Cost Accounting Entries and How to Prepare Them

Table of contents:

- What are Cost Accounting Entries?

- What are the Accounting Treatments for the Production Process Costing software?

- Accounting Entries for Job Order Costing software

- Accounting Treatment of Material Movement

- Recording the Value of Damaged or Lost Materials

- Accounting Treatment of Labor Costs (Wages)

- Accounting Treatment of Other Additional Expenses and Services

- Accounting Treatment of Indirect Manufacturing Costs

- What is Flexible Cost Accounting?

- Frequently Asked Questions

In manufacturing environments, cost accounting entries are vital for recording all expenses incurred to bring the product to completion. Cost accounting entries for production costs form the cornerstone of an industrial organization's cost software. They serve as a special language that translates production operations into precise financial figures. But have you ever wondered what valuable and important information these entries hide? Industrial cost accounting entries help record the actual costs of production by allocating direct expenses to produced units. This allows companies to properly evaluate inventory and cost of goods sold. The main purposes of cost accounting entries are:

- Accurately tracking costs of raw materials, labor, and overhead expenses related to production

- Assigning costs to produced units and recording them during work in process and finished goods inventory

- Identifying any variances or waste involved in production

- Calculating the total cost of goods sold when selling inventory

- Determining the actual profitability of produced goods or services

This article will explain cost accounting entries and the accounting treatment of cost elements, and how to record them in industrial project books. The accounting treatment differs according to the cost software used to measure production costs, as there are two cost software: the job order costing software and the process costing software.

Key Points:

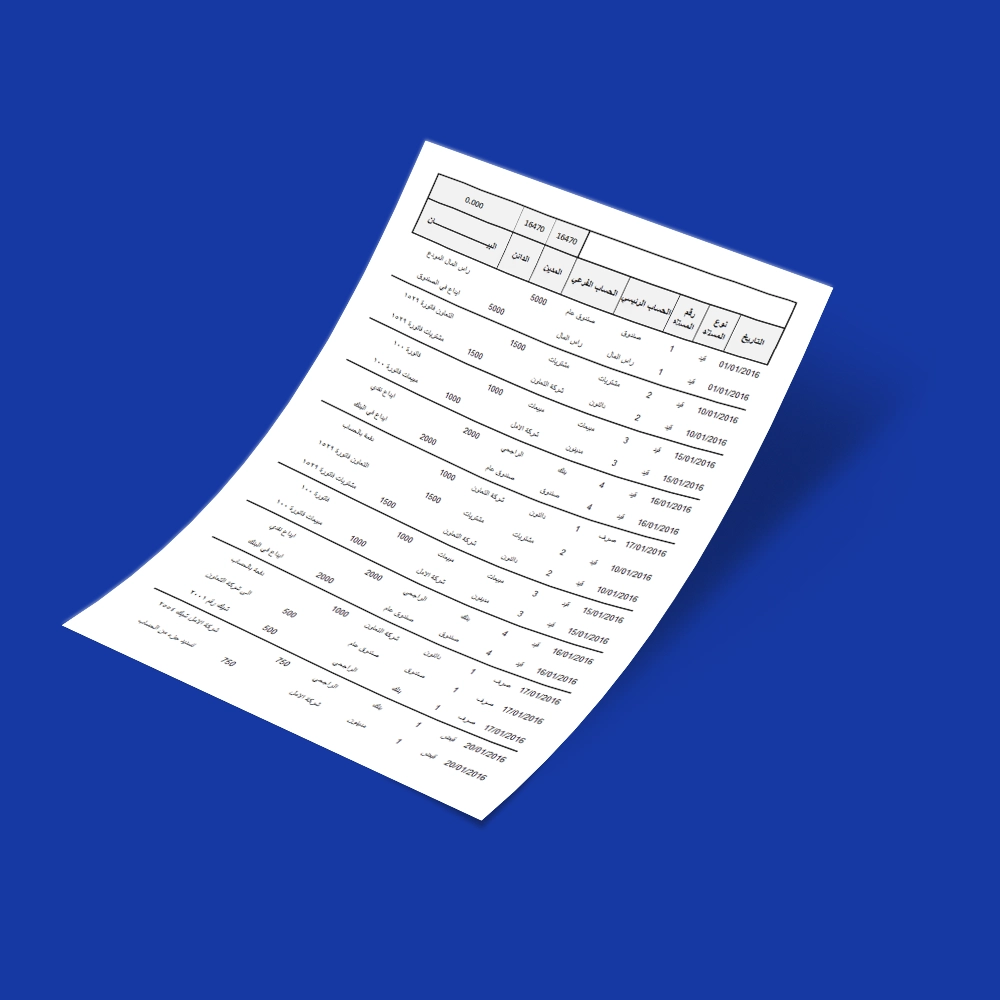

|

What are Cost Accounting Entries?

