What are Closing Entries in Accounting?

Table of contents:

- What are Closing Entries?

- What are the Objectives of Preparing Closing Entries?

- Types of Closing Entries

- How to Perform Accounting Closing Entries

- Practical Example of Closing Entries

- How is the Annual Closing of the Balance Sheet Done at Year-End, and Which Accounts are Closed?

- The Difference Between Closing Entries and Journal Entries

- Most Common Accounting Errors When Making Closing Entries

- Points to Consider When Preparing Closing Entries

- Frequently Asked Questions About Closing Entries

- How Daftra helps in preparing closing entries automatically

What is meant by the term "closing entries" in the field of accounting, which is an ocean full of various concepts and principles? And how do closing entries in accounting affect the accuracy of financial reports?

The answer lies in the role of annual closing entries, or year-end closings, in understanding and evaluating the financial performance of institutions. Financial reports provide a clear picture of the financial health of organizations. The concept of closing entries arose from the diversity of accounts according to their types.

Among these types, we find a category of accounts called temporary accounts or nominal accounts, which are opened at the beginning of the accounting period and closed at the end.

Therefore, in the lines of this article, we present an explanation of closing entries, mentioning their importance and primary purpose, leading to their types and the method of creating accounting entries from the beginning, with detailed steps, and examples of closing entries.

What are Closing Entries?

Closing entries are defined as an accounting process that occurs at the end of the accounting cycle to record final activities and operations and prepare the company's financial statements. These entries are an important part of the company's comprehensive accounting process, during which financial data is compiled at the end of the accounting period to prepare financial reports.

Closing entries in accounting play a crucial role in ensuring that financial reports are accurate and reliable, contributing to a correct picture of the institution's financial performance and position.

Explanation of Closing Entries

Closing entries are made for temporary accounts, which are income statement accounts such as (revenues, expenses, income summary), so that the accounting entry is written in contrast to the nature of each account; This is done by registering accounts payable to the debtor party, and accounts receivable to the creditor party, after which the balance of the (temporary accounts) in the (income statement) is transferred to the Retained Earnings account (permanent account).

What are the Objectives of Preparing Closing Entries?

There are several objectives for preparing annual closing entries, including the preparation of accurate and comprehensive financial statements, which provide the financial data upon which important future decisions are based. Below we review some of them in detail:

1- Preparing Accurate Financial Statements

One of the most important objectives of preparing closing entries is to prepare accurate financial statements for the company, which include the income statement, balance sheet, profit and loss statement, and cash flow statement, and record final operations and necessary adjustments to ensure the accuracy of these statements and provide a correct picture of the company's financial performance and financial position.

2- Achieving Accounting Obligations

Closing entries help achieve important accounting obligations for the company. When the accounting cycle is closed, the company's accrued liabilities are determined, such as accrued salaries, deferred taxes, and accruals due to suppliers and customers, among others. Then, closing entries are prepared to record these obligations and ensure an accurate representation of them in the financial statements.

Read more about tax restrictions and how they work.

3- Preparing Accounting Records

Learn how accounting closing entries work and how to prepare the company's final accounting records through the following explanation:

- Recording final balances for various accounts.

- Converting temporary balances to permanent accounts.

- In addition to determining the retained earnings balance and transferring it to capital or distributing it to shareholders.

4- Achieving Matching and Consistency

Closing entries help achieve matching and consistency in the company's accounting records. They ensure that all accounting operations and activities are performed correctly according to approved accounting standards, contributing to the prevention of errors or violations in recording financial data.

5- Providing Information for Decision Making

Closing entries also play an important role in providing accurate and reliable information. Through implementing this process correctly and systematically, a comprehensive picture of the company's financial performance is provided. This comprehensive picture helps enhance the transparency and credibility of the company's accounting system, and this information enables stakeholders to analyze results, understand, and evaluate financial performance so they can make appropriate and informed strategic decisions for the benefit of the company.

