Debt-to-Equity Ratio and How to Calculate It

Table of contents:

- What Is the Debt-to-Equity Ratio?

- How Does the Debt-to-Equity Ratio Work?

- What Are the Limits of the Debt-to-Equity Ratio?

- How Is the Debt-to-Equity Ratio Classified?

- What Is the Formula for Calculating the Debt-to-Equity Ratio?

- How Is the Debt-to-Equity Ratio Calculated?

- What Is the Importance of Calculating the Debt-to-Equity Ratio?

- Factors Affecting the Debt-to-Equity Ratio

- Difference Between Debt-to-Equity Ratio and Leverage Ratio

- Examples of How to Calculate the Debt-to-Equity Ratio

- How to Read Debt-to-Equity Ratio Indicators?

- What Is Daftra’s Role in Efficiently Managing the Debt-to-Equity Ratio?

- Frequently Asked Questions

Understanding the Debt-to-Equity Ratio is essential for making sound investment decisions, as it helps reveal how debt can affect a company’s financial performance and growth.

So, what is the relationship behind the debt-to-equity ratio? And how do investors and creditors benefit from debt-to-equity indicators?

These questions and more are answered by clearly explaining the importance of this ratio in assessing a company’s financial health, understanding its financing strategies, how to calculate the debt-to-equity ratio, and how to evaluate its results.

This helps business owners identify the optimal limits for the debt-to-equity ratio in a way that ensures a balance between financial risk and profitability returns.

What Is the Debt-to-Equity Ratio?

The Debt-to-Equity Ratio is a financial metric calculated by dividing total liabilities by total equity (or shareholders’ equity). This ratio indicates how much financing a company obtains through borrowing compared to financing through equity.

The debt-to-equity ratio is considered one of the most important indicators that investors and corporate financial management review when making decisions related to offering company shares for public subscription. It helps identify aspects of a company’s financial health and thus contributes to making informed financial and administrative decisions.

How Does the Debt-to-Equity Ratio Work?