Cost accounting entries are the process of tracking and analyzing project costs while identifying which accounts are debited and credited. They also help in making smart decisions about resource allocation, budgeting, and pricing strategies to be used. Additionally, these entries make everything clear and allow business owners to easily see where money is going and ensure that everything follows financial regulations.

Cost accounting entries are divided into:

- Production process costing software entries

- Job order costing software entries

What are the Accounting Treatments for the Production Process Costing software?

The accounting treatments for the production process costing software involve processing stages related to homogeneous or similar products, dividing all costs by the number of units to arrive at the cost per unit. Indirect costs are also allocated to unit costs. Products go through stages depending on the type of industry - for example, shoe manufacturing goes through more stages than textile spinning and weaving. These stages are limited to the following:

Sequential Stages in One Line:

These are independent stages not linked to any previous or subsequent activities. Each stage has its own entries, with transitional entries between each stage.

Parallel Stages:

Production is divided into multiple parts or stages that then converge to form the final product. The product cannot be completed without any of the parts, as they are all interconnected, or it's possible that not all parts converge, but the second stage cannot be completed without the first stage, as in shoe manufacturing.

Integrated Stages:

More than one product shares the same stage or different stages, and a product's role may end at another stage without appearing, such as in the pharmaceutical and chemical industries.

Recording entries for the production process costing software includes the following:

- Direct raw material costs

- Direct labor costs

- Manufacturing overhead costs

- Transfer between stages

- Recording finished production

- Cost of goods sold

Direct Raw Material Costs Entry:

This entry is used to record all costs related to raw materials used in each production stage. It includes recording quantities consumed of each raw material, plus the unit price for each material.

| Description | Debit | Credit |

| Work in Process - Stage (1) | xxxx | |

| Work in Process - Stage (2) | xxxx | |

| To: Raw Materials Inventory | xxxx |

Direct Labor Costs Entry:

This entry is used to record direct labor costs used in each production stage. It includes recording work hours for each direct worker in each stage, plus the wage rate per hour.

| Description | Debit | Credit |

| Work in Process - Stage (1) | xxxx | |

| Work in Process - Stage (2) | xxxx | |

| To: Wages Payable | xxxx |

Manufacturing Overhead Costs Entry:

This entry is used to record any other direct costs related to each production stage, such as energy or maintenance costs. It includes recording quantities consumed of services or other direct resources, plus determining the unit price for each. Example: In a food factory, electricity costs used in the packaging stage can be recorded, plus periodic maintenance costs for equipment.

| Description | Debit | Credit |

| Work in Process - Stage (1) | xxxx | |

| Work in Process - Stage (2) | xxxx | |

| To: Applied Manufacturing Overhead | xxxx |

Transfer Between Stages Entry:

A production stage ends, but the final product has multiple stages, moving from one production stage to another, like packaging, so the product's transition from stage to stage must be recorded in a specific entry.

| Description | Debit | Credit |

| Work in Process - Stage (2) | xxxx | |

| To: Work in Process - Stage (1) | xxxx |

Finished Production Entry:

This is the final stage where the final product appears and establishes the completion of the manufacturing process and readiness for sale.

| Description | Debit | Credit |

| Finished Goods Inventory | xxxx | |

| To: Work in Process - Stage (2) | xxxx |

Cost of Goods Sold Entry:

This is an accounting procedure performed at the end of the production process to record the cost of manufactured goods that have been sold. This entry aims to determine the cost of goods sold and record it in the accounting records.

| Description | Debit | Credit |

| Cost of Goods Sold | xxxx | |

| To: Finished Goods Inventory | xxxx |

Accounting Entries for Job Order Costing software

A production order, also known as a work order, is an order issued by the company's production department to produce a specified quantity of a product with predetermined specifications. This software is characterized by being used to accurately measure the cost of producing each unit of the product, due to the variety in product specifications, quantities, and costs among different production orders

The job order costing software allows tracking of all direct and indirect costs associated with producing each unit of the product, leading to a highly accurate determination of actual manufacturing costs and identification of the most expensive elements. This enables management to make strategic decisions to reduce costs and improve profitability. The types of entries and accounting treatments in the job order software are divided into several types as follows:

- Material entries

- Labor entries

- Other additional expenses and services entries

- Indirect manufacturing cost entries

Read also: Cost-Benefit Analysis and How to Perform It.