Types of Closing Entries

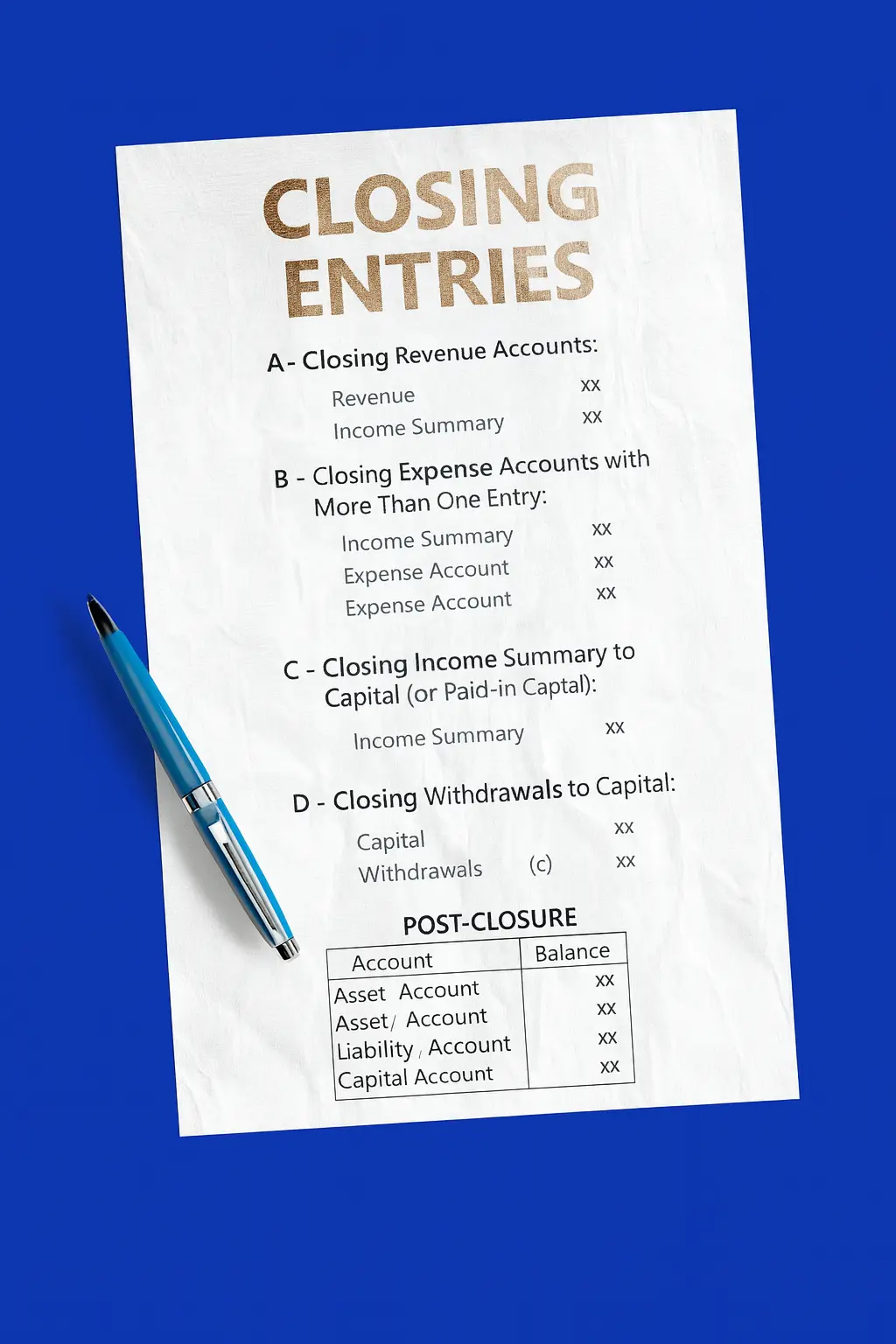

Closing entries consist of four types, all of which are prepared at the end of each accounting period, so that temporary accounts return to their nature and the preparation of records for the next accounting period begins. Below, we will present each of the four types in detail:

