to maturity, and three years thereafter.

When Is a Promissory Note Canceled?

A promissory note may be canceled by agreement of both parties, the creditor and the debtor, or in cases of forged signatures, signatures made under threat, or failure to meet the essential data requirements of the note.

How Can a Promissory Note Be Canceled?

A promissory note can be canceled through the Najiz electronic portal by:

- First, logging in via the national access system.

- Then selecting “Enforcement Package” and “Request to End Enforcement Request”.

- Then selecting the note to be canceled.

- Then choosing the reason for cancellation and submit supporting documents, if any.

- Finally, submit the request and wait for confirmation.

Does a Promissory Note Affect Financing?

Yes, a debtor’s failure to pay a promissory note may undermine trust when applying for financing from a funding entity.

What Is the Penalty for Forging a Promissory Note?

The law stipulates imprisonment and fines as penalties for forging a promissory note. The prison sentence ranges from one to five years to protect trust in commercial and financial transactions.

Do I Have the Right to Refuse a Promissory Note?

Yes, a person has the right to refuse a promissory note if there is a reason for its invalidity, such as forgery or failure to meet the required data.

What Does It Mean When a Promissory Note Is Closed?

Closing a promissory note means that the creditor no longer has the right to claim it.

How Do I Cancel a Promissory Note After Payment?

You can cancel a promissory note after payment through the Najiz electronic portal by submitting documents proving payment, after which the court issues a legal order canceling the note.