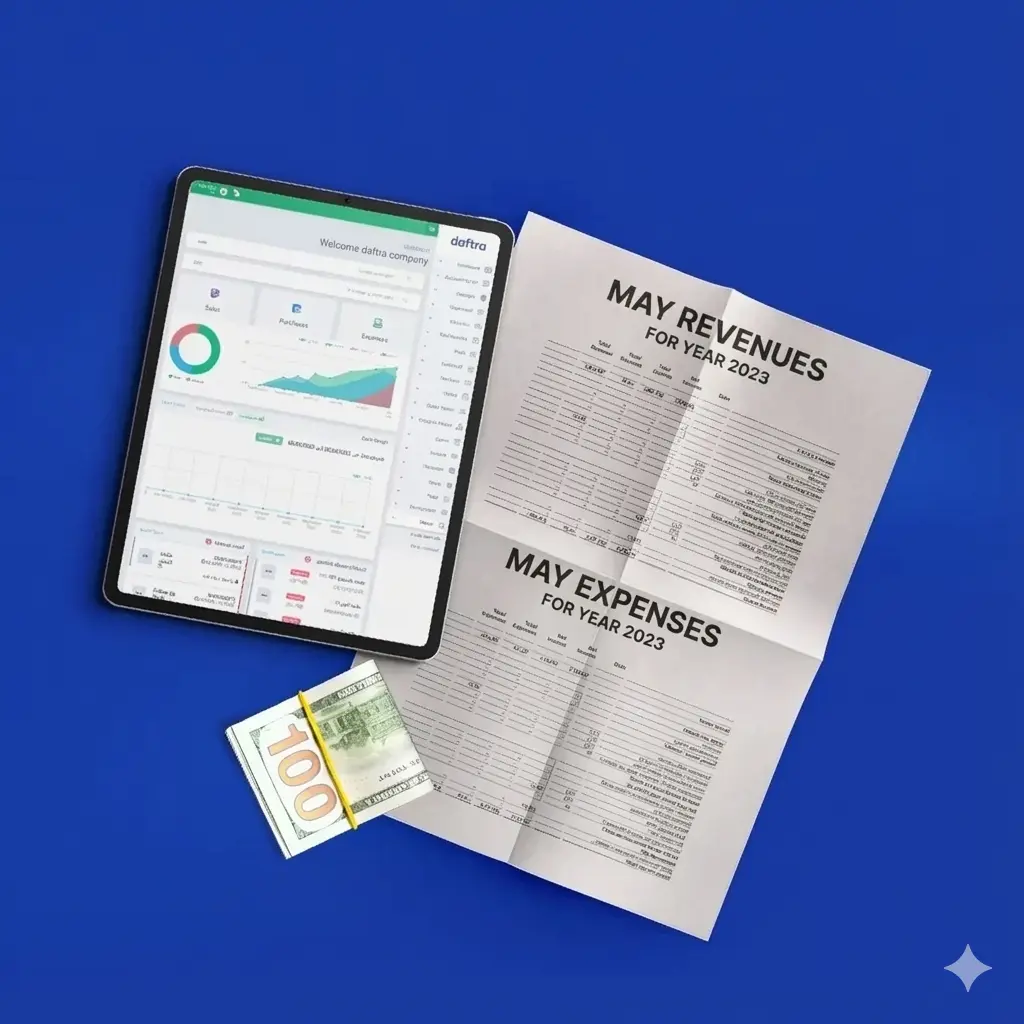

Daftra software offers you an integrated expense calculation and tracking program for companies to record, track, and categorize costs, as well as link them to cost centers and other primary and secondary operations.