1- Closing Revenue Accounts to Income Summary

Through this type of closing entry, debit balances in revenue accounts are transferred to the income summary account, which helps summarize the revenues achieved during the accounting period. Therefore, when the accountant transfers the balance from the temporary account to the permanent account, this helps them execute fewer closing entries. It should be noted that this type of closing entry is used when the company is liquidating its accounts. The form of the revenue entry is as follows:

Dr. Revenue Account Cr. Income Summary Account

2- Closing Expense Accounts to Income Summary

In this type of entry, credit balances in expense accounts are transferred to the income summary account, and expenses incurred during the accounting period, such as rent, interest, and salaries, are summarized. The form of the expense entry upon closing is as follows:

Dr. Income Summary Account Cr. Expense Account

3- Closing Income Summary Account

This type of accounting entry involves transferring the balance from the income summary account to the retained earnings account. Through this process, net income or loss for the accounting period is determined, in addition to updating retained earnings. The form of the income summary account entry upon closing is as follows:

Dr. Income Summary Account Cr. Capital Account

4- Closing Dividends and Owner Withdrawals

In this type of closing entry, the accountant closes dividend accounts to the retained earnings account, where the debit balance in the dividend account is transferred to the retained earnings account. This entry reflects the distribution of profits to shareholders and helps reduce the retained earnings balance, and closes withdrawal accounts belonging to company owners, known as owner drawings, and transfers them to their capital accounts. The form of the entry is as follows:

Dr. Capital Account Cr. Owner Drawings Account

How to Perform Accounting Closing Entries

Accounting closing entries are accounting procedures performed at the end of the accounting period, which is usually annual, with the purpose of closing the accounting cycle and determining the final profits or losses of the company during that period. Therefore, the accountant should understand and execute them accurately to ensure the accuracy of financial reports and compliance with accounting standards. This can be achieved by following organized and precise steps to prepare these entries so that the accountant can complete the accounting closing process and ensure transparency and reliability in the financial information provided about the company. Below are the main organized steps that the accountant needs to perform accounting closing entries:

Step One: Identifying Temporary and Permanent Accounts

Before beginning the accounting closing process, temporary accounts that will be closed must be identified. These accounts include revenue accounts, expense accounts, tax accounts, and interest accounts. After that, the accountant proceeds to identify permanent accounts that will be used to transfer the closed balances, such as the retained earnings account and the profit and loss account. This step is executed as follows:

- Review temporary accounts that need closing.

- Identify permanent accounts that will be used to transfer the closed balances.

Read more about temporary and permanent accounts.

Step Two: Performing Accounting Closing Entries

Each type of account is closed in an organized and different manner as follows:

1- Closing Revenue Accounts

The first step is to transfer credit balances in revenue accounts to the profit and loss account or retained earnings account. This is done by the accountant recording a debit entry for the total amount of revenues in the revenue account and a credit entry for the same amount in the profit and loss account or retained earnings account.

2- Closing Expense Accounts

This step is performed by transferring debit balances in expense accounts to the profit and loss account or retained earnings account. Here, the accountant records a debit entry for the total amount of expenses in the expense account and a credit entry for the same amount in the profit and loss account or retained earnings account.

3- Closing Profit and Loss Account or Retained Earnings Account

When closing these accounts, net income or loss from revenue and expense accounts is transferred to the profit and loss account or retained earnings account. The accountant's role here is to record a credit or debit entry for the amount of net income or loss in the profit and loss account or retained earnings account, depending on whether there is positive or negative net income.

4- Closing Dividends Account

If the company used a dividends account, it records closing entries for this account by recording a credit entry for the net income amount in the retained earnings account and a debit entry for the same amount in the profit and loss account or retained earnings account.

Step Three: Verification and Final Closing of Accounts

After performing the previous steps, the final stage comes, which is ensuring the correctness of the account closings performed by the accountant, through:

1- Verifying Balance Accuracy

It must be ensured that all transferred balances have been recorded correctly and that they accurately reflect the correct results for the accounting period without any errors.

