What is Tax Accounting, Its Importance, and Key Principles of Tax Accounting

Table of contents:

- What is Tax Accounting?

- What are the Types of Tax Accounting?

- What is the Importance of Tax Accounting?

- What are the Most Important Principles of Tax Accounting?

- What is the Difference Between Tax Accounting and Financial Accounting?

- How is Tax Accounting Applied in Daftra?

- Frequently Asked Questions

In ancient times, before the emergence of governments, taxes and tax accounting were not established concepts. Tribal affairs were managed by chiefs who acted out of responsibility rather than as economically organized authorities with financial control over their subjects.

With the rise of the state concept, new systems emerged to organize all aspects of life: law came to regulate social and moral life, financial authority emerged to organize economic life, and politics developed to handle governance and administration.

During these early periods, tax accounting was not well-established with organized regulations. Instead, taxes resembled collection and extraction, where rulers would take portions of their subjects' possessions and earnings, either in monetary form or in kind, such as parts of agricultural harvests.

As the concept of taxation crystallized and became entrenched in society, people began demanding participation in political decisions in exchange for their financial contributions. Without such participation, they threatened to refuse payment, rendering the state's legitimacy meaningless.

This gave birth to democracy, which appeared intertwined with taxation like two strands of the same braid. Here emerged the critical importance of accounting, auditing, and monitoring tax collection processes to ensure transparency in governance systems and accountability for both tax authorities and taxpayers.

The implementation of monitoring, transparency, and trust in tax laws was accompanied by the development of tax accounting, leading to significant expansion and the creation of various accounting disciplines. This evolution reached its pinnacle in the digital age with the transition to electronic accounting systems, including tax accounting, which we will explore in detail in the following sections.

What is Tax Accounting?

To answer the question "What is the definition of tax accounting?", tax accounting refers to the accounting methods that are concerned exclusively with tax matters, distinct from the general concerns related to financial accounting.

Tax accounting is governed by certain principles and, of course, international accounting standards, which regulate the standards that individuals and companies must follow to manage their tax transactions and submit tax returns properly.

In tax accounting, there is a concept known as the tax year, which is the period during which taxes are calculated. It has a defined beginning and end, and the tax year may align with the accounting cycle used in financial accounting or may differ from it, depending on state policies and company regulations.

What are the Types of Tax Accounting?

The types of tax accounting are organized according to the classifications encompassed by different types of taxes. While taxes fall under two categories—direct and indirect—they include taxes on individual income and on personal property, such as real estate.

Similarly, taxes are collected from companies, either directly on the company's net profits as corporate income tax, or indirectly on the company's sales and products, where the tax burden falls on the final consumer, such as value-added tax, while companies remain responsible for it before governments.

This is in addition to taxes imposed on institutions that are exempted from payment, with the state bearing the burden instead.

From the above, we can categorize the forms of tax accounting into only three types:

1- Individual Tax Accounting

This relates to the total income of an individual from salary and personal property. By individuals, we mean it pertains to personal income and the individual specifically, and does not include profits from their company, for example, since the company is considered an independent entity from its owner and follows corporate tax accounting as it is a legal entity. The individual is required to submit a simple tax return that they can compile and prepare themselves without legal or accounting complications.

2- Corporate Tax Accounting

Almost every company is subject to taxes, with tax types varying according to the country and the nature of its commercial activity. Companies require expertise in legal accounting, administrative financial management, and the application of modern managerial accounting methods.

They also need familiarity with tax methods, which can be achieved by mastering tax accounting specifically to prepare proper tax reports, resort to legitimate methods for tax reduction, and avoid tax evasion and its resulting penalties.

| The Daftra software helps you record taxes and all related details in your buying and selling operations, with complete tax management including all types of taxes and incorporating them within invoices, in addition to obtaining tax returns easily and simply. |

3- Tax Accounting for Tax-Exempt Institutions

Although tax-exempt institutions do not pay taxes, the state is interested in monitoring profits even if it will not deduct a percentage from these funds. Tax accounting is not just part of corporate accounting; even government entities are subject to it.

In some cases, the state may bear the tax payments for exempt institutions on their behalf, considering this as services provided by the state through its tax contribution.

What is the Importance of Tax Accounting?