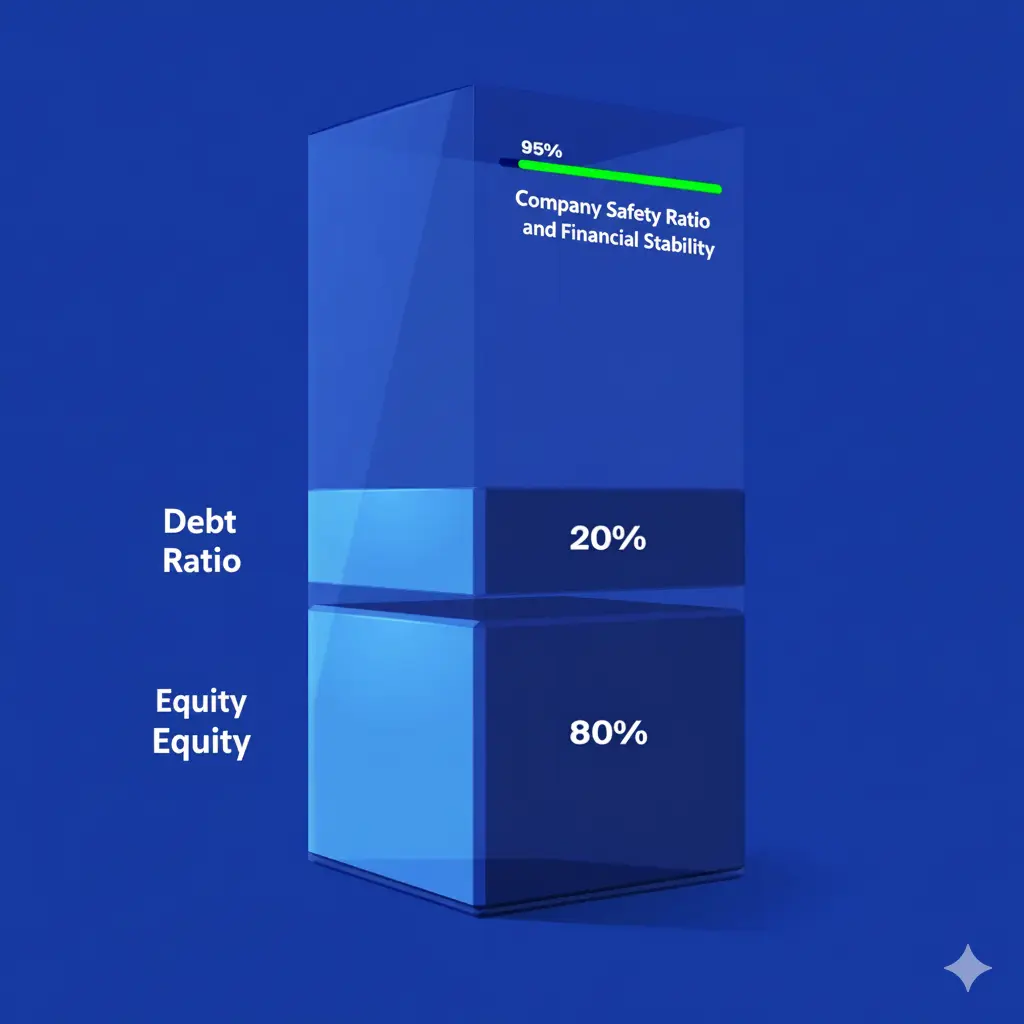

A low debt-to-equity ratio indicates that a company uses a lower level of financial leverage and does not face significant risk from debt. In this case, its debt is lower than its equity, meaning it relies less on borrowing to operate.

On the other hand, companies with a high debt-to-equity ratio have debt levels that exceed their equity. This leads to an important implication: taking on additional debt may pose future risks, as the company may face difficulties at times in meeting all its obligations, especially if its income declines.

However, a high debt-to-equity ratio can also be an advantage if the company successfully uses borrowed funds to expand its business and increase its sources of profit.

You can download a free debt-to-equity ratio calculation template to save time and effort during the calculation process.

What Are the Limits of the Debt-to-Equity Ratio?

There is no single debt-to-equity ratio that all companies must maintain in general. The ideal ratio varies from one company to another due to several factors, most notably differences in industries and business sectors.

For example, a low debt-to-equity ratio is more suitable for companies operating in industries such as energy, technology, retail, and capital goods. On the other hand, a high debt-to-equity ratio may be more appropriate for companies in real estate, utilities, transportation, and healthcare services.

Therefore, each company should compare its own ratio with that of competing companies within the same industry or sector.

How Is the Debt-to-Equity Ratio Classified?

At times, financial analysts may differ in how they classify debt versus equity. For example, preferred shares are classified as equity; however, their dividend distributions and liquidation priority compared to common shareholders make this type of equity closely resemble debt.

As a result, including preferred shares within total debt would increase the debt-to-equity ratio, giving the impression that the company relies more heavily on debt, even if the company’s financial health actually indicates stability.

Consequently, this can affect investors’ assessments of a company’s financial risk and may lead to incorrect conclusions that influence investment and financing decisions.

What Is the Formula for Calculating the Debt-to-Equity Ratio?

The debt-to-equity ratio is calculated using a simple and easy-to-apply formula: Debt-to-Equity Ratio = Total Liabilities ÷ Shareholders’ Equity