2- Closing the Accounting Cycle

Finally, temporary accounts whose balances have already been transferred to permanent accounts are closed, accounting information for the period is compiled, and final financial reports are prepared.

Practical Example of Closing Entries

If the adjusted trial balance data at the end of the fiscal year 2021/12/31 is as follows:

| Account Name | Debit Balances | Credit Balances |

| Cash | 50,000 | |

| Bank | 130,000 | |

| Accounts Receivable | 35,000 | |

| Computers and Printers | 27,000 | |

| Financial Investments | 30,000 | |

| Investment Income | 3,000 | |

| Accounts Payable | 25,000 | |

| Owner Withdrawals | 11,000 | |

| Notes Payable | 22,000 | |

| Notes Receivable | 60,000 | |

| Capital | 250,000 | |

| Salary Expense | 170,000 | |

| Utilities Expense | 10,000 | |

| Prepaid Rent | 6,000 | |

| Unearned Service Revenue | 24,000 | |

| Office Supplies | 2,000 | |

| Accrued Investment Income | 1,000 | |

| Accrued Salaries Payable | 15,000 | |

| Rent Expense | 12,000 | |

| Office Supplies Expense | 5,000 | |

| Tourism Service Revenue | 210,000 | |

| Depreciation Expense - Computers and Printers | 2,500 | |

| Accumulated Depreciation - Computers and Printers | 2,500 | |

| Total | 551,500 | 551,500 |

The closing entries will be as follows: 1- Revenue Closing Entry

| Debit | Credit | Description | Date |

| 210,000 | Dr. Service Revenue | 2021/12/31 | |

| 3,000 | Dr. Investment Income | ||

| 213,000 | Cr. Income Summary |

2- Expense Closing Entry

| Debit | Credit | Description | Date |

| 199,500 (Total Expenses) | Dr. Income Summary | 2021/12/31 | |

| 170,000 | Cr. Salary Expense | ||

| 12,000 | Cr. Rent Expense | ||

| 5,000 | Cr. Office Supplies Expense | ||

| 2,500 | Cr. Depreciation Expense - Computers and Printers | ||

| 10,000 | Cr. Utilities Expense |

3- Income Summary Closing Entry

| Debit | Credit | Description | Date |

| 13,500 (Net Income or Profit) | Dr. Income Summary | 2021/12/31 | |

| 13,500 | Cr. Capital |

4- Owner Withdrawals Closing Entry

| Debit | Credit | Description | Date |

| 11,000 | Dr. Capital | 2021/12/31 | |

| 11,000 | Cr. Owner Withdrawals |

How is the Annual Closing of the Balance Sheet Done at Year-End, and Which Accounts are Closed?

The annual closing includes several steps to ensure that all transactions for the fiscal year have been recorded correctly, and these steps are as follows:

- Ensuring that all accounts have been adjusted and updated by recording all adjusting entries, such as prepaid expenses, accrued revenues, and accrued expenses.

- Preparing financial statements such as the income statement, statement of financial position, and cash flow statement.

- Closing income statement accounts and profit and loss accounts (revenues and expenses) and transferring them to the income summary account.

- Determining net income or loss and transferring it to the retained earnings account or capital account.

- Updating the balance sheet after making all closing entries to reflect the company's financial position at the end of the fiscal year.

The Difference Between Closing Entries and Journal Entries

In accounting, the terms closing entries and journal entries are used to refer to recording financial operations in companies. Although the general objective of both types is to provide accurate and reliable financial information, there are slight differences between them. Below, we will learn in detail and in an organized manner about the differences between them:

- Journal entries record daily financial operations immediately, while closing entries are made at the end of the accounting period.

- Journal entries help track daily financial operations and prepare periodic financial records, while closing entries aim to prepare final financial reports and record final balances.

- Journal entries focus on the details of financial operations, while closing entries focus on transferring and converting balances from temporary accounts to permanent accounts.