Accounting Treatment of Material Movement

Accounting treatment of material movement refers to the process of recording and tracking the movement of raw materials and manufactured materials from the moment of receipt from suppliers to their consumption in the production process or sale of the final product to customers. This process aims to provide accurate information about production costs, inventory, and profits, helping make informed management decisions. It is divided into several entries as follows:

Material Purchase Entries

Material cost represents all direct and indirect costs incurred by the company to obtain raw or manufactured materials from suppliers until they reach the factory warehouses.

| Description | Debit | Credit |

| Materials Control | xxxx | |

| To: Cash | xxxx |

Material Issuance Entries

Materials issued from warehouses are divided into direct and indirect materials. If the issued materials are direct materials, meaning they were issued directly for production or the production order, then they are charged and transferred to the work-in-process account.

Direct Material Issuance Entry for Production:

Direct materials represent the basic components used directly in manufacturing products. Therefore, entries for recording the issuance of these materials from warehouses are a fundamental accounting process in manufacturing companies.

When issuing direct materials from warehouses, the following accounting entry is used:

| Description | Debit | Credit |

| Work in Process Control | xxxx | |

| To: Materials Control | xxxx |

Indirect Material Issuance Entry for Production

The indirect material issuance entry is a temporary account in the cost accounting software used to record the cost of indirect materials used in the production process during a specified time period (usually a month or year). This account is used to accumulate indirect material costs before distributing them to production units or final products.

When issuing indirect materials from warehouses, the following accounting entry is used:

| Description | Debit | Credit |

| Manufacturing Overhead Control | xxxx | |

| Selling and Marketing Expenses | xxxx | |

| Administrative and General Expenses | xxxx | |

| To: Materials Control | xxxx |

Material Return Entries to Warehouses

Material return to warehouses is the process of returning unused or excess materials from the point of use (such as a production site or construction site) to the central inventory. This process is used to ensure effective inventory management and reduce costs and waste.

When returning direct and indirect materials to warehouses, the following accounting entry is used:

| Description | Debit | Credit |

| Materials Control | xxxx | |

| To: Work in Process Control (direct materials) | xxxx | |

| To: Manufacturing Overhead Control | xxxx | |

| To: Indirect Marketing Returns | xxxx | |

| To: Indirect Administrative Returns | xxxx |

Material Transfer Entries Between Production Centers:

Material transfer between production centers is the process of moving raw materials or semi-finished materials from one production center to another within the same facility or from one production stage to another production stage. This process is used to link different production stages and provide the necessary materials for each stage at the appropriate time.

Direct Material Transfer Entry for Production

Transferring direct materials from production order #1 to production order #2

| Description | Debit | Credit |

| Work in Process Control (transferred to) | xxxx | |

| To: Work in Process Control (transferred from) | xxxx |

Indirect Material Transfer Entry for Production

Transferring indirect materials from production order #1 to production order #2

| Description | Debit | Credit |

| Manufacturing Overhead Control (transferred to) | xxxx | |

| To: Manufacturing Overhead Control (transferred from) | xxxx |

Recording the Value of Damaged or Lost Materials

Recording the value of damaged or lost materials is an accounting process used to record losses incurred by the entity due to damage or loss of raw materials, work in process, or finished products. This recording helps determine the cost of these losses and their impact on the entity's profits, and is an essential part of the internal control software in any organization. The types of entries for damaged or lost materials depend on the nature of the damage to the materials, responsibility for this damage, and the possibility of recovering the value of the materials. In general, entries for damaged or lost materials can be classified into the following types:

- Entry for natural spoilage - unsold

- Entry for natural spoilage - sold

- Entry for abnormal spoilage - sold

- Entry for abnormal spoilage - unsold

- Entry for Natural Spoilage - Unsold

Entry for Natural Spoilage - Unsold

This is spoilage that occurs to materials due to natural factors beyond the entity's control, such as storage conditions or passage of time, and occurs before selling them to customers, as follows:

| Description | Debit | Credit |

| Direct Materials - Natural Spoilage | XXXXX | |

| Indirect Materials - Natural Spoilage | XXXXX | |

| To: Natural Spoilage | XXXXX |

Entry for Natural Spoilage - Sold

This is spoilage that occurs to materials due to natural factors beyond the entity's control, but after selling them to customers, yet before delivering them or after delivery as returns, as follows:

| Description | Debit | Credit |

| Direct Materials - Natural Spoilage | XXXXX | |

| Indirect Materials - Natural Spoilage | XXXXX | |

| Cash | XXXXX | |

| To: Inventory Control | XXXXX |

Entry for Abnormal Spoilage - Sold

This entry is used to record losses incurred by the entity due to damage or loss of materials caused by employee negligence, misuse, or accidents, but sold at a cost lower than its original cost, as follows:

| Description | Debit | Credit |

| Responsible Individual A/c or Profit & Loss | XXXXX | |

| Cash | XXXXX | |

| To: Inventory Control | XXXXX |

Entry for Abnormal Spoilage - Unsold

When spoilage is due to negligence, the problem is solved in two ways: either responsibility is assigned to the warehouse keeper, or no one is held responsible, and it is charged to the profit and loss account as a loss, as follows:

| Description | Debit | Credit |

| Warehouse Keeper A/c | XXXXX | |

| Profit & Loss (when no one is held responsible) | XXXXX | |

| To: Abnormal Spoilage | XXXXX |

Accounting Treatment of Labor Costs (Wages)

Labor cost (wages) is one of the most important elements of production costs and includes all amounts paid by the entity to its employees for their work, including basic salaries, allowances, bonuses, social security contributions, health insurance, sick leave, vacation leave, and other benefits. Wages are divided into two types: direct wages and indirect wages.

It is divided into the following entries:

Wage Accrual Entry:

The wage accrual entry is an accounting process used to record salaries and wages due to employees at the end of each time period (usually a month or week). This entry helps match employee-related costs with revenues earned in the same period and is an essential part of the accounting software in any organization.

| Description | Debit | Credit |

| Wages Expense | xxxx | |

| To: Deductions | xxxx | |

| To: Wages Payable | xxxx |

Recording Wages Paid

This entry is used to record the value of salaries and wages paid to employees after they are due and not at the end of the time period, before payment. Employee compensation is calculated based on the quantity of production they achieve, regardless of the number of working hours spent, or the worker's wage is calculated based on the number of working hours spent, regardless of production quantity. It is divided into direct wages and indirect wages.

| Description | Debit | Credit |

| Work in Process Control (direct expenses) | xxxx | |

| Production Wages Control | xxxx | |

| Marketing Wages Control | xxxx | |

| Administrative Wages Control | xxxx | |

| To: Wages Control | xxxx |

Production entries are divided into other specific entries as follows:

| Description | Debit | Credit |

| Work in Process (direct) | xxxx | |

| Manufacturing Overhead | xxxx | |

| To: Wages Control | xxxx |

Daftra accounting software provides you with programs and tools that help you manage wages and salaries, such as the monthly salary calculation program for employees.

Accounting Treatment of Other Additional Expenses and Services

The accounting treatment of expenses refers to those expenditures that benefit several departments or production units in the entity during the accounting period, rather than being associated with a specific production activity. Therefore, these expenses cannot be charged entirely to production costs for one production line or specific unit, and are as follows:

Entry for Recording Payment of Expenses:

When recording payment of expenses, the following accounting entry is used:

| Description | Debit | Credit |

| Additional Expenses Control | xxxx | |

| To: Cash | xxxx |

Entry for Allocating Expenses to Different Project Activities:

The process of allocating expenses to different project activities is a fundamental step in project cost analysis and budget management. This process aims to assign project expenses to different activities that contributed to resource consumption, as follows:

| Description | Debit | Credit |

| Work in Process Control (direct expenses) | xxxx | |

| Indirect Manufacturing Expenses | xxxx | |

| Indirect Marketing Expenses | xxxx | |

| Indirect Administrative Expenses | xxxx | |

| To: Additional Expenses Control | xxxx |

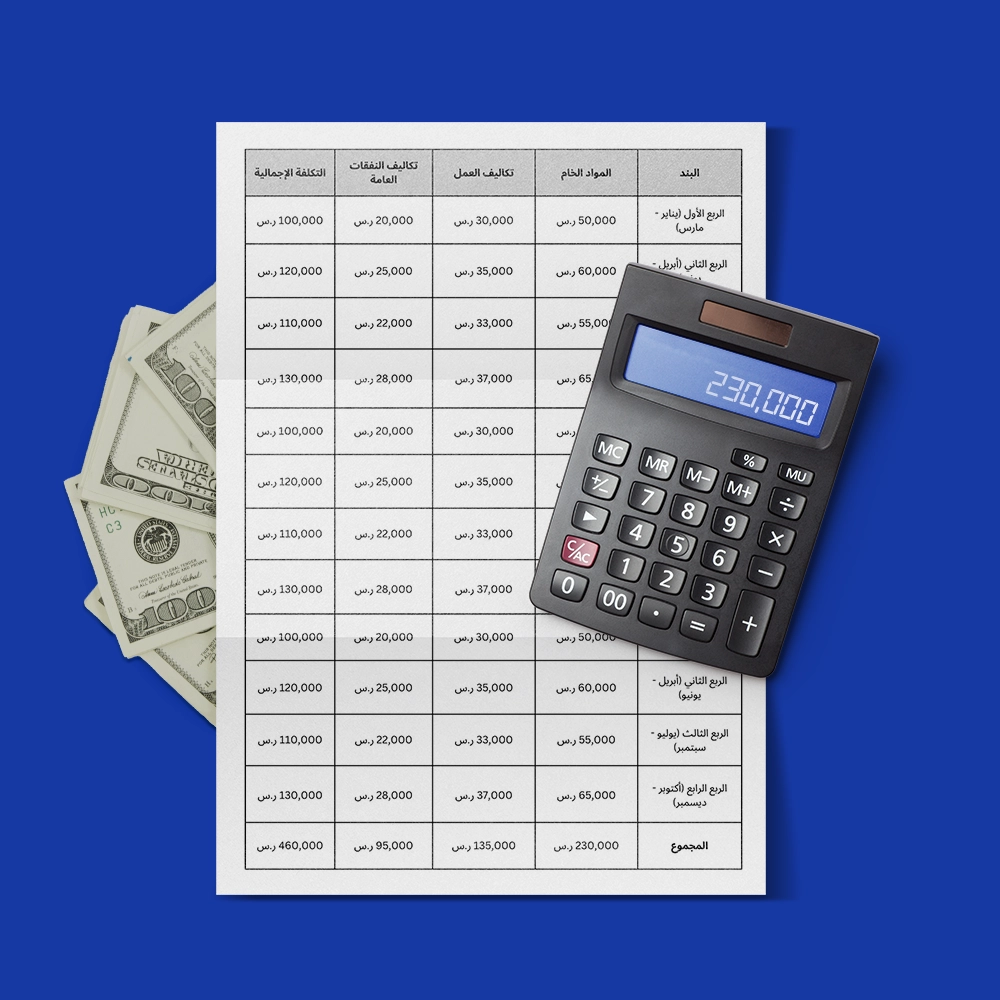

Instead of calculating project expenses manually, Daftra's website provides you with a free template that helps business owners and accountants calculate project costs through a downloadable and editable project cost calculation template with one click.

Accounting Treatment of Indirect Manufacturing Costs

After charging indirect manufacturing costs such as materials, wages, and other expenses, they are distributed to products or work orders. Each product or work order bears a portion of these actual costs. However, sometimes companies need to know production costs before the end of the fiscal year or even before starting production. In this case, indirect manufacturing costs are estimated using allocation rates such as production quantity or direct labor hours. Then, at the end of the fiscal year, variances between actual and estimated costs are reconciled through the following entries:

Recorded Cost Accounting Entries:

An entry is created to charge estimated indirect manufacturing costs to work-in-progress activities. After that, a closing entry is created specifically for the estimated indirect manufacturing costs account as part of the indirect manufacturing costs control account.

Entry for Charging Work in Process with Applied Manufacturing Overhead

This entry is recorded to charge estimated indirect manufacturing costs to work in process.

| Description | Debit | Credit |

| Work in Process Control | xxxx | |

| To: Applied Manufacturing Overhead Control | xxxx |

Entry for Closing Indirect Manufacturing Expenses Account

This entry is recorded to close the estimated indirect manufacturing costs account.

| Description | Debit | Credit |

| Applied Manufacturing Overhead Control | xxxx | |

| To: Work in Process Control | xxxx |

Entry for Manufacturing Overhead Variance Settlement:

At the end of the accounting period, actual costs can be determined, and variances between them and estimated costs appear. If estimated costs are greater than actual costs (overapplied overhead), the difference is distributed among several accounts according to their balance ratios. This entry is recorded when there are variances between actual and estimated costs.