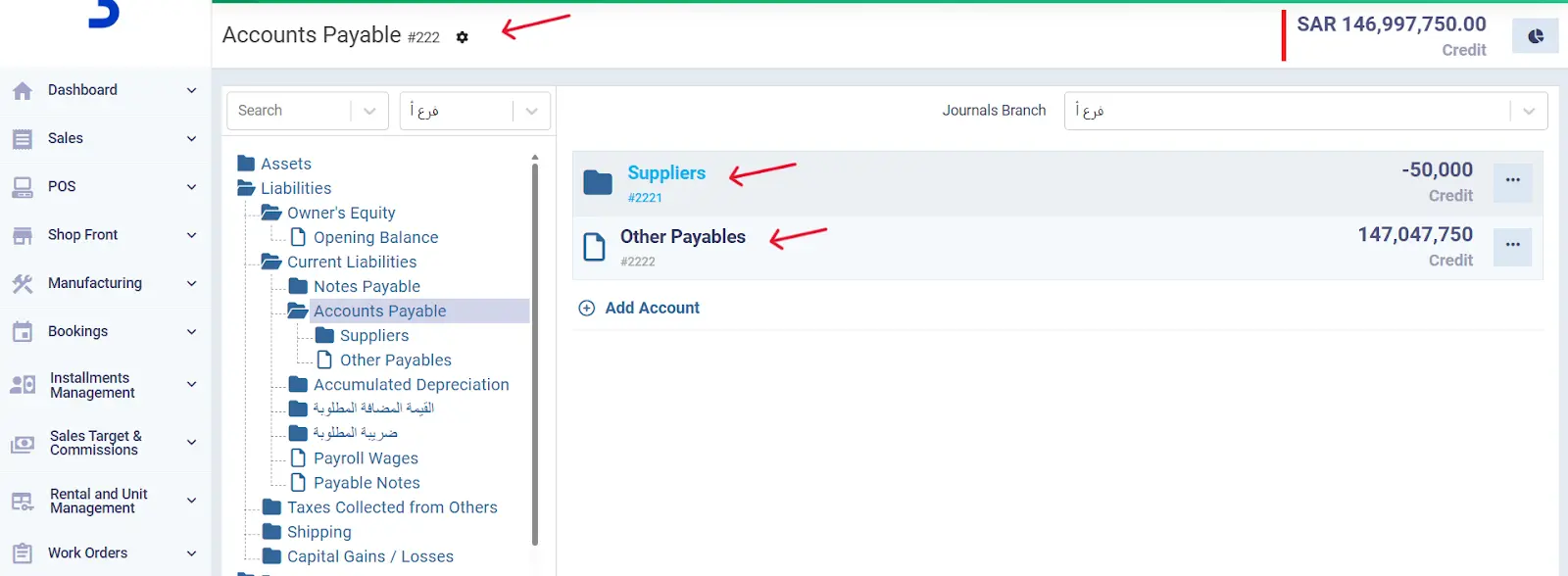

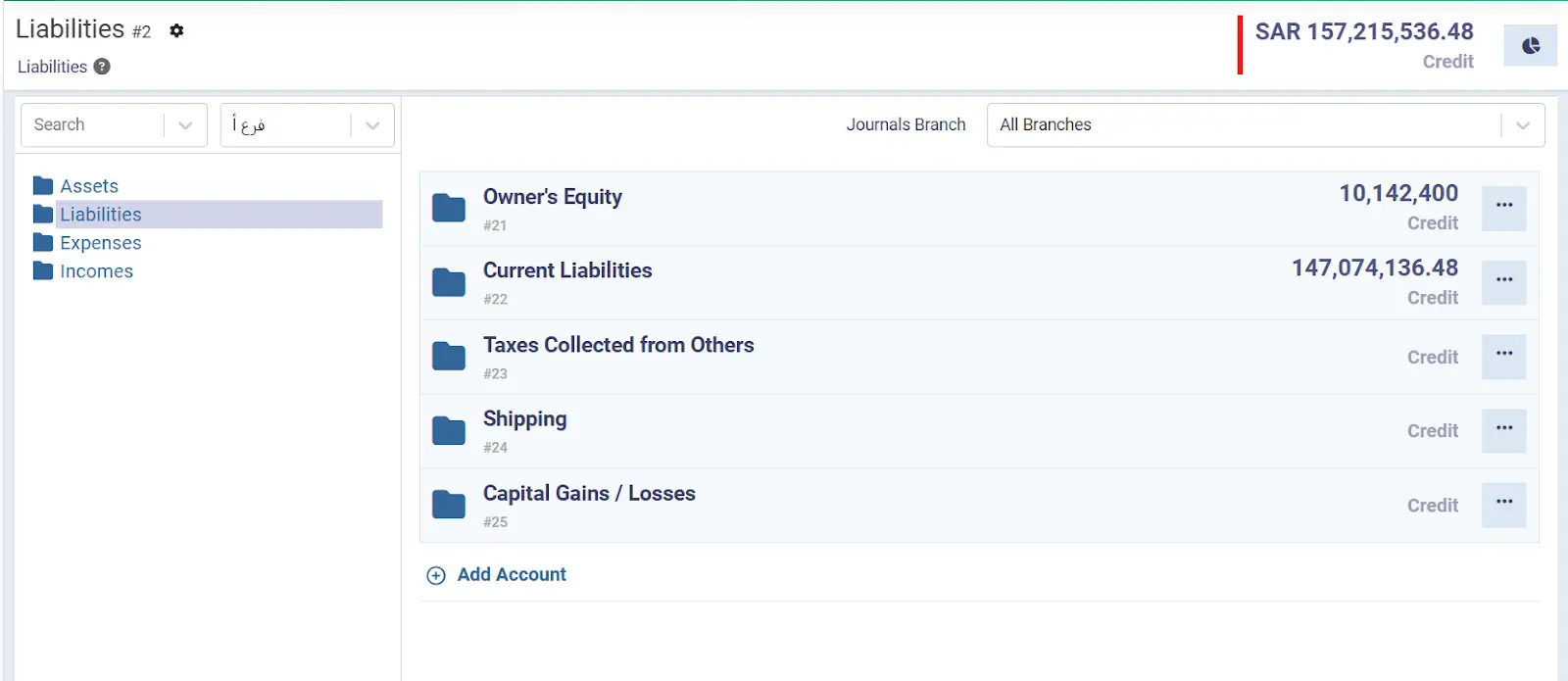

Alternatively, you can rely on Daftra to calculate the debt-to-equity ratio by gathering the required data from the balance sheet, including total short-term and long-term liabilities, equity, capital, retained earnings, and reserves.

Instead of manually identifying the accounts related to calculating the debt-to-equity ratio, you can leave it to the Daftra accounting system, which automatically accesses the chart of accounts, balance sheet, financial reports, and financial analysis tools to accurately determine the final result.

How Is the Debt-to-Equity Ratio Calculated?

There are some important organizational steps that should be followed to ensure the most accurate possible result when calculating the debt-to-equity ratio. These steps include the following:

1- Identify Financial Liabilities

This step involves gathering all of the company’s liabilities and debts, whether short-term or long-term. You can easily obtain this information from your company’s balance sheet, and it is essential not to overlook any figures during this process.

2- Determine Shareholders’ Equity

Shareholders’ equity represents everything remaining from the company’s assets after the financial management deducts the liabilities, as explained in the previous step. Shareholders’ equity includes common stock, retained earnings, and additional paid-in capital. You can also find this data easily from the company’s balance sheet.

3- Calculate the Debt-to-Equity Ratio

Now, after gathering the total liabilities and understanding the shareholders’ equity, you can calculate the ratio using the formula mentioned earlier. This will give you a numerical result, which you can multiply by 100 if you want to convert it into a percentage, accurately representing the company’s debt-to-equity ratio.

