Best Bookkeeping Software in Saudi Arabia

Table of contents:

- Best Bookkeeping Software

- 1- Daftra Bookkeeping Software

- 2- QuickBooks Bookkeeping Software

- 3- Zoho Books Bookkeeping Software

- 4- Xero Bookkeeping Software

- 5- Sage Accounting Software

- 6- Oracle NetSuite Bookkeeping Services

- 7- FreshBooks Bookkeeping Software

- 8- Wave Bookkeeping Software

- 9- Bill.com Bookkeeping Software

Bookkeeping software is a program that enables you to record daily financial transactions (such as sales, purchases, receipts, and payments) and maintain accurate account books for revenues, expenses, assets, and liabilities. The bookkeeping system is designed to track income, expenses, invoices, receipts, and bank transactions for small businesses. Due to its simple and user-friendly interface, it is easier to use than accounting software. Not all bookkeeping software is ideal for your business; that's why this article will streamline the process of finding and selecting the best bookkeeping software in Saudi Arabia.

Best Bookkeeping Software

The choice of bookkeeping software depends on your business needs; for example, freelancers may require basic tools such as invoicing and expense tracking. On the other hand, you will find enterprise-level companies searching for powerful accounting tools with AI power to shortcut manual and tedious processes. The best bookkeeping software must include automating financial data collection, capturing the company's financial health data, and presenting it in an easy-to-read format. Here is the list of the Best Bookkeeping software

- Quickbooks Online

- Zoho Books

- Sage Accounting Software

- Xero Bookkeeping Software

- Oracle Net-Suite Accounting Software

- FreshBooks

- Wave

- NetSuite

- Bill.com

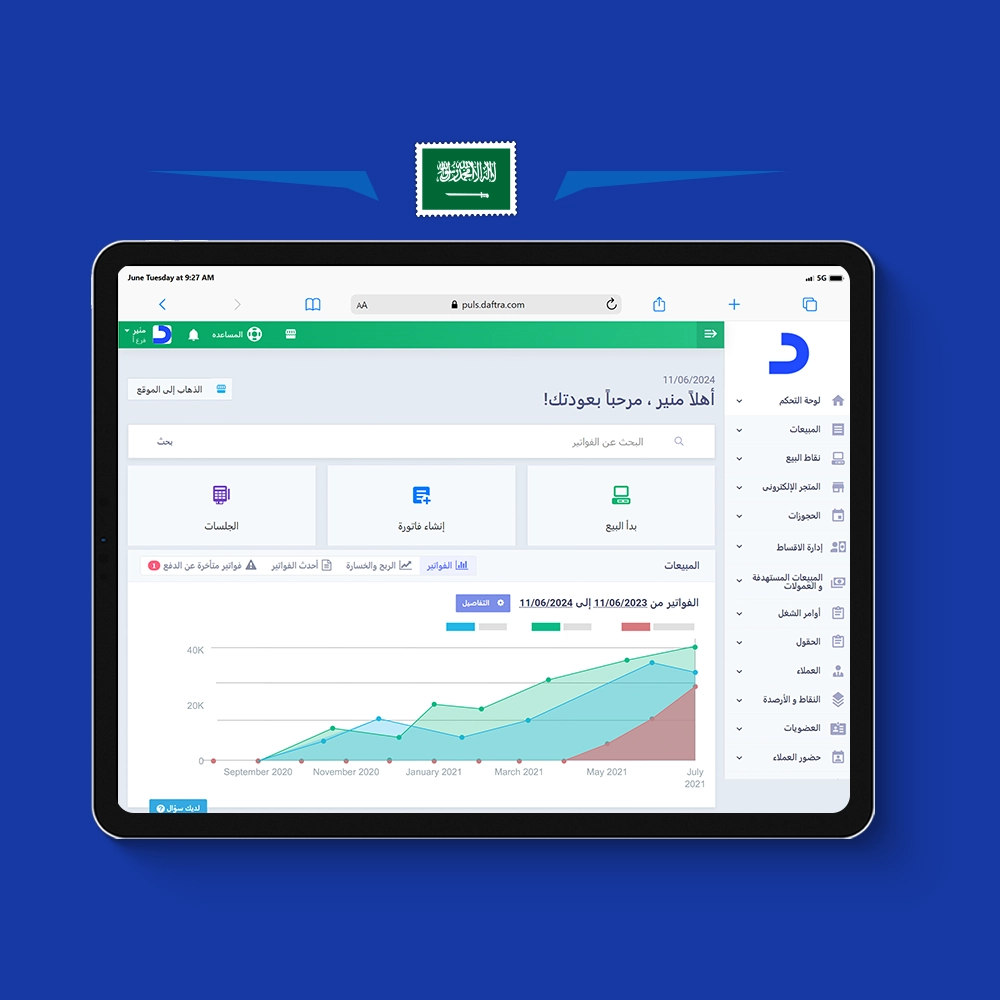

1- Daftra Bookkeeping Software

Let's define bookkeeping software in Daftra: it is a system for recording and organizing financial data of transactions to create and analyze reports that enable the evaluation of expenses and incomes, aimed at enhancing business performance over time. Daftra Bookkeeping includes all processes from basic data entry to tax preparation and bank reconciliation, among other processes you will get to know in this article.