If Actual Costs are Greater than Estimated, the Following Entry is Recorded:

If actual costs are greater than estimated, the entry is recorded by charging the difference to the cost of sales or profit and loss account as follows:

| Description | Debit | Credit |

| Cost of Sales | xxxx | |

| To: Manufacturing Overhead Control | xxxx |

If Actual Costs are Less than Estimated, the Following Entry is Recorded:

If actual costs are less than estimated, the entry is recorded by crediting the difference to the manufacturing overhead account as follows:

| Description | Debit | Credit |

| Manufacturing Overhead Control | xxxx | |

| To: Cost of Sales | xxxx |

What is Flexible Cost Accounting?

Flexible cost accounting emerged in the 1990s when companies adopted lean manufacturing principles and found that traditional cost accounting practices were incompatible. Flexible accounting aims to support lean manufacturing objectives, which focus on increasing customer value while reducing expenses.

Flexible accounting is based on several key principles:

- Focus on Direct Costs, Not Allocations: Flexible accounting avoids allocating overhead costs, which can hide waste and inefficiencies. Instead, it focuses on direct costs for more valuable streams.

- Simplicity: Flexible accounting simplifies reporting processes and metrics to provide decision-makers with essential data in a timely manner without clutter or complexity.

- Waste Reduction: All flexible accounting operations aim to reduce wasteful activities.

- Continuous Improvement: Flexible accounting supports continuous improvement efforts through non-financial reporting, such as production metrics and quality issues.

By adopting flexible accounting principles, companies can enhance decision-making processes, promote a culture of continuous improvement, and better align accounting and operational objectives. It shifts focus from tracking costs and managing budgets to eliminating waste and delivering greater value to customers.

Frequently Asked Questions

What are the Five Constraints of Cost Accounting?

The five constraints of cost accounting are as follows:

- Direct Cost Constraints: These are costs that are tracked directly through specific product cost allocation, such as raw materials used in manufacturing the product.

- Indirect Cost Constraints: These are costs that cannot be traced directly, such as building or warehouse rent.

- Fixed Cost Constraints: These are costs that do not change regardless of increases or decreases in production rate and volume, such as employee salaries.

- Variable Cost Constraints: These are costs that change according to production volume, such as variable worker wages.

- Mixed Cost Constraints: These are costs that include both variable and fixed costs, such as electricity bills.

What is the Theory of Constraints in Cost Accounting?

The theory of constraints in cost accounting involves identifying recorded constraints and addressing them. Its goal is to chart the path to achieving company objectives related to sales and profit increase. The theory of constraints in cost accounting focuses primarily on increasing productivity, reducing costs, and utilizing available resources.

What are the Elements of Cost Accounting?

The elements of cost accounting are direct materials (such as raw materials used in manufacturing the product), direct labor (such as worker wages), and indirect expenses (such as maintenance costs).

What are the Rules of Cost Accounting?

Cost accounting rules are used to help companies evaluate their financial position and support decisions. This is done by identifying types of costs involved in manufacturing the product, whether directly or indirectly.

- Identify all direct and indirect cost elements.

- Distribute and classify costs according to their type (direct, indirect, fixed, mixed, and others).

- There are two methods of calculating costs: either activity-based or traditional methods.

- Analyze costs and examine reasons for changes, whether positive or negative.

- Make improvement and development decisions and price products.

- Prepare financial reports each period.

What is the Main Objective of Cost Accounting Software?

The main objective of cost accounting software is to establish budget plans, price products, and support future decisions based on determining the cost of goods sold and their impact on the company's financial position.

Conclusion By using appropriate accounting entries, production costs can be documented and recorded accurately and effectively. These entries bear responsibility for distributing costs among products or work orders, whether based on actual or estimated costs. By analyzing variances between actual and estimated costs, this approach allows companies to gain a deeper understanding of production cost performance and improve their management in the future.

Having accurate and up-to-date cost information is critically important for making sound decisions regarding pricing, profitability analysis, process improvement, and resource allocation. As the business environment continues to evolve, updating cost accounting methods is essential to support strategic goals and objectives.