In short, you can perform all these steps in one go using the Daftra system, which automatically collects the necessary data from linked programs and calculates the debt-to-equity ratio accurately, helping to avoid common errors.

What Is the Importance of Calculating the Debt-to-Equity Ratio?

Measuring the debt-to-equity ratio plays a crucial role in a company’s financial management for investors, economic entities, financial analysts, and others. The importance of calculating the debt-to-equity ratio includes the following:

1- Indicator of the Company’s Financial Position

The debt-to-equity ratio reflects the amount of debt a company carries for every unit of shareholders’ equity and shows the company’s ability to meet its obligations on time based on its equity funds.

If the debt-to-equity ratio is less than 1, it indicates that the company relies more on its own capital than on borrowing.

If the ratio is greater than 1, it suggests that the company relies more heavily on debt.

2- Analyzing Capital Structure

Many companies set specific strategies to achieve a target capital structure that balances debt and equity. By monitoring the debt-to-equity ratio over a long period, the company can analyze its progress toward this goal and determine what financial management strategies are needed in the future.

3- Investment Research Indicator

The movements in stock prices and debt levels can reflect changes in a company’s share price, especially when the market values of equity and debt are used in the debt-to-equity ratio calculation. This can serve as a starting point to determine whether the company’s securities, stocks, or bonds are suitable for inclusion in an investment portfolio.

Factors Affecting the Debt-to-Equity Ratio

The debt-to-equity ratio is influenced by several factors that must be well understood when analyzing a company’s financial structure, helping assess how much the company relies on debt to fund its operations:

- The ratio of self-financing versus external financing through borrowing or shareholder contributions.