Elements of Bookkeeping you will find in Daftra

- Bank reconciliation is the process of comparing a company's bank statements with its financial records to make sure the data is accurate. Daftra automatically imports bank statements, then matches the transaction record, highlights any differences, and generates reconciliation reports if required.

- Financial statements are formal records of a company's financial activities; Daftra's financial reports include the following: the balance sheet, income statement, and cash flow statement. They are summarized to provide an overview of the financial position, performance, and changes.

- A ledger is a book, also known as a collection of accounts, that serves as the principal book. Daftra Ledger book contains all financial transactions, organized by account with an opening balance, and records them as follows: debit or credit.

- A balance sheet is a financial statement that lists a company's assets, liabilities, and equity covering a specific period of time. The Daftra balance sheet aims to provide investors with return rates and evaluate the company's capital structure.

- Invoicing is the process of creating invoices that include all essential information and sending them to the client for goods or services provided. Daftra invoicing supports the Zakat, Tax, and Customs Authority.

- Journal entries in Daftra record all detailed transactions in chronological order before they are transferred to the ledger.

- The double-entry system is a bookkeeping system in Daftra that records accounts while ensuring the equality of debit and credit entries to keep the equation balanced.

- A trial balance is a report offered by Daftra Software that contains the balances of the ledger accounts (including assets, liabilities, equity, revenues, expenses, gains, and losses) to verify the total equality of debits and credits at a certain point in time.

- A Chart of Accounts is a list that contains all account names and numbers in the system, organized by categories, which are assets, liabilities, equity, revenue, and expenses. Daftra allows users to create a well-structured and customize account names and codes.

Read Also: Best accounting software in Saudi Arabia

Pros

- User-Friendly Interface.

- Allows customization to fit specific business needs.

- Cloud-Based Accessible from anywhere.

- Competitive pricing plans.

- Provides customer support and training.

- Multi-Language Support.

Daftra Bookkeeping Software Pricing Plan

| Plan | Basic | Advanced | Premium |

| Yearly | 489.50 SAR Billed monthly | 977.58 SAR Billed monthly | 1960.00 SAR Billed monthly |

| Monthly | 733 SAR Billed monthly | 1225.00 SAR Billed monthly | 2448.00 SAR Billed monthly |

Read also: Best Sole Trader Accounting Software

2- QuickBooks Bookkeeping Software

QuickBooks Online has designed bookkeeping software suitable for small businesses and offers a 30-day free trial. QuickBooks bookkeeping records and tracks financial transactions and provides advanced financial reports. It includes creditors and debtors, asset accounts, liability accounts, equity accounts, and credit card and bank accounts. QuickBooks offers a Live Bookkeeping service for small businesses; it works by connecting the businesses with certified virtual bookkeepers to lead and run essential reports and aims to provide specialized product support and tax resource support, among other benefits.

Pros

- A mobile application allows accounts management.

- Offers various support customers channels.

- User-Friendly Interface.

- Integrates with numerous third-party applications.

Cons

- Subscription fees can add up for advanced tools.

- Limited Customization for some options.

- Customer support long wait times response.

QuickBooks Bookkeeping Software Pricing Plan

| Plan Name | Monthly Price (SAR) |

| Simple Start | SAR 130 |

| Essentials | SAR 240 |

| Plus | SAR 365 |

| Advanced | SAR 870 |

Read Also: Best accounting software For small and medium business

3- Zoho Books Bookkeeping Software

Zoho Books Bookkeeping Software is mainly used by Small Businesses. It offers a cloud-based system for maintaining accounting transactions and making informed decisions. The software features a friendly interface for creating easy invoices and sets automatic payment reminders, plus recurring invoices for regular transactions. Zoho Books Bookkeeping Software offers free technical support over email, phone, and chat, in addition to allowing online payment acceptance and record of advance payments.

Pros

- Offers a 14-day free trial and is available in Saudi Arabia

- Offers various apps for iOS, Android, and Windows desktops.

- Competitive pricing for small businesses and startups.

- Integration with various applications.

Cons

- Slow loading times with larger datasets.

- Limited customization options.

Zoho Books Bookkeeping Software Pricing Plan

| Plan Name | Monthly Price (SAR) |

| Free | SAR 0 |

| Standard | SAR 69 |

| Professional | SAR 129 |

| Premium | SAR 159 |

| Elite | SAR 349 |

| Ultimate | SAR 799 |

Read Also: Best ERP software in Saudi Arabia

4- Xero Bookkeeping Software

Xero Bookkeeping Software is tailored for small businesses, enabling them to manage finances and cash flow easily by the automated features of invoice processing and bank transaction reconciliation. Xero Bookkeeping Software includes creating professional invoices, tracking expenses, bank reconciliations, creating advanced financial reports, and supporting multi-currency.

Pros

- User-friendly interface.

- Strong integration capabilities with third-party apps.