Tax accounting is an accounting branch that intersects with many other sciences, most closely related to law, especially tax laws and legal accounting specialization. Tax accounting has great importance as it helps companies avoid fines or accountability regarding taxes. Additionally, tax accounting assists in preparing tax returns and determining the percentage that should be added to product prices.

Therefore, tax accounting is a highly influential and effective tool both economically and socially. Let us mention the clearest points related to the benefits of tax accounting and its importance:

1- Legal Liability Relief for Companies

Avoiding fines resulting from delayed tax payments or manipulation of the required payment amount through creative accounting methods.

2- Paying the Minimum Required Taxes

Within the legal framework, without exposure to illegal tax evasion penalties, such as establishing your company in a country that does not impose many taxes, or avoiding products subject to high specific taxes.

3- Preparing and Submitting Tax Returns

One of the important things that tax accounting provides is preparing and submitting taxes, which helps in knowing the taxes required to be paid and following up on all related developments. The Daftra system can be used to prepare and submit these returns easily.

4- Product Price Estimation

Tax accounting helps estimate product prices appropriately in accordance with the tax increase imposed on the final consumer.

5- Tax Forecasting

By tracking the company's net profits, it becomes easier to forecast the imposed tax and therefore make correct financial decisions based on more accurate data.

6- VAT Tax Refunds

Tax accounting helps recover taxes related to value-added tax without any problems or incorrect calculations.

7- Contributing to National Economic Growth

Tax accounting contributes to the state's economic growth through continuous monitoring and fair and appropriate tax collection for each company, helping to reduce the country's external debts.

What are the Most Important Principles of Tax Accounting?

Tax accounting is ultimately a branch of accounting, so you will find that tax accounting principles are derived from general accounting principles, with focus on principles that directly affect taxes. In the following paragraphs, we simply explain what the most important tax accounting principles are:

1- Tax is Related to Net Profit, Not Gross Income:

Corporate income tax is considered one of the most widespread direct taxes, but is the tax rate calculated on everything the company earns during the tax year?

The answer is no. Costs and expenses are deducted from total sales, then tax is calculated on the net profit, which is the difference between sales and expenses. This reduces the tax burden and differs from government accounting, where expenses are not compared to revenues for profit achievement purposes in this manner.

2- Standardizing and Fixing Product Prices as Much as Possible:

Sales tax or value-added tax is in the form of a percentage of the product price, which affects product pricing and imposes an increase in product prices.

If you sell the same product at different prices, it requires changing the tax value imposed on it with each sale, which makes the process of collecting tax value not as easy as it could be.

Therefore, try to fix the product price and tax on it as much as possible, and price the product taking into account the tax increase that will be imposed on it.

3- Deferring Some Tax Obligations:

If you have assets in good condition and in the period of use and consumption, there is a deferred tax obligation on you in case of selling the asset or benefiting from its capital and converting it to liquid cash value.

Therefore, take into account that your assets will one day turn into a tax obligation, which benefits you in tax and financial planning based on predicting the timing of selling or liquidating the asset.

| Due to the importance of this matter, you can manage your assets and liabilities through Daftra's asset management program to input all the details of your assets for easy identification of taxes and all changes related to these assets easily and with a simple user interface. |