- The company’s profits and sales performance.

- Interest rates can increase the cost of debt.

- Growth and expansion strategies, as companies targeting rapid growth require more external financing, increasing the debt-to-equity ratio.

- Company policies for managing potential risks associated with higher debt levels.

Difference Between Debt-to-Equity Ratio and Leverage Ratio

The concept of the debt-to-equity ratio is considered part of the broader leverage ratio, to the extent that many people and entities may confuse the two terms. The leverage ratio refers to a company’s financial leverage.

Fundamentally, the distinction between the two concepts is as follows: leverage refers to the amount of debt a company borrows for investment purposes to achieve higher returns, while leverage ratio (or indebtedness) refers to debt in relation to total equity, expressing the proportion of a company’s financing obtained through borrowing.

In clearer terms, leverage focuses on the use of debt, whereas the leverage ratio is a type of financial analysis that includes the owner’s equity and is expressed as a ratio in the company’s financial analysis. Company size is often taken into account by financial analysts and investors when evaluating leverage.

Larger, more stable companies can manage higher debt levels without risk of default, while smaller companies with a shorter track record of experience and success face greater risks when taking on high levels of debt.

Examples of How to Calculate the Debt-to-Equity Ratio

To help you better understand the debt-to-equity ratio, here are two illustrative examples: the first represents a positive or acceptable ratio, and the second shows a high ratio that indicates potential risk if the company takes on more debt.

Example 1:

Suppose there is a clothing manufacturing company seeking financing to open a new factory to help expand its operations. The financing party would, of course, request the company’s balance sheet to calculate the debt-to-equity ratio before deciding whether to grant the loan.

If the company’s shareholders’ equity is 100,000 USD and the total debt and liabilities required from the company are about 80,000 USD,

Debt-to-Equity Ratio = Total Liabilities ÷ Shareholders’ Equity

80,000÷100,000=0.8

Based on this result, the lender may approve granting the company the loan it needs, as the debt-to-equity ratio is less than 1, meaning the company is capable of repaying the loan even if it experiences a period of declining sales.

Example 2:

Suppose a large company is seeking to attract more investors to increase its market share. To achieve this, the company’s financial management calculates its debt-to-equity ratio to help investors make informed decisions.

If the company’s equity is 1,250,000 USD and its liabilities are 2,500,000 USD,

Debt-to-Equity Ratio = Total Liabilities ÷ Shareholders’ Equity

2,500,000÷1,250,000=2 This result indicates that the company is borrowing twice the amount of its equity, making investment in it risky.

Consequently, investors may look for another company to invest in, one with a stronger financial position than this company.

How to Read Debt-to-Equity Ratio Indicators?

When reading debt-to-equity ratio indicators, this reading should be done through a comprehensive comparison that includes several aspects:

1- Time Comparison

Compare the company’s debt-to-equity ratio over different periods. An increasing reliance on debt over multiple periods requires analyzing the reasons for this increase, such as financing new projects.

2- Comparison with Competitors

Reading debt-to-equity ratio indicators requires comparison with competitors in the same industry, which provides a better view of the company’s financial position and performance, and realistically reflects its competitive standing in the market.

3- Comparison with Other Indicators

The debt-to-equity ratio should be read in conjunction with other financial indicators, such as Return on Assets (ROA) and Return on Equity (ROE), to assess the company’s financial health and its ability to manage and allocate assets while generating profit and meeting its obligations on time.

What Is Daftra’s Role in Efficiently Managing the Debt-to-Equity Ratio?

The Daftra Chart of Accounts system helps you manage all transactions recorded in the chart of accounts. With the smart solutions provided by the Daftra cloud system, you can track total revenues, expenses, asset and liability amounts, and generate detailed profit reports.

This helps manage the debt-to-equity ratio in a balanced way that supports growth and expansion, enhances financial health, and strengthens the company’s competitive position.

Frequently Asked Questions

What Are the Disadvantages of the Debt-to-Equity Ratio?

Relying solely on the debt-to-equity ratio can lead to inaccurate results regarding company evaluations. The main disadvantages or drawbacks of the debt-to-equity ratio include:

- The ideal debt-to-equity ratios vary across industries; a high ratio may be acceptable in some sectors but unacceptable and raise financial risk concerns in others.