- Excellent customer support.

Cons

- Pricing can be higher compared to some competitors.

- Limited features for inventory management.

Xero Bookkeeping Software Pricing Plan

| Plan | Monthly Price (SAR) |

| Early | 49 SAR |

| Growing | 139 SAR |

| Established | 263 SAR |

5- Sage Accounting Software

Sage bookkeeping features a quick setup and user-friendly software; you can access and update the financial accounts anytime and on any device. Additionally, it enables report customization and invoice generation. Sage 50cloud is an online accounting software tailored for small and medium businesses; includes budgeting, cash flow, invoicing, and tax management, and the connection of your bank accounts to easier receivables tracking, making deposits, and transferring funds Sage Accounting Software offers invoicing, expense tracking, and financial reporting that cut off time and effort to make, ensuring accurate record-keeping and enhancing the decision-making process.

Pros

- A user-friendly interface that is particularly helpful for small businesses.

- Offers strong customer support.

Cons

- The system is expensive compared to other software.

- Advanced program features require time to learn.

Sage Bookkeeping Software Pricing Plan

| Plan | Monthly Price (SAR) |

| Sage Business Cloud | 150 SAR |

| Sage 50cloud | 300 SAR |

| Sage Accounting | 200 SAR |

Read Also: Best Sales Software for Small and Medium Business

6- Oracle NetSuite Bookkeeping Services

Oracle NetSuite Bookkeeping Services includes accounts payable, accounts receivable, reconciliations, tax planning, payroll processing, and more. Oracle Bookkeeping Services offers outsourced CFO review and meetings, as well as connecting the accounts to online banking. NetSuite Bookkeeping Services has integrated financial systems, advanced technology, and offers expert advice for strategic business decisions.

Pros

- Flawless order management and procurement.

- Saves time with automated journal entries and data imports.

- Automates financial processes.

Cons

- It may be expensive for small businesses or startups.

- Setting up the software can be a time-consuming process.

- Requires a stable internet connection for access

Oracle NetSuite Bookkeeping Pricing Plan

| Plan | Monthly Price (SAR) |

| NetSuite Essentials | 1,500 SAR |

| NetSuite Mid-Sized | 3,500 SAR |

| NetSuite Enterprise | 5,500 SAR |

7- FreshBooks Bookkeeping Software

FreshBooks bookkeeping software creates monthly reports that include income and expenses, transaction categorization, bank reconciliation, and a monthly profit and loss statement. FreshBooks Bookkeeping Software has a partnership with the trusted bookkeeping firm “Integra” that aims to save time and effort and, on top of all, enhance business growth. The Integra service works by providing expert bookkeeping and tax services in FreshBooks bookkeeping software to handle it for you while you are focusing on another process in the system.

Pros

- Built-in time tracking feature for accurate billing to clients.

- Various channels for customer service.

- Offers receipt capture via mobile app.

Cons

- No Payroll Integration.

- Limited Features for Larger Businesses.

FreshBooks Bookkeeping Software Pricing Plan

| Plan | Monthly Price (SAR) |

| Lite | 100 SAR |

| Plus | 200 SAR |

| Premium | 350 SAR |

| Select | Custom Pricing |

8- Wave Bookkeeping Software

Wave Bookkeeping Software is free cloud-based accounting software. It is designed especially for small businesses, providing tools for tracking income and expenses, generating financial reports, and managing invoicing and payments. The system automatically imports all transactions, reducing manual data entry, and offers customized invoicing, besides the reporting tools to create profit and loss statements, balance sheets, and other financial reports with ease.

Pros

- Cloud-Based Convenience

- Integration with Other Apps

- Easy navigation, even for non-accountants.

- Core accounting tools are completely free.

Cons

- Lack of advanced features.

- Limited Customer Support.

- Payroll services are not available in all countries.

Wave Bookkeeping Software Pricing Plan

| Plans | Price (SAR) |

| Basic Accounting | Free |

| Payroll (if available) | 250 SAR |

| Additional Features | Varies |

9- Bill.com Bookkeeping Software

Bill.com is bookkeeping software for all-sized businesses; it includes automated accounts payable and accounts receivable as well as sending invoices and bills automatically to the contractors and vendors. The Bill system is connected with Sage Intacct, Oracle NetSuite, Xero, and QuickBooks.

Pros

- Reduced manual entry.

- Synchronization of crucial data.

- Automates back-office financial processes.

Cons

- Monthly fees are high for small businesses.

- The system interface is complex for the users.

- Primarily focused on AP/AR, lacking broader accounting features.

Bill.com Bookkeeping Software Pricing Plan

| Plan | Monthly Price (SAR) |

| Essentials | 450 SAR |

| Plus | 900 SAR |

| Premium | Custom Pricing |

In the end, every bookkeeping system has its strengths, but the best choice depends on your business goals. Selecting the right software improves accuracy by automating data entry and calculations while saving time on repetitive tasks such as invoicing, payroll, and reconciliation. Most importantly, the ideal system should support better cash flow management and ensure tax compliance, helping your business grow with confidence.