Most Common Accounting Errors When Making Closing Entries

Accountants can improve the accuracy of their financial reports by paying attention to the most common accounting errors that can occur when preparing closing entries. These errors include:

- Failing to record some revenues or expenses affects the accuracy of profit and loss calculations.

- Recording the same entry twice results in errors in transaction figures in financial statements.

- Incorrectly transferring balances from temporary accounts to permanent accounts.

- Not making closing entries at the specified time or recording entries in the wrong accounting period results in financial operation data not matching the appropriate time period, as well as neglecting to update accounts periodically, leading to delays in preparing financial reports.

- Not recording accrued expenses, which are those that have been incurred but not yet paid, affects the accuracy of financial results.

- Not adhering to approved accounting standards and uniform methods when preparing closing entries, such as the depreciation method, the cost method, or applying the matching principle or accounting accrual principle, may lead to errors in financial reports and their inconsistency.

- Neglecting to review entries and recorded operations before final closing, leading to discovering errors too late.

Points to Consider When Preparing Closing Entries

There are some points that should be taken into consideration when preparing closing entries, which contribute to providing a clear picture of a company's financial performance. These points include:

1- Accurate Data Collection

Ensuring identification of all temporary accounts that must be closed as mentioned in the previous lines, then collecting all financial data related to these accounts for the specified accounting period, including invoices, receipts, vouchers, and any other necessary information or documents.

2- Updating Account Balances

Ensuring that permanent account balances are updated correctly after closing temporary accounts, and verifying the recording of all accrued revenues that were not collected by the end of the accounting period, as failure to record them leads to showing profits unrealistically, as well as verifying the recording of accrued expenses that were incurred during the period, even if they have not been paid yet.

3- Review and Documentation

Setting a specific timeline for preparing closing entries to ensure no delay in preparing financial reports, then reviewing entries before finally closing temporary accounts to ensure there are no errors or duplications, and maintaining accurate records of all adjusting entries to ensure transparency and facilitate audit purposes if necessary.

Frequently Asked Questions About Closing Entries

There are many questions that come to mind when searching for closing entries, so we have tried as much as possible to identify the most common questions about closing entries and attempt to answer them.

When are closing entries made?

Closing entries are made at the end of the accounting period for companies, whether this period is monthly, quarterly, or annual. They are used to close temporary accounts and record final balances for permanent accounts, including transferring revenues and expenses to the profit and loss account, converting the profit and loss account balance to retained earnings, and transferring remaining balances to the next accounting period.

What are closing entries in the periodic inventory system?

In the periodic inventory system, there is no need to adjust entries as ending inventory is recognized through closing entries, and there is no tracking of merchandise inventory accounts.

What are closing entries in the perpetual inventory system?

The closing process in the perpetual inventory system is done by entering an adjusting entry to match the merchandise inventory balance recorded in the books with the actual value of the inventory counted in warehouses. Closing entries in the perpetual inventory system include closing revenue accounts, credit balances, and merchandise inventory at the end of the accounting period. This is done by transferring revenue balances from their sub-accounts to the income summary account, and recognizing ending inventory by recording the actual inventory count and determining its value based on estimating the value of existing goods.

What is the profit and loss closing entry?

The profit and loss closing entry is an accounting entry created at the end of the accounting period to record net profit or loss, where the profit and loss account balance is transferred to the retained earnings account, then accumulated for subsequent periods or distributed as dividends to shareholders. It should be noted that closing the profit and loss account represents the end point of the accounting period and the beginning of the next accounting period.

What is the difference between adjusting entries and closing entries?

The main difference between closing entries and adjusting entries lies in the purpose of each. Adjusting entries are used to modify balances in asset, liability, and equity accounts to reflect an accurate picture of the institution's financial position, including operations such as recording depreciation and estimating unpaid expenses, and do not result in zeroing accounts. Closing entries are used to transfer business results from the income statement (profit or loss) to capital accounts or retained earnings to zero accounts and start fresh.