- The debt-to-equity ratio does not take economic variables into account, such as recession or economic growth, which may affect the company’s ability to repay its debts.

- Focusing on reducing the debt-to-equity ratio may sometimes lead to missed investment opportunities necessary for growth, negatively affecting future performance and the company’s competitive position in the market.

What Does a Negative Debt-to-Equity Ratio Indicate?

A negative debt-to-equity ratio generally indicates that the company is facing serious financial problems and has weak financial stability. A negative ratio occurs when the total value of the company’s assets is less than the total amount of debts and other liabilities.

This ratio points to ineffective management strategies that rely on borrowing large amounts without generating sufficient returns to cover interest payments and repay debts.

Is the Debt Ratio the Same as the Equity Ratio?

The debt ratio is not the same as the equity ratio. The debt ratio is a percentage compared to the company’s equity.

Is the Debt-to-Equity Ratio a Liquidity Ratio?

The debt-to-equity ratio is not a liquidity ratio. Liquidity ratios assess the company’s ability to repay debts, while the debt-to-equity ratio measures the company’s reliance on debt to finance its operations.

What Is a Good Debt-to-Equity Ratio for a Bank?

A good debt-to-equity ratio for a bank is less than 1 or 100%. This indicates that the company relies more on equity to finance its operations than on debt.

What If the Debt-to-Equity Ratio Is Less Than 1?

If the debt-to-equity ratio is less than 1, this is a good sign as it indicates that the company relies on equity to finance its assets and operations rather than depending on debt.

Is a Debt-to-Equity Ratio of 0.75 Good?

Yes, a debt-to-equity ratio of 0.75 is good because it is less than 1.

Is a Debt-to-Equity Ratio of 0.8 Good?

Yes, a debt-to-equity ratio of 0.8 is good because it is less than 1.

Is a Debt-to-Equity Ratio of 2.5 Good?

No, a debt-to-equity ratio of 2.5 is very high and indicates that the company relies heavily on debt to finance its assets and investments.

Why Is the Ideal Debt-to-Equity Ratio 2:1?

A 2:1 ratio means that the company has debt equal to twice the value of its equity. This ratio is considered ideal because it balances risk while maintaining the ability to finance various operations.

Is the Debt-to-Equity Ratio a Solvency Ratio or a Profitability Ratio?

The debt-to-equity ratio is a solvency ratio, not a profitability ratio. Profitability ratios measure a company’s ability to generate profit and are not related to debt.

What Is Another Name for the Debt-to-Equity Ratio?

The debt-to-equity ratio is also called the leverage ratio, debt ratio, or debt-to-capital ratio.

Is the Debt-to-Equity Ratio Book Value or Market Value?

The debt-to-equity ratio can use book value when calculating total debts and shareholders’ equity, and market value when considering the company’s publicly traded shares.

Is a Debt-to-Equity Ratio of 0.5 Good?

Yes, a debt-to-equity ratio of 0.5 is good, as any ratio below 1 is considered favorable.

What Does a Debt-to-Equity Ratio of 0.4 Mean?

A debt-to-equity ratio of 0.4 means the company has less financing from debt compared to its equity or shareholders’ equity.

What Is a Good Personal Debt-to-Equity Ratio?

A personal debt-to-equity ratio below 1 is considered good, indicating that an individual’s debt is less than their equity balance.

What If the Debt-to-Equity Ratio Is Extremely Low?

If the debt-to-equity ratio is extremely low, this indicates two possibilities: either the company relies heavily on equity to finance its operations and investments, or it may suggest that the company is not using its assets efficiently.

What Is the Formula to Test the Debt-to-Equity Ratio?

Use the following formula to calculate the debt-to-equity ratio: Debt-to-Equity Ratio = Total Debt ÷ Equity

In conclusion, measuring the debt-to-equity ratio is highly important for various economic institutions. It helps in making informed borrowing and investment decisions to avoid potential financial risks.

You can also rely on Daftra accounting software to calculate the debt-to-equity ratio through smart solutions that manage accounts and financial ratios automatically, in addition to providing detailed financial reports to help manage the company’s performance more efficiently.