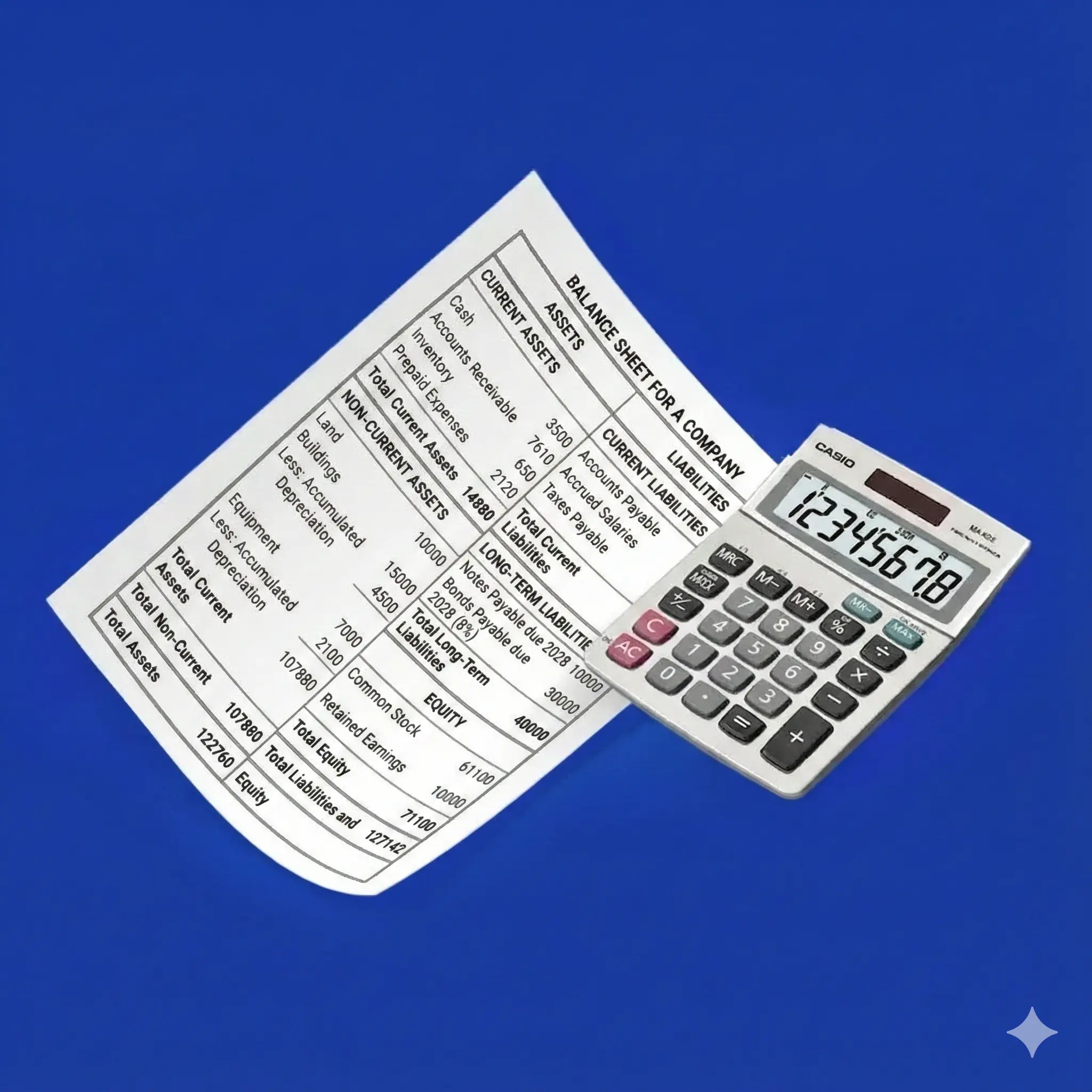

What is the Difference Between Tax Accounting and Financial Accounting?

There are fundamental differences between tax accounting and financial accounting, and these differences are represented in:

Tax accounting specializes in everything related to taxes from a legal perspective and how to ensure compliance with them. This is achieved by obtaining accurate tax returns and aims to comply precisely with tax legislation.

On the other hand, financial accounting works on finances completely and provides complete information about the financial performance of companies and the financial status of various people in the company. Financial accounting also aims to provide financial reports and data that facilitate informed decision-making.

We can conclude from this briefly that the differences between tax accounting and financial accounting are that tax accounting is concerned only with tax matters, while financial accounting deals with everything related to finances.

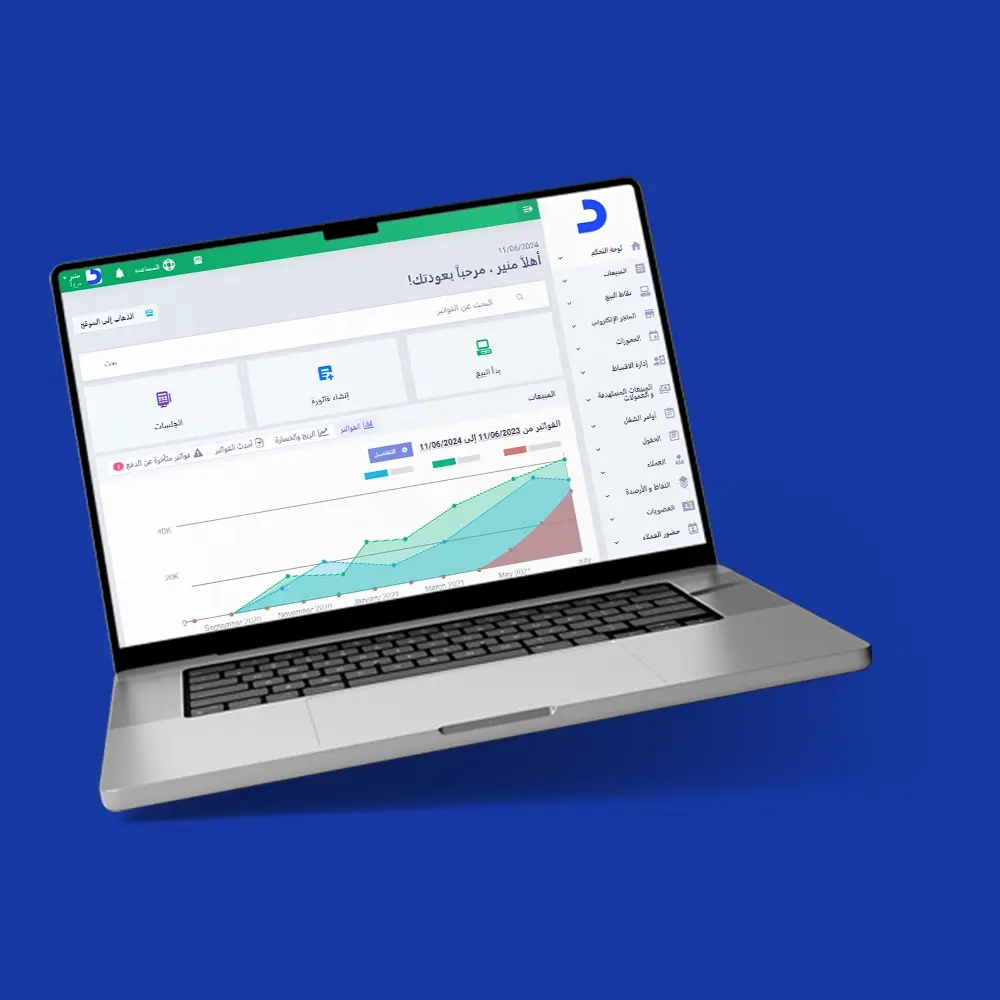

How is Tax Accounting Applied in Daftra?

Daftra's accounting program allows you to add different taxes and include or exclude them from invoices. For example, you can add value-added tax, income tax, specific tax, or deductions and additions while fixing the tax rate and adding it to the total tax for the customer or in reports.

Daftra helps you easily issue tax returns, based on pre-existing data in the program resulting from your financial transactions, such as sales and purchases.

There is a set of tax reports available at the click of a button to clarify what tax-related expenses you are responsible for.

Frequently Asked Questions

What is the concept of tax accounting?

Tax accounting is the calculation and collection of remaining taxes on an individual or company and includes all types of taxes.

What are the duties of a tax accountant?

- Following up and submitting annual and quarterly tax returns

- Continuous review

- Providing necessary consultations regarding taxes

- Analyzing various financial data

- Dealing with and organizing records

How much is a tax accountant's salary in Saudi Arabia?

Tax accountant salaries vary based on many criteria such as experience, the company and its size, the accountant's qualifications and skills, and many other factors that companies use to determine salary.

What is the difference between accounting and tax accounting?

Accounting provides a comprehensive and general picture of a company's financial condition and all account details, whereas tax accounting specializes in tax-related matters, including their legal status and maintaining compliance.

What is Zakat and tax accounting?

It is the process of determining and calculating taxes and Zakat imposed on companies and individuals, and recording them periodically for payment and compliance.

What is the role of a tax accountant in tax planning?

The tax accountant works to accurately study the financial situation and develop strategies, while providing support in making major decisions.

How do I know my tax information?

By accessing the Zakat, Tax, and Customs Authority and verifying your tax registration, you can then access the reports and returns for your number to find all your tax information.

What is the main purpose of tax accounting?

The main purpose of tax accounting is to calculate taxes accurately, know the dues required to be paid, and ensure compliance with laws.