Which accounts appear in the trial balance after closing?

After conducting closing operations, the trial balance shows permanent accounts that contain balances only, such as assets, liabilities, and equity accounts like capital and retained earnings. These accounts are not closed at the end and are continued for the next fiscal year.

What is the relationship between closing entries and inventory adjustments?

The relationship between inventory adjustments and closing entries is one of sequence and integration, where inventory adjustments involve modifications to liability, asset, expense, and revenue account balances to reflect true balances at the end of the financial period, ensuring there are no errors in inventory values or transaction recording. Therefore, inventory adjustments contribute to verifying final balances before making closing entries, reflecting correct and accurate account figures.

Which accounts are closed at the end of the fiscal year?

Accounts that are closed at year-end are revenue accounts, expense accounts, other income accounts, provision accounts, cost of goods sold accounts, and profit and loss accounts.

Who is responsible for making closing entries?

The accounting team collectively prepares closing entries, including collecting data related to financial operations and making inventory adjustments, and then the closing entries are reviewed by the financial manager, auditors, and senior management.

Can closing entries be changed after closing accounts?

Yes, closing entries can be changed after closing accounts, but any modifications or changes must be documented and recorded as new adjusting entries, clarifying reasons for modification, such as discovering errors or inaccurate accounting information, and updating financial reports with changes made to closing entries.

What are closing and opening entries in accounting?

Closing entries are entries that determine final balances for permanent accounts after transferring and closing temporary accounts to prepare financial reports at year-end. Opening entries are entries that record remaining financial balances from the previous fiscal year, such as assets, liabilities, and equity, to begin the new accounting cycle.

What are provision closing entries?

Provision closing entries are entries made at the end of the fiscal year to close accounts for provisions for doubtful debts. Provision closing entries help clarify the financial impact of provisions on profits and losses, ensuring the accuracy of figures in financial reports.

What is the accumulated depreciation of the closing entry?

Accumulated depreciation closing entry is the accounting entry made at the end of the fiscal year to close the accumulated depreciation account for fixed assets. It is used to provide a clear picture of the book value of fixed assets due to depreciation, contributing to accurate financial report preparation.

What is a fixed asset closing entry?

Fixed asset closing entry involves determining the net book value of fixed assets at the end of the accounting period before preparing financial reports.

What is the salary closing entry?

Salary closing entry involves zeroing temporary salary account balances and transferring net salaries to profit and loss accounts.

What is the expense of closing an entry?

Expense closing entry involves closing expense accounts at the end of the accounting period and transferring the balance to the profit and loss account.

What is the net profit closing entry?

Net profit closing entry involves zeroing temporary accounts by closing temporary accounts at the end of the fiscal year and transferring net profit or loss to the profit account.

What are purchase closing entries?

Purchase closing entries involve closing purchase accounts at the end of the fiscal year and transferring balances to the income summary account.

How Daftra helps in preparing closing entries automatically

Closing entries at the end of the accounting period to accurately calculate profits and losses and then prepare financial reports and statements is extremely important, and failure to master it results in significant accounting risks. In Daftra's accounting program, you can determine accounting periods and control the timing of each cycle. You can also view closed accounting periods from the archive where they are stored, allowing greater insight for analyzing your operation periods, in addition to automatic report generation.

Conclusion In conclusion to this article, we can confirm that accounting closing entries are essential in financial accounting. Throughout this article, we have covered everything an accountant might need to know about accounting closing entries, starting with defining them as accounting processes that occur at the end of each period, then mentioning the objectives behind performing them, which focus primarily on closing period accounts and preparing financial reports, while mentioning the importance of these entries in providing a specific framework for recording financial transactions and restricting money movement in companies and institutions, thus enhancing transparency and credibility in reports and reducing opportunities for manipulation and fraud.

From here, after reviewing all details and information about closing entries and a comprehensive understanding of all aspects of this important accounting process, an accountant can execute closing entries in any company professionally, easily, and